Question: Activity type This is a group assignment. Refer to the case titled The Accounting Software Installation Project. The case is at the bottom of this

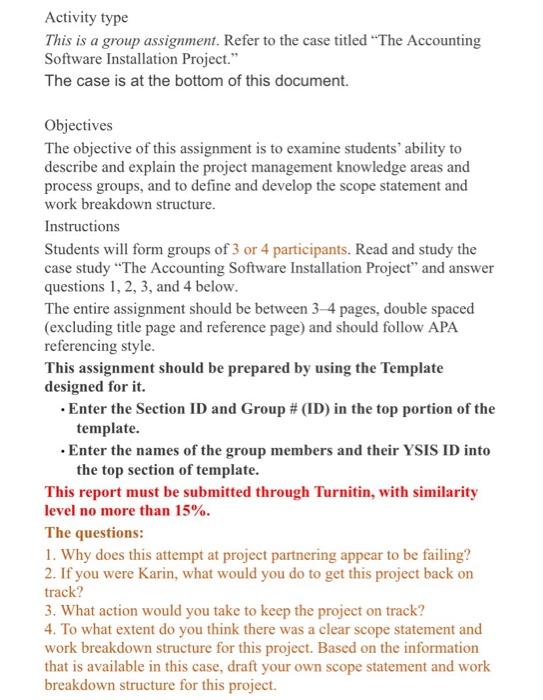

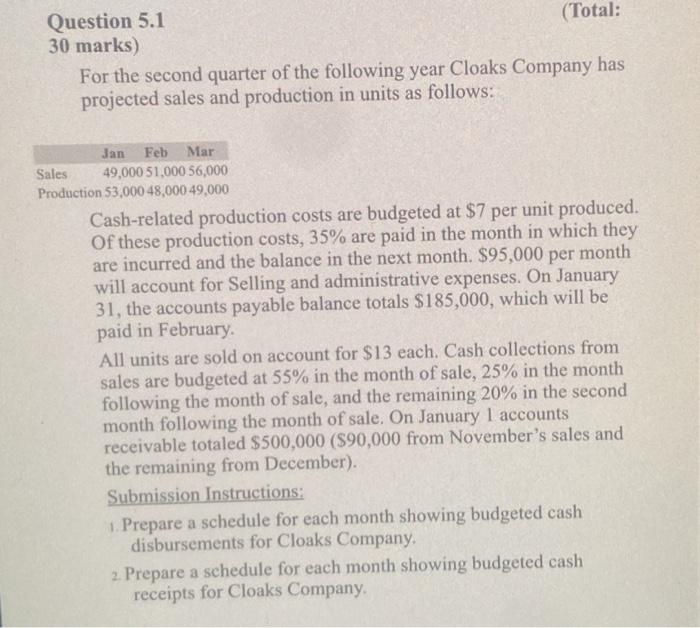

Activity type This is a group assignment. Refer to the case titled "The Accounting Software Installation Project." The case is at the bottom of this document. Objectives The objective of this assignment is to examine students' ability to describe and explain the project management knowledge areas and process groups, and to define and develop the scope statement and work breakdown structure. Instructions Students will form groups of 3 or 4 participants. Read and study the case study The Accounting Software Installation Project" and answer questions 1, 2, 3, and 4 below. The entire assignment should be between 3-4 pages, double spaced (excluding title page and reference page) and should follow APA referencing style. This assignment should be prepared by using the Template designed for it. Enter the Section ID and Group # (ID) in the top portion of the template. Enter the names of the group members and their YSIS ID into the top section of template. This report must be submitted through Turnitin, with similarity level no more than 15%. The questions: 1. Why does this attempt at project partnering appear to be failing? 2. If you were Karin, what would you do to get this project back on track? 3. What action would you take to keep the project on track? 4. To what extent do you think there was a clear scope statement and work breakdown structure for this project. Based on the information that is available in this case, draft your own scope statement and work breakdown structure for this project. Question 5.1 (Total: 30 marks) For the second quarter of the following year Cloaks Company has projected sales and production in units as follows: Feb Jan Mar Sales 49,000 51.000 56,000 Production 53,000 48,000 49.000 Cash-related production costs are budgeted at $7 per unit produced. Of these production costs, 35% are paid in the month in which they are incurred and the balance in the next month. $95,000 per month will account for Selling and administrative expenses. On January 31, the accounts payable balance totals $185,000, which will be paid in February All units are sold on account for $13 each. Cash collections from sales are budgeted at 55% in the month of sale, 25% in the month following the month of sale, and the remaining 20% in the second month following the month of sale. On January 1 accounts receivable totaled $500,000 ($90,000 from November's sales and the remaining from December). Submission Instructions: 1. Prepare a schedule for each month showing budgeted cash disbursements for Cloaks Company, 2. Prepare a schedule for each month showing budgeted cash receipts for Cloaks Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts