Question: ACTIVITY 5-5 Determine whether each transaction should be recorded in a CRJ - Cash Receipts Journal CDJ - Cash Disbursement Journal SJ - Sales Journal

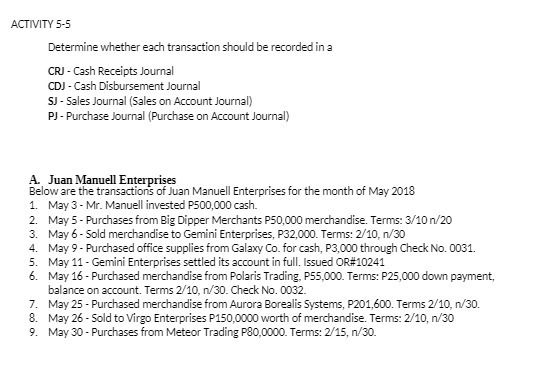

ACTIVITY 5-5 Determine whether each transaction should be recorded in a CRJ - Cash Receipts Journal CDJ - Cash Disbursement Journal SJ - Sales Journal (Sales on Account Journal) PJ - Purchase Journal (Purchase on Account Journal) A. Juan Manuell Enterprises Below are the transactions of Juan Manuell Enterprises for the month of May 2018 1. May 3 - Mr. Manuell invested P500,000 cash. 2. May 5 - Purchases from Big Dipper Merchants P50,000 merchandise. Terms: 3/10 n/20 3. May 6 - Sold merchandise to Gemini Enterprises, P32,000. Terms: 2/10, n/30 4. May 9 - Purchased office supplies from Galaxy Co. for cash, P3,000 through Check No. 0031. 5. May 11 - Gemini Enterprises settled its account in full. Issued OR#10241 6. May 16 - Purchased merchandise from Polaris Trading, P55,000. Terms: P25,000 down payment, balance on account. Terms 2/10, n/30. Check No. 0032. 7. May 25 - Purchased merchandise from Aurora Borealis Systems, P201,600. Terms 2/10, n/30. 8. May 26 - Sold to Virgo Enterprises P150,0000 worth of merchandise. Terms: 2/10, n/30 9. May 30 - Purchases from Meteor Trading P80,0000. Terms: 2/15, n/30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts