Question: Acker, Inc. has the following cost data for Product X, and unit product cost using variable costing when production is 2,000 units, 2,500 units, and

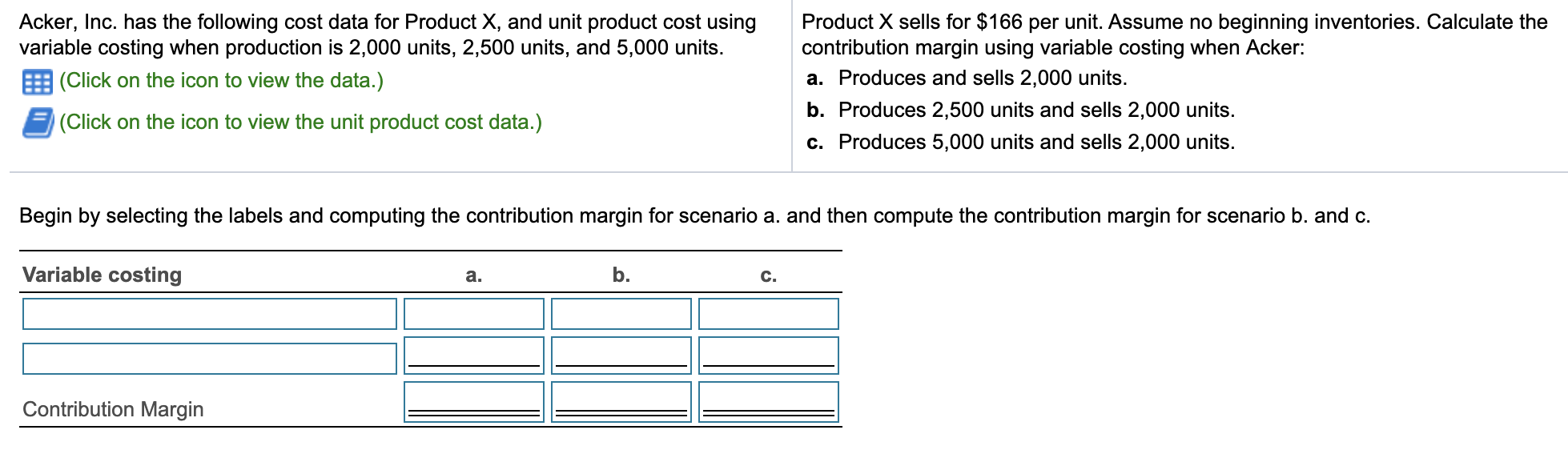

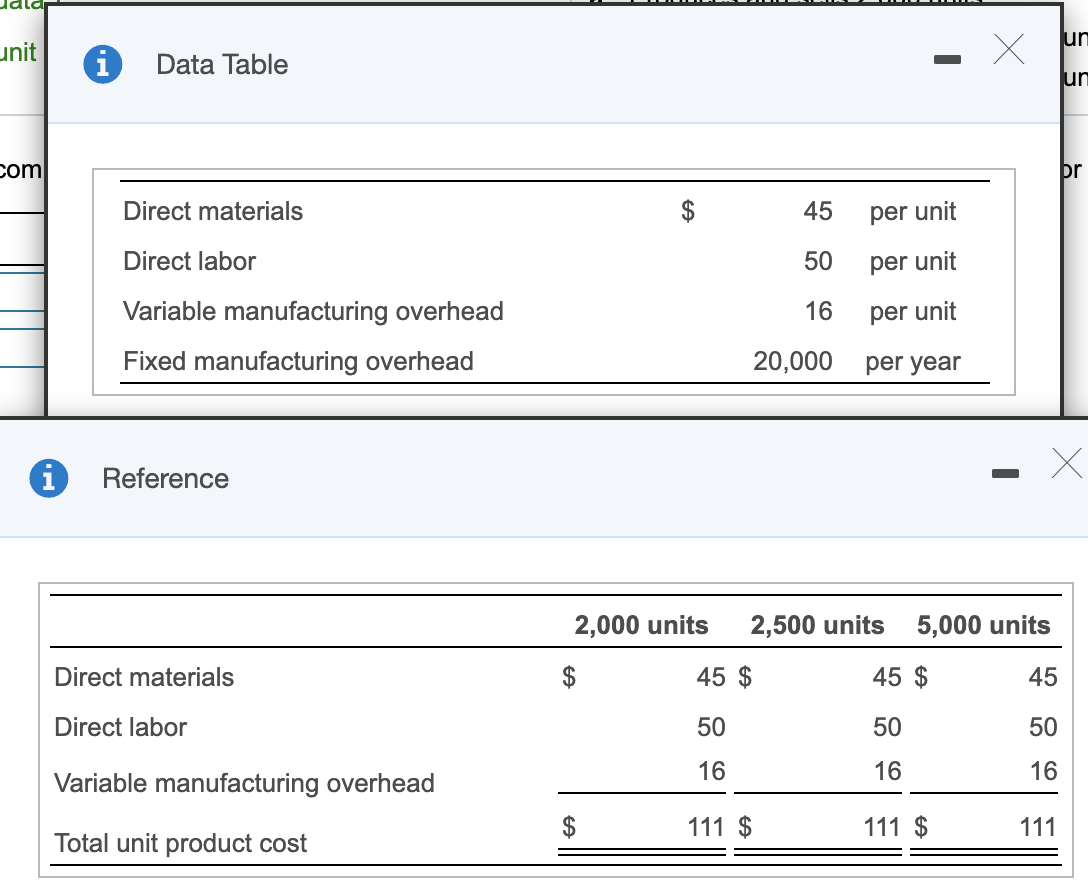

Acker, Inc. has the following cost data for Product X, and unit product cost using variable costing when production is 2,000 units, 2,500 units, and 5,000 units. (Click on the icon to view the data.) (Click on the icon to view the unit product cost data.) Product X sells for $166 per unit. Assume no beginning inventories. Calculate the contribution margin using variable costing when Acker: a. Produces and sells 2,000 units. b. Produces 2,500 units and sells 2,000 units. c. Produces 5,000 units and sells 2,000 units. Begin by selecting the labels and computing the contribution margin for scenario a. and then compute the contribution margin for scenario b. and c. Variable costing a. b. C. Contribution Margin un unit X Data Table un com pr Direct materials 45 per unit Direct labor 50 per unit 16 per unit Variable manufacturing overhead Fixed manufacturing overhead 20,000 per year X 1 Reference 2,000 units 2,500 units 5,000 units Direct materials 45 $ 45 $ 45 Direct labor 50 50 50 16 16 16 Variable manufacturing overhead $ 111 $ 111 $ 111 Total unit product cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts