Question: Actually I already get the answer.....but I cannot understand it If U are not mind, could U just do it more detailed? 104229 Cost and

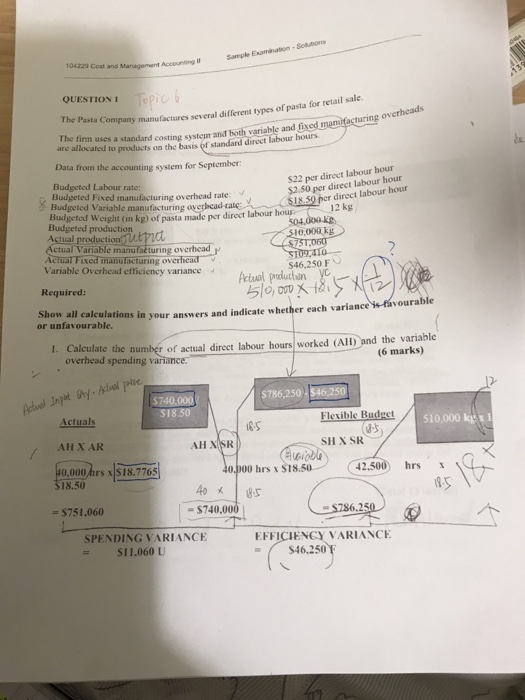

104229 Cost and QUESTION The Pasta Company manufactures several different types of pasta for retail sale. The firm uses a standard costing system and both variable and are allocated to products on the basis of standard direct labour hours Data from the accounting system for September Budgeted Labour rate: Budgeted Fixed manufacturing overhead rate Budgeted Variable manufacturing overbcad Budgeted Weight (in S22 per direct labour hour S2.50 per direct labour hour $18.50 per r direct labour hour 12 kg kg) of pasta made per direct labour hous Budgeted production tnd ctual Variable manufatturing overhcad Actual production Acual Fixed manufacturing overhead Variable Overhead efficiency variance $46,250 F Required: Show all calculations in or unfavourable. your answers and indicate whether each variance is favourable I. Calculate the number of actual direct labour hours worked (AH) and the variable overhead spending variance (6 marks) $740,000 $786,250 546,250 S18 Actuals AH X AR 40,000 hrs x $18.776 Flexible Budget SHX SR 4 510,000 ki 1 40,000 hrs x S18.50 (42,500) hrs $18.50 - $751,060 = $740,000 ! SPENDING VARIANCE SI1.060 U EFFICIENCY VARIANCE $46.250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts