Question: Acme, Inc. has a product that has been experiencing high growth and is considering buying additional machines to assemble this product. The company can

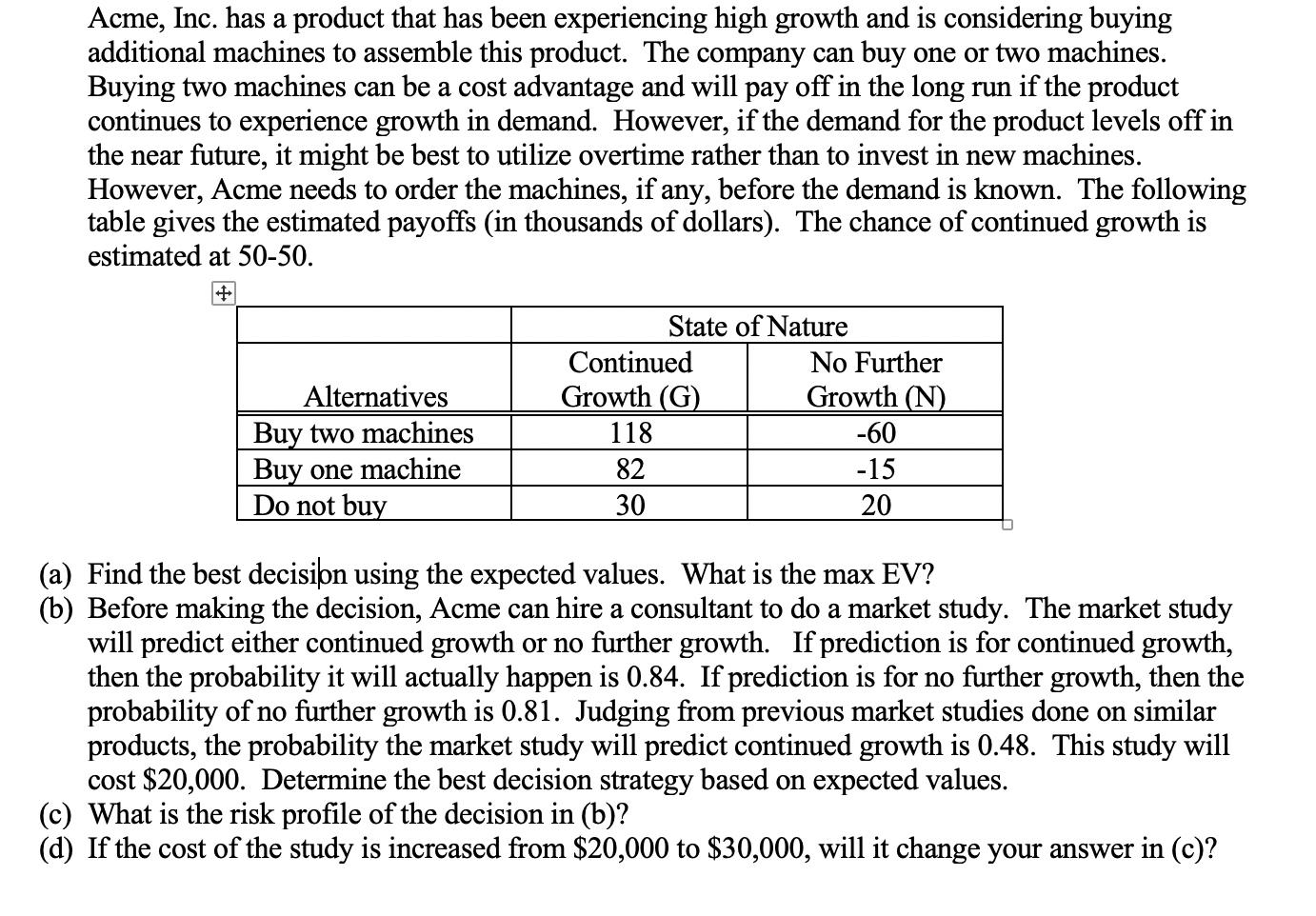

Acme, Inc. has a product that has been experiencing high growth and is considering buying additional machines to assemble this product. The company can buy one or two machines. Buying two machines can be a cost advantage and will pay off in the long run if the product continues to experience growth in demand. However, if the demand for the product levels off in the near future, it might be best to utilize overtime rather than to invest in new machines. However, Acme needs to order the machines, if any, before the demand is known. The following table gives the estimated payoffs (in thousands of dollars). The chance of continued growth is estimated at 50-50. Alternatives Buy two machines Buy one machine Do not buy State of Nature Continued Growth (G) 118 82 30 No Further Growth (N) -60 -15 20 (a) Find the best decision using the expected values. What is the max EV? (b) Before making the decision, Acme can hire a consultant to do a market study. The market study will predict either continued growth or no further growth. If prediction is for continued growth, then the probability it will actually happen is 0.84. If prediction is for no further growth, then the probability of no further growth is 0.81. Judging from previous market studies done on similar products, the probability the market study will predict continued growth is 0.48. This study will cost $20,000. Determine the best decision strategy based on expected values. (c) What is the risk profile of the decision in (b)? (d) If the cost of the study is increased from $20,000 to $30,000, will it change your answer in (c)?

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

a The expected value of buying two machines 11805 6005 29 thousand dollars The expected value of buy... View full answer

Get step-by-step solutions from verified subject matter experts