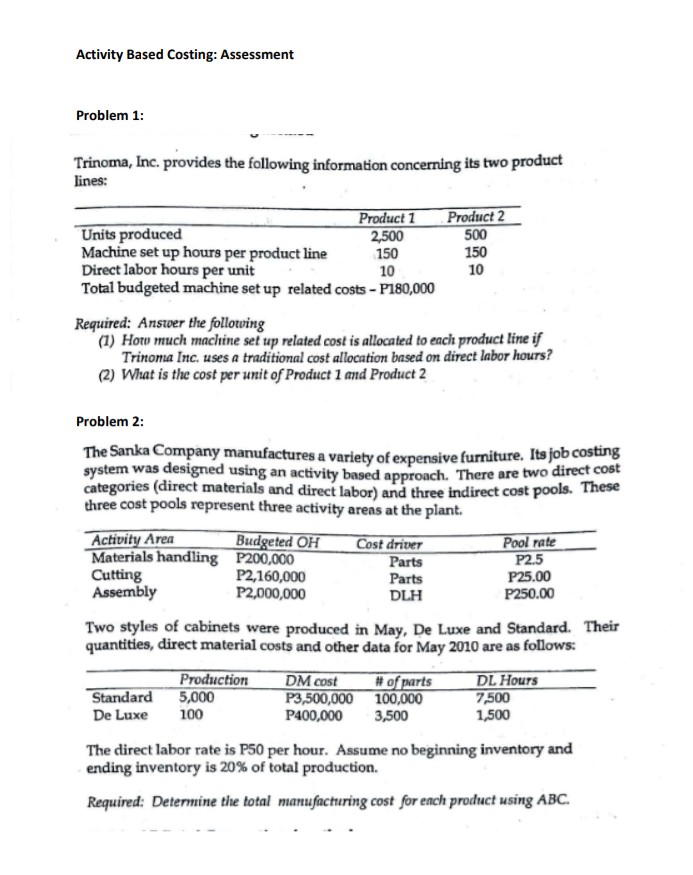

Question: Activity Based Costing: Assessment Problem 1: Trinoma, Inc. provides the following information concerning its two product lines: Product 1 Product 2 Units produced 2,500 500

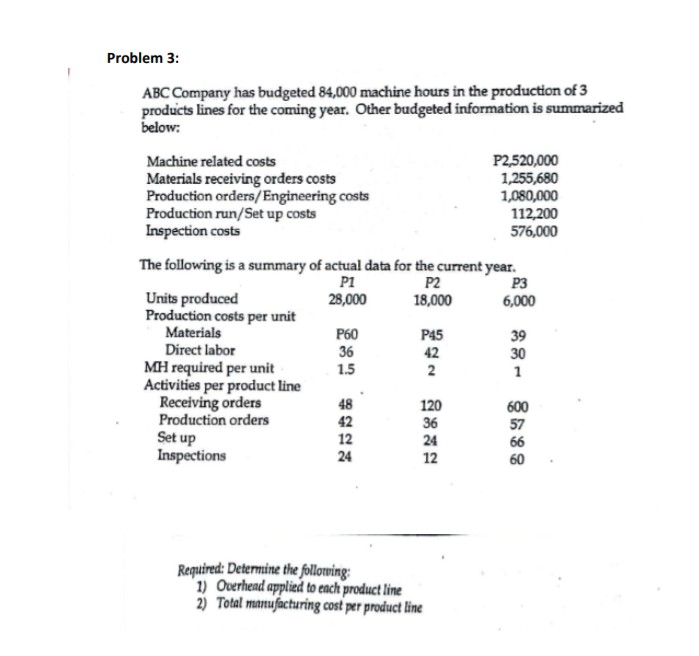

Activity Based Costing: Assessment Problem 1: Trinoma, Inc. provides the following information concerning its two product lines: Product 1 Product 2 Units produced 2,500 500 Machine set up hours per product line 150 150 Direct labor hours per unit 10 10 Total budgeted machine set up related costs - P180,000 Required: Answer the following (1) How much machine set up related cost is allocated to each product line if Trinoma Inc. uses a traditional cost allocation based on direct labor hours? (2) What is the cost per unit of Product 1 and Product 2 Problem 2: The Sanka Company manufactures a variety of expensive furniture. Its job costing system was designed using an activity based approach. There are two direct cost categories (direct materials and direct labor) and three indirect cost pools. These three cost pools represent three activity areas at the plant. Activity Area Budgeted OH Cost driver Pool rate Materials handling P200,000 Parts P2.5 Cutting P2,160,000 Parts P25.00 Assembly P2,000,000 DLH P250.00 Two styles of cabinets were produced in May, De Luxe and Standard. Their quantities, direct material costs and other data for May 2010 are as follows: Production DM cost # of parts DL Hours Standard 5,000 P3,500,000 100,000 7,500 De Luxe 100 P400,000 3,500 1,500 The direct labor rate is P50 per hour. Assume no beginning inventory and ending inventory is 20% of total production. Required: Determine the total manufacturing cost for each product using ABC.Problem 3: ABC Company has budgeted 84,000 machine hours in the production of 3 products lines for the coming year. Other budgeted information is summarized below: Machine related costs P2,520,000 Materials receiving orders costs 1,255,680 Production orders/ Engineering costs 1,080,000 Production run/Set up costs 112,200 Inspection costs 576,000 The following is a summary of actual data for the current year. P1 P2 P3 Units produced 28,000 18,000 6,000 Production costs per unit Materials P60 P45 39 Direct labor 36 42 30 MH required per unit 1.5 2 1 Activities per product line Receiving orders 48 120 600 Production orders 42 36 57 Set up 12 24 66 Inspections 24 12 60 Required: Determine the following: 1) Overhead applied to each product line 2) Total manufacturing cost per product line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts