Question: Actuarial 10. Following information about a project is given a. Project duration: 10 years b. Risk free interest rate: 5% C. Cost of capital 11%

Actuarial

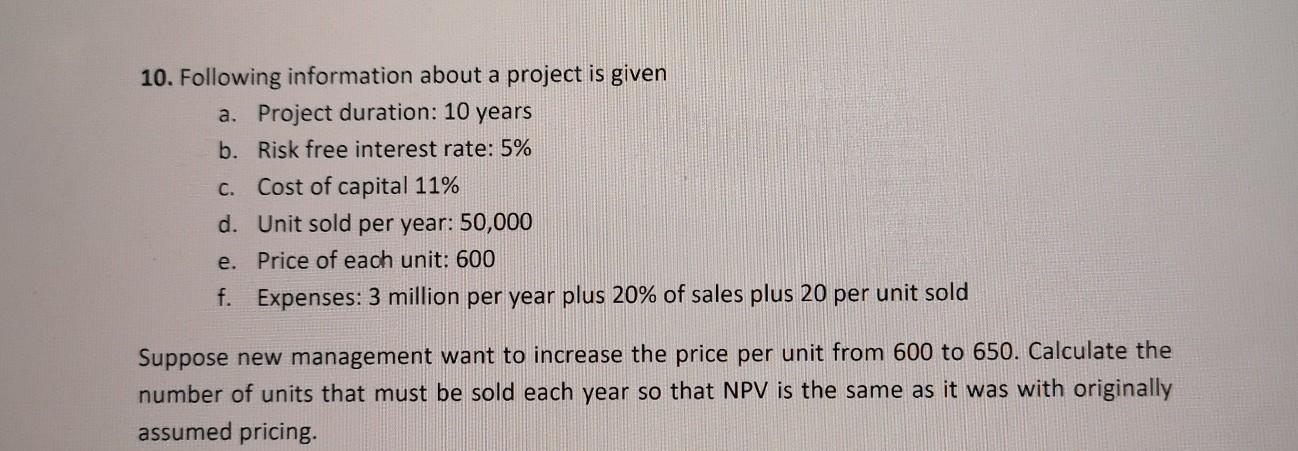

10. Following information about a project is given a. Project duration: 10 years b. Risk free interest rate: 5% C. Cost of capital 11% d. Unit sold per year: 50,000 e. Price of each unit: 600 f. Expenses: 3 million per year plus 20% of sales plus 20 per unit sold Suppose new management want to increase the price per unit from 600 to 650. Calculate the number of units that must be sold each year so that NPV is the same as it was with originally assumed pricing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock