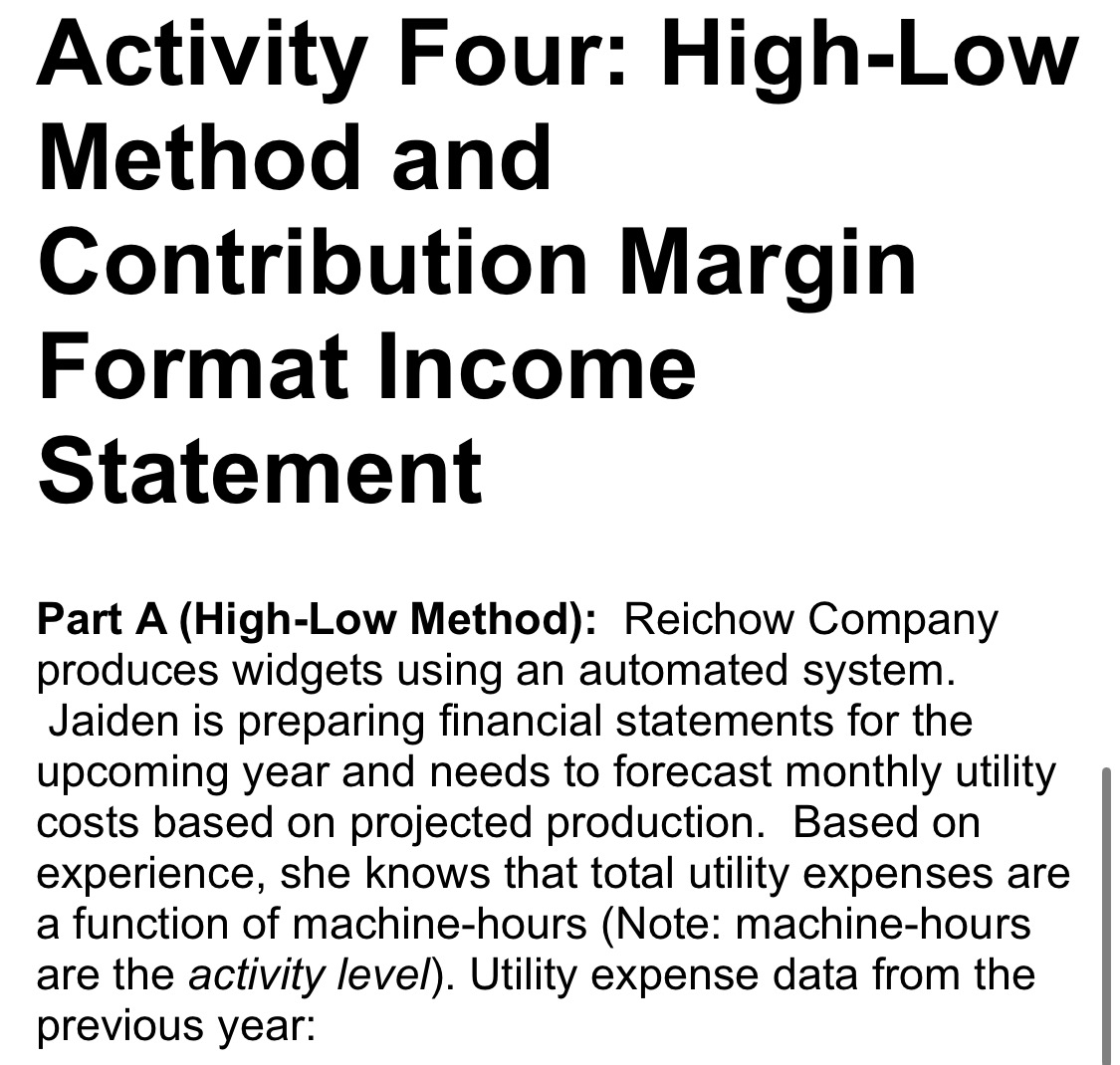

Question: Activity Four: High-Low Method and Contribution Margin Format Income Statement Part A (High-Low Method): Reichow Company produces widgets using an automated system. Jaiden is preparing

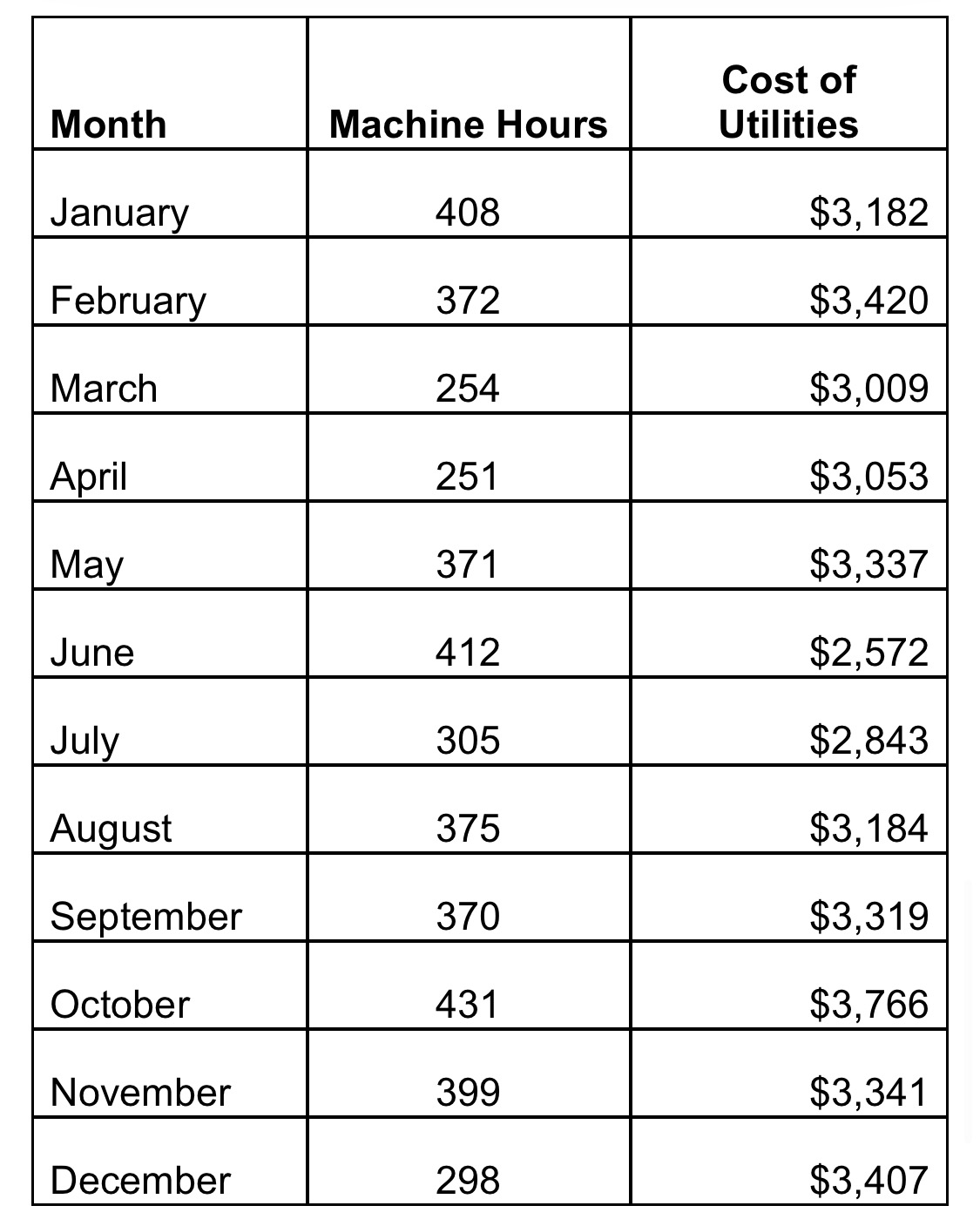

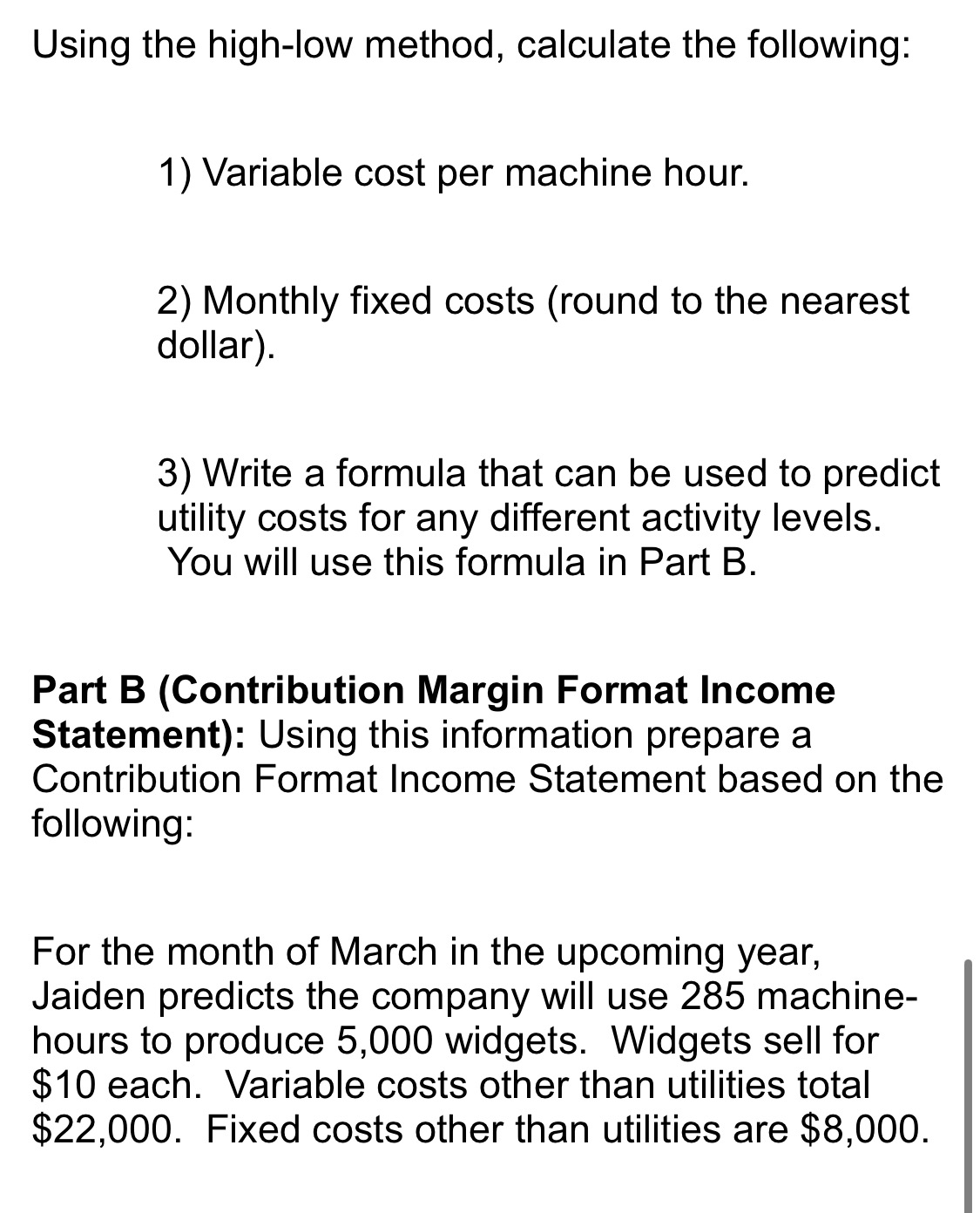

Activity Four: High-Low Method and Contribution Margin Format Income Statement Part A (High-Low Method): Reichow Company produces widgets using an automated system. Jaiden is preparing financial statements for the Jaiden is preparing financial statements for the upcoming year and needs to forecast monthly utilit experience, she knows that total utility expenses ar a function of machine-hours (Note: machine-hours are the activity level). Utility expense data from the previous year \begin{tabular}{|l|c|r|} \hline Month & Machine Hours & \multicolumn{1}{c|}{\begin{tabular}{l} Cost of \\ Utilities \end{tabular}} \\ \hline January & 408 & $3,182 \\ \hline February & 372 & $3,420 \\ \hline March & 254 & $3,009 \\ \hline April & 251 & $3,053 \\ \hline May & 371 & $3,337 \\ \hline June & 412 & $2,572 \\ \hline July & 305 & $2,843 \\ \hline August & 375 & $3,184 \\ \hline September & 370 & $3,319 \\ \hline October & 431 & $3,766 \\ \hline November & 399 & $3,341 \\ \hline December & 298 & $3,407 \\ \hline \end{tabular} Using the high-low method, calculate the following: 1) Variable cost per machine hour. 2) Monthly fixed costs (round to the nearest dollar). 3) Write a formula that can be used to predict utility costs for any different activity levels. You will use this formula in Part B. Part B (Contribution Margin Format Income Statement): Using this information prepare a Contribution Format Income Statement based on the following: For the month of March in the upcoming year, Jaiden predicts the company will use 285 machinehours to produce 5,000 widgets. Widgets sell for $10 each. Variable costs other than utilities total $22,000. Fixed costs other than utilities are $8,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts