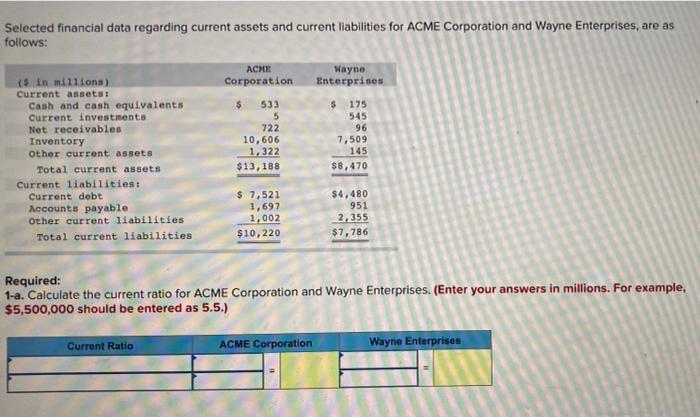

Question: Acme Corporation Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation 533 5 722

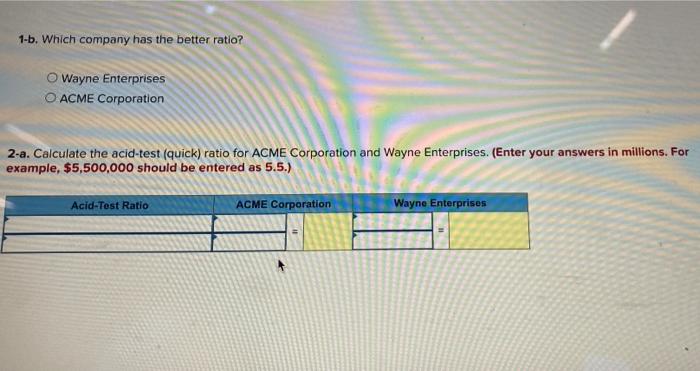

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation 533 5 722 10,606 1,322 $13,188 Wayne Enterprises $ 175 545 is in million) Current assets: Cash and cash equivalents Current investments Net receivables Inventory Other current assets Total current assets Current liabilities: Current debt Accounts payable Other current liabilities Total current liabilities 96 7,509 145 $8,470 $ 7,521 1,697 1,002 $10,220 $4,480 951 2,355 $7,786 Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example, $5,500,000 should be entered as 5.5.) Curront Ratio ACME Corporation Wayne Enterprises 1-b. Which company has the better ratio? Wayne Enterprises O ACME Corporation 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example, $5,500,000 should be entered as 5.5.) Acid-Test Ratio ACME Corporation Wayne Enterprises

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts