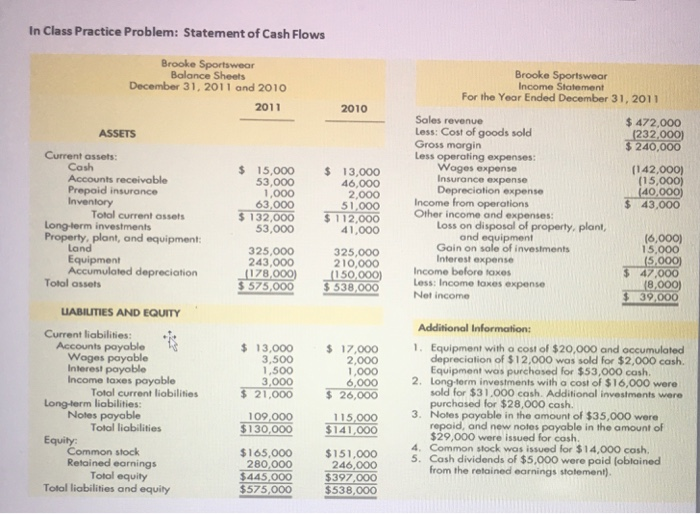

Question: a)Compute the net cash flow from operating activities using th indirect method. b) Compute the net cash flow from investing activities. c) Compute the net

In Class Practice Problem: Statement of Cash Flows Brooke Sportswear Balance Sheets December 31, 2011 and 2010 2011 Brooke Sportswear Income Statement For the Year Ended December 31, 2011 2010 ASSETS $ 472,000 (232,000) $ 240,000 Current assets: Cash Accounts receivable Propoid insurance Inventory Total current assets Long term investments Property, plant, and equipment: Land Equipment Accumulated depreciation Total assets $ 15,000 53,000 1,000 63,000 $ 132,000 53,000 325,000 243,000 (178,000) $575,000 $ 13,000 46,000 2,000 51.000 $ 112,000 41,000 (142,000) (15,000) (40,000) $ 43,000 Sales revenue Less: Cost of goods sold Gross margin Less operating expenses Woges expense Insurance expense Depreciation expense Income from operations Other income and expenses: Loss on disposal of property, plant, and equipment Goin on sale of investments Interest expense Income before foxes Less: Income taxes expense Not income 325,000 210,000 (150.000) $ 538,000 16,000) 15,000 15.000) $ 47,000 (8,000) $ 39,000 LIABILITIES AND EQUITY Current liabilities: Accounts payable Wages payable Interest payoblo Income taxes payable Total current liabilities Long-term liabilities: Notes payable Total liabilities Equity Common stock Retained earnings Totol equity Total liabilities and equity $ 13,000 3,500 1,500 3,000 $ 21,000 109,000 $130,000 $ 17,000 2,000 1,000 6,000 $ 26,000 115.000 $141,000 Additional Information: 1. Equipment with a cost of $20,000 and occumulated depreciation of $12,000 was sold for $2,000 cash. Equipment was purchased for $53,000 cash. 2. Long-term investments with a cost of $16,000 were sold for $31.000 cash. Additional investments were purchased for $28,000 cash. 3. Notes payable in the amount of $35,000 were repaid, and new notes payable in the amount of $29,000 were issued for cash. 4. Common stock was issued for $14,000 cash. 5. Cash dividends of $5,000 were paid (obloined from the retained earnings statement). $165,000 280,000 $445,000 $575,000 $151,000 246,000 $397,000 $538,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts