Question: Activity Rates and Product Costs using Activity - Based Costing begin { tabular } { lrl } Activity & begin { tabular }

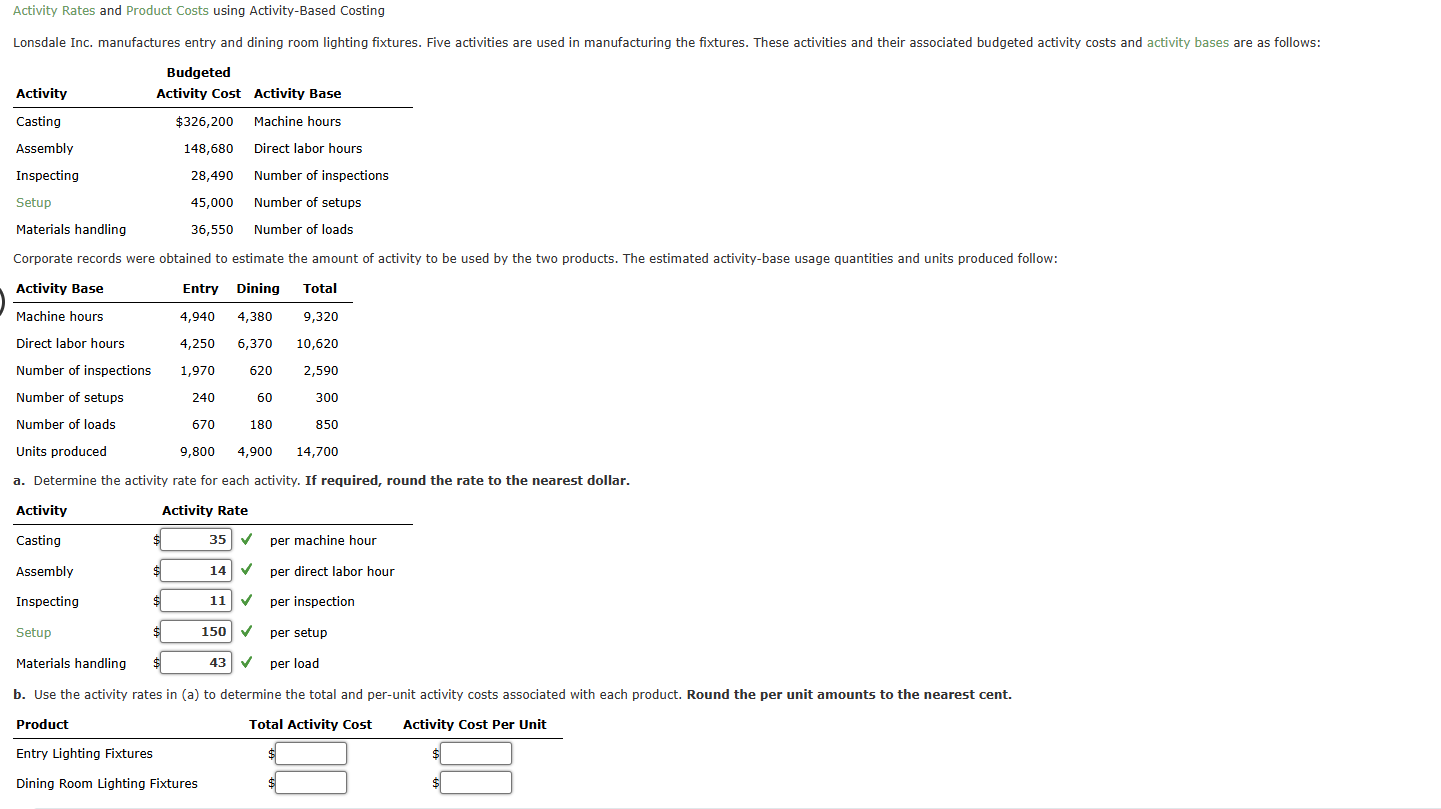

Activity Rates and Product Costs using ActivityBased Costing

begintabularlrl

Activity & begintabularc

Budgeted

Activity Cost

endtabular & Activity Base

hline Casting & $ & Machine hours

Assembly & & Direct labor hours

Inspecting & & Number of inspections

Setup & & Number of setups

Materials handling & & Number of loads

endtabular

Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activitybase usage quantities and units produced follow:

begintabularlrrr

Activity Base & Entry & Dining & Total

hline Machine hours & & &

Direct labor hours & & &

Number of inspections & & &

Number of setups & & &

Number of loads & & &

Units produced & & &

endtabular

a Determine the activity rate for each activity. If required, round the rate to the nearest dollar.

begintabularllll

Activity & multicolumnc Activity Rate

hline Casting & & checkmark & per machine hour

Assembly & vdots & checkmark & per direct labor hour

Inspecting & vdots & checkmark & per inspection

Setup & checkmark & checkmark & per setup

Materials handling & & checkmark & per load

endtabular

b Use the activity rates in a to determine the total and perunit activity costs associated with each product. Round the per unit amounts to the nearest cent.

begintabularlcc

Product & Total Activity Cost & Activity Cost Per Unit

hline Entry Lighting Fixtures & $ & $

Dining Room Lighting Fixtures & $ & $

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock