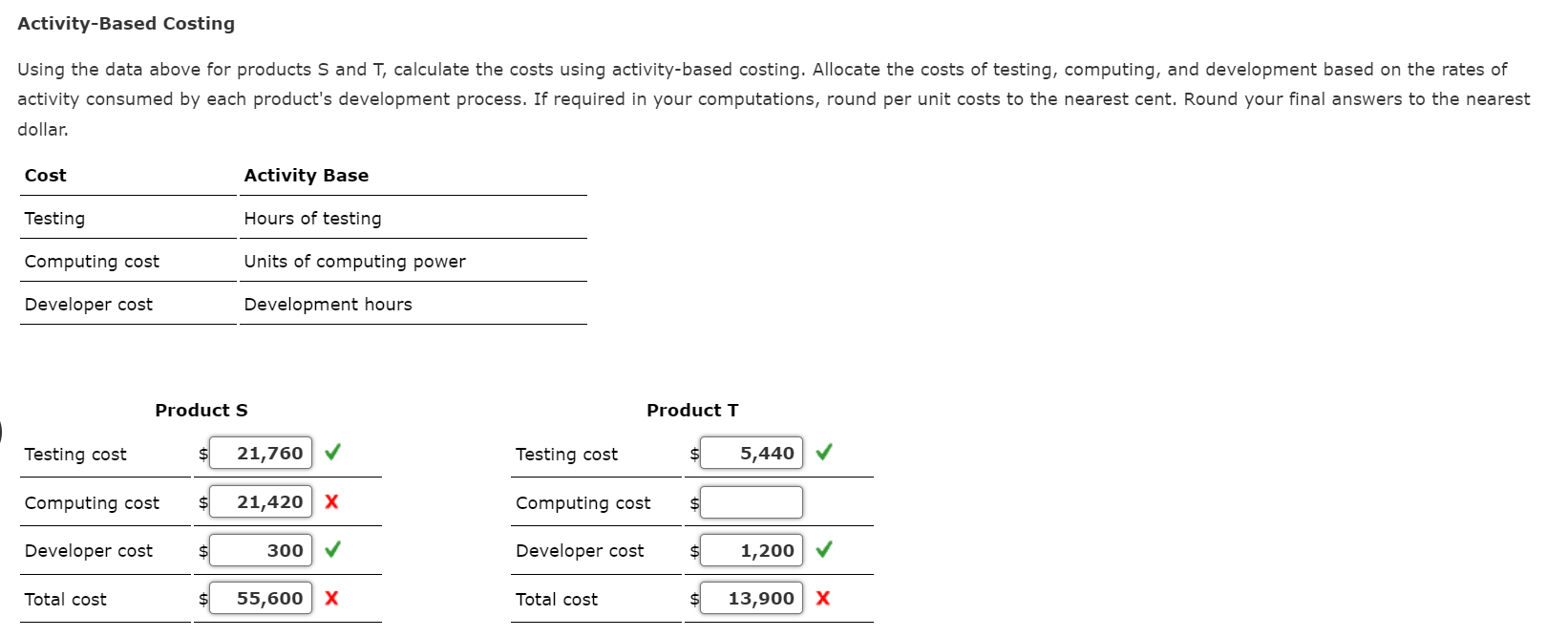

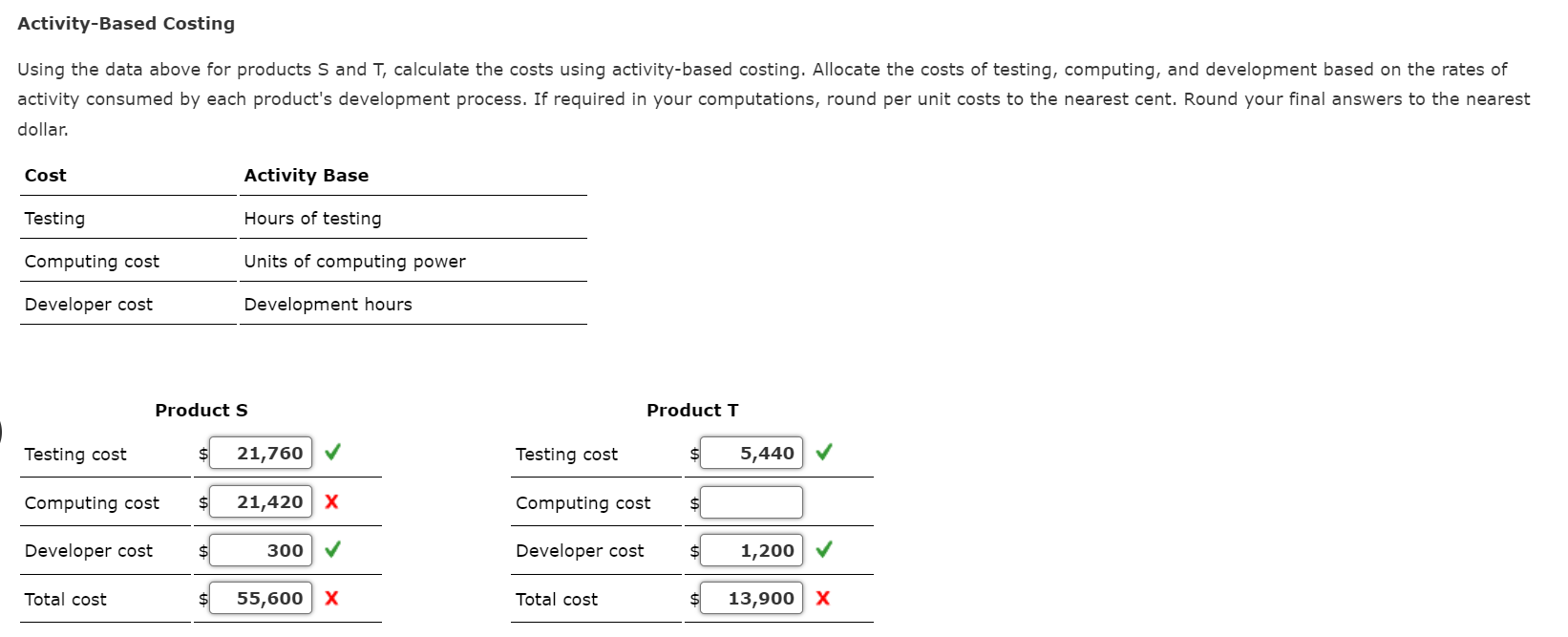

Question: Activity-Based Costing Using the data above for products S and T, calculate the costs using activity-based costing. Allocate the costs of testing, computing, and development

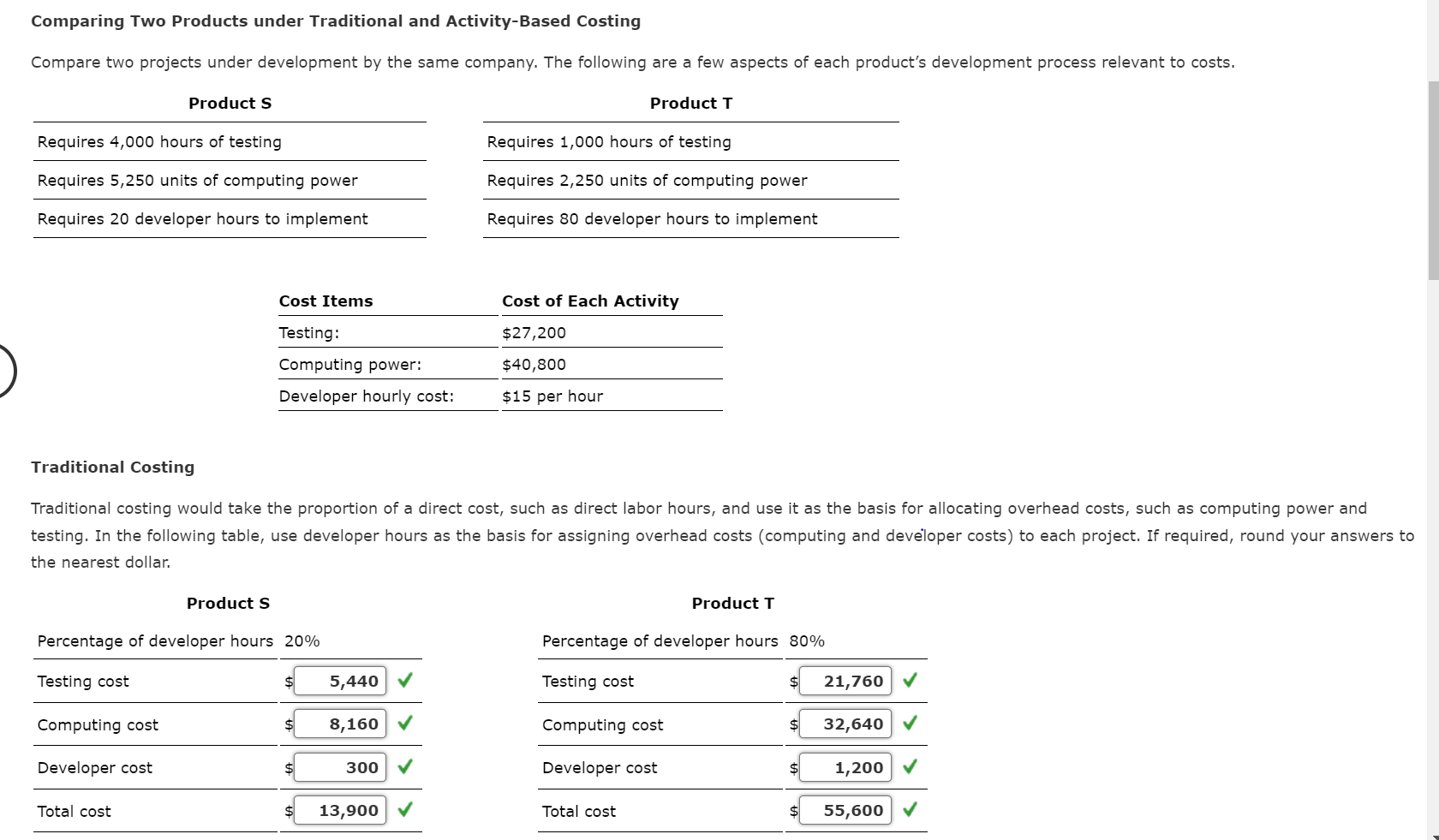

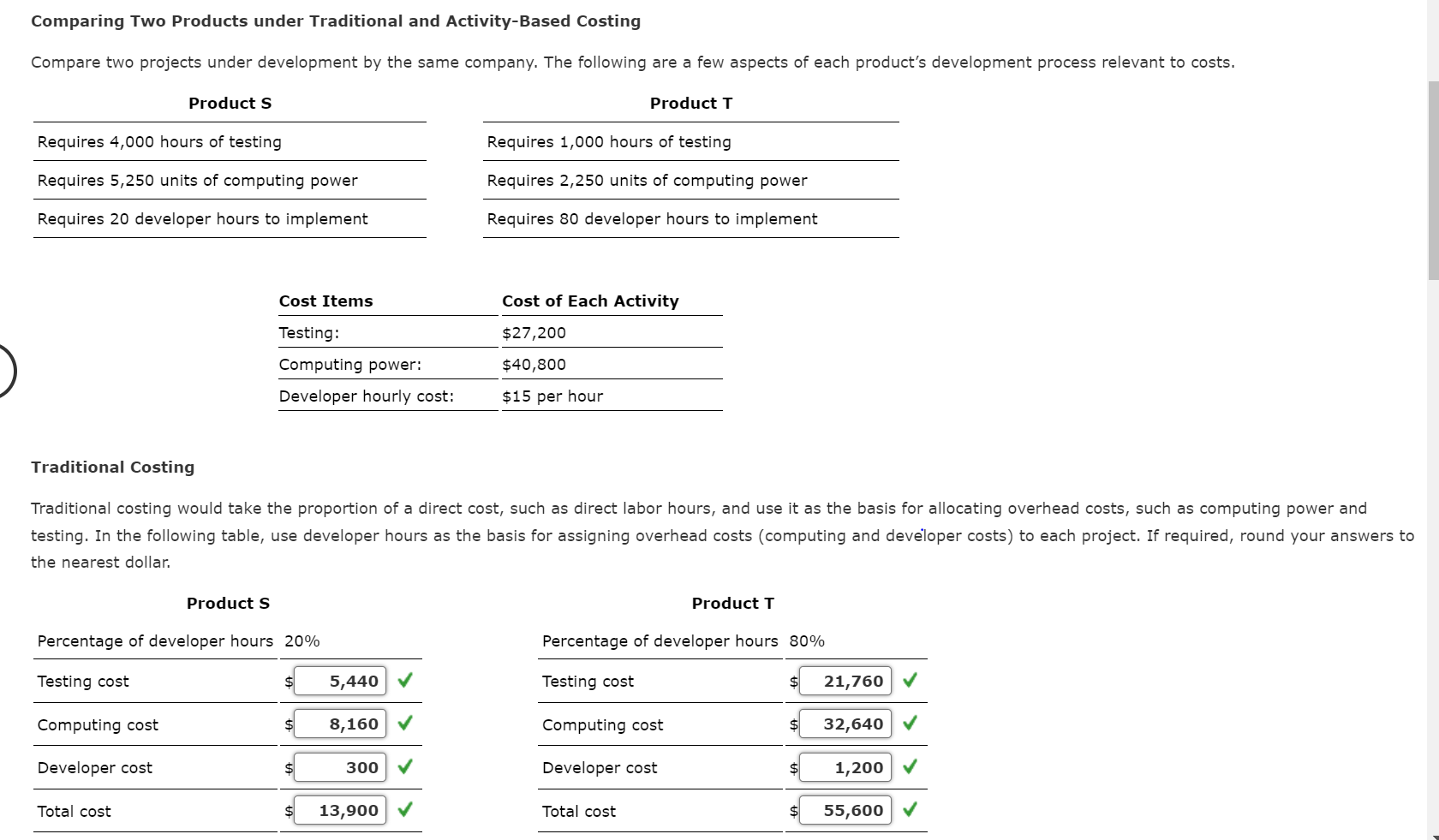

Activity-Based Costing Using the data above for products S and T, calculate the costs using activity-based costing. Allocate the costs of testing, computing, and development based on the rates of activity consumed by each product's development process. If required in your computations, round per unit costs to the nearest cent. Round your nal answers to the nearest dollar. Cost Activity Base Testing Hours of testing Computing cost Units of computing power Developer cost Development hours Product 5 Product T Testing cost $ 21,760 4 Testing cost Computing cost Computing cost E Developer cost 4 Total cost $- X Total cost Developer cost Comparing Two Products under Traditional and ActivityBased Costing Compare two projects under development by the same company. The foilowing are a few aspects of each product's development process relevant to costs. Product 5 Product T Requires 4,000 hours of testing Requires 1,000 hours of testing Requires 5,250 units of computing power Requires 2,250 units of computing power Requires 20 developer hours to implement Requires 80 developer hours to implement Cost Items Cost of Each Activity Testing: $27,200 Computing power: $40,800 Developer hourly cost: $15 per hour Traditional Costing Traditional costing would take the proportion of a direct cost, such as direct iabor hours, and use it as the basis for allocating overhead costs, such as computing power and testing. In the following table, use developer hours as the basis for assigning overhead costs (computing and developer costs) to each project. If required, round your answers to the nearest dollar. Product S Product T Percentage of developer hours 20% Percentage of developer hours 80% Testing cost VI Testing cost $- I Computing cost 2- VI Computing cost 35- 5' Developer cost VI Developer cost $- VI Total cost 2- VI Total cost 35- V/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts