Question: Activity 4: Manufacturing Inventory Flow: COGM & COGS Income Statement Work backwards to find missing amounts: Andrew Electronics manufactures and sells smartphones. Unfortunately, the company

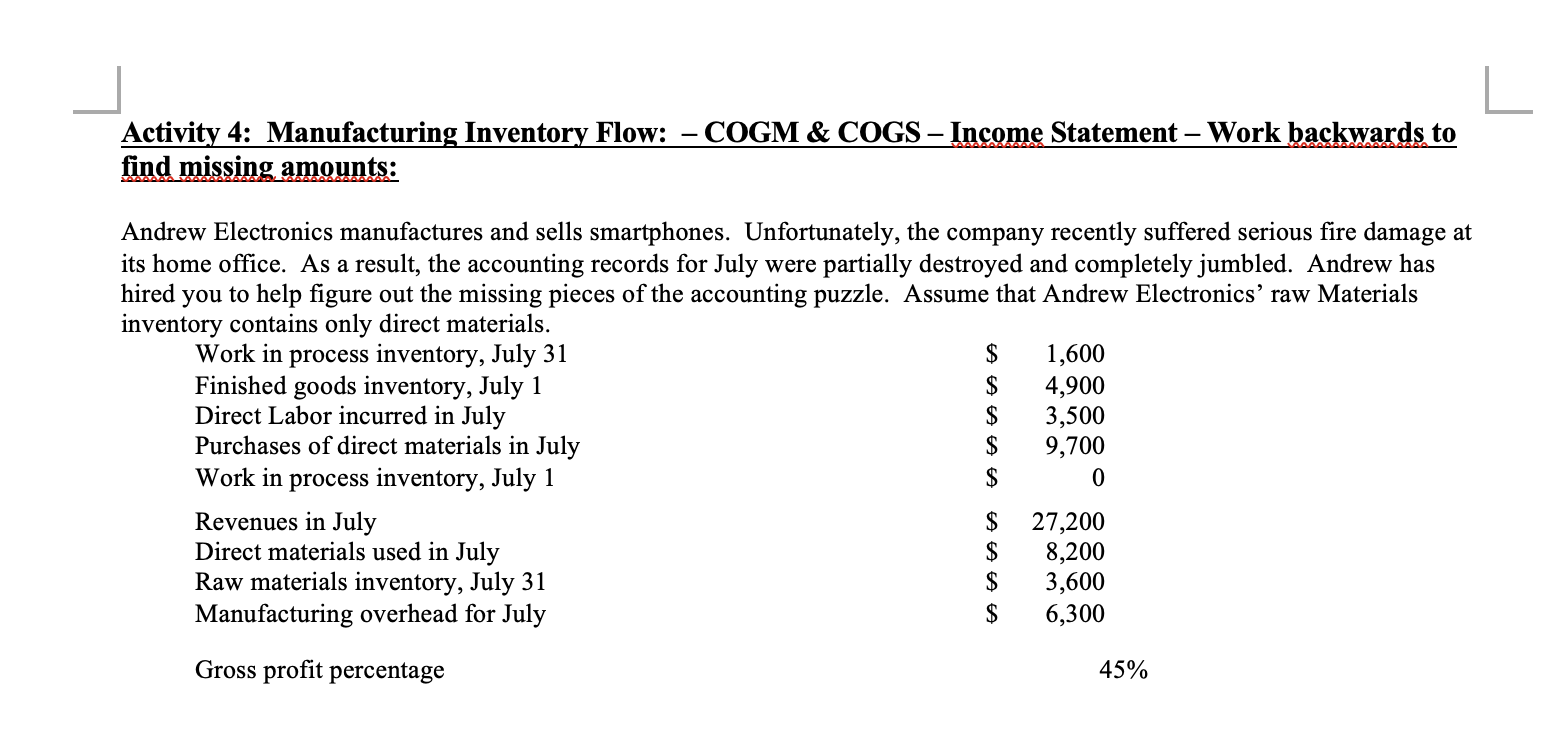

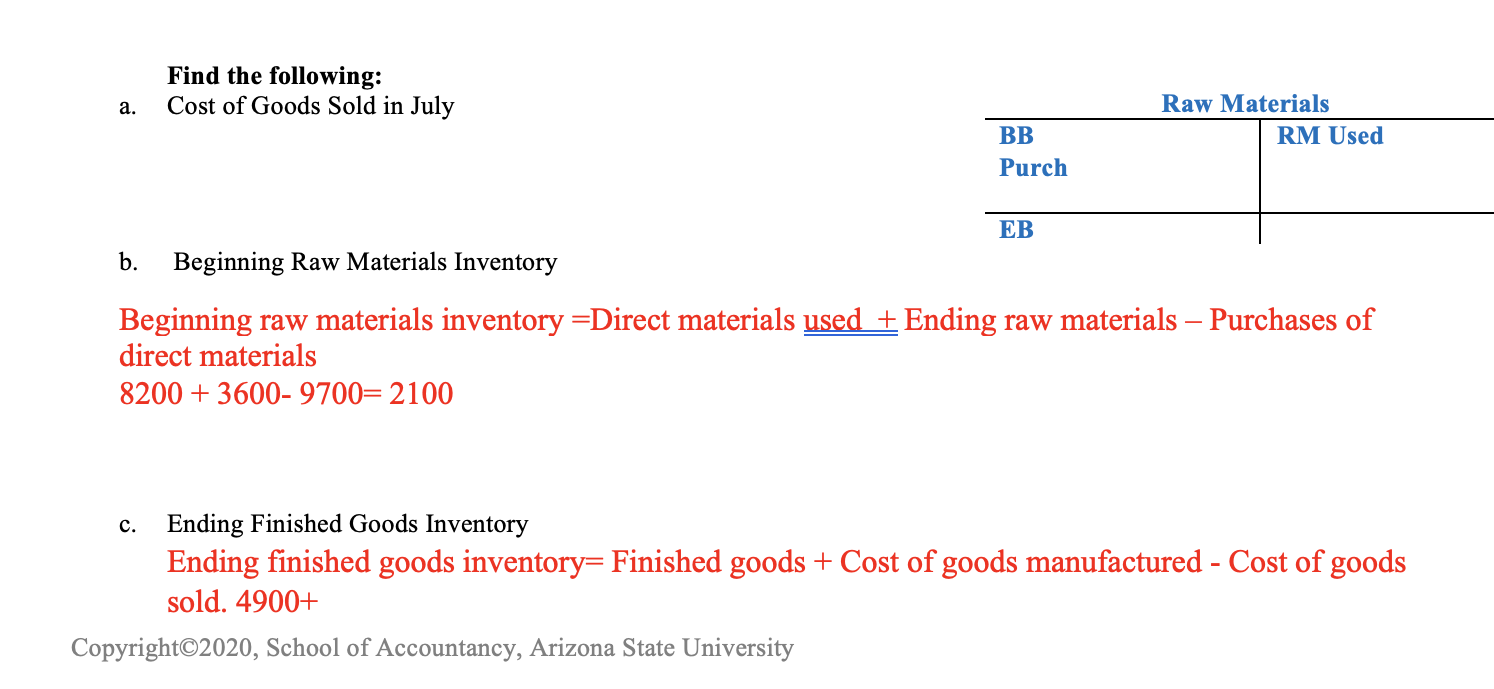

Activity 4: Manufacturing Inventory Flow: COGM & COGS Income Statement Work backwards to find missing amounts: Andrew Electronics manufactures and sells smartphones. Unfortunately, the company recently suffered serious fire damage at its home office. As a result, the accounting records for July were partially destroyed and completely jumbled. Andrew has hired you to help figure out the missing pieces of the accounting puzzle. Assume that Andrew Electronics raw Materials inventory contains only direct materials. Work in process inventory, July 31 $ 1,600 Finished goods inventory, July 1 $ 4,900 Direct Labor incurred in July $ 3,500 Purchases of direct materials in July $ 9,700 Work in process inventory, July 1 $ 0 Revenues in July $ 27,200 Direct materials used in July $ 8,200 Raw materials inventory, July 31 $ 3,600 Manufacturing overhead for July $ 6,300 Gross profit percentage 45% Find the following: Cost of Goods Sold in July a. Raw Materials RM Used BB Purch EB b. Beginning Raw Materials Inventory Beginning raw materials inventory =Direct materials used + Ending raw materials Purchases of direct materials 8200 + 3600-9700= 2100 c. Ending Finished Goods Inventory Ending finished goods inventory= Finished goods + Cost of goods manufactured - Cost of goods sold. 4900+ Copyright2020, School of Accountancy, Arizona State University

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts