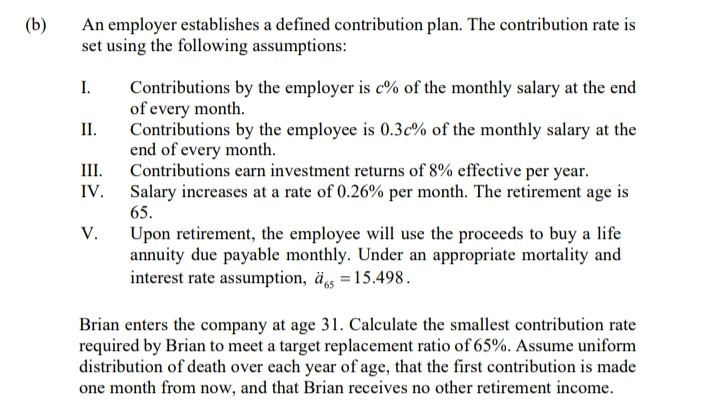

Question: Actuarial Mathematics (b) An employer establishes a defined contribution plan. The contribution rate is set using the following assumptions: I. III. Contributions by the employer

Actuarial Mathematics

(b) An employer establishes a defined contribution plan. The contribution rate is set using the following assumptions: I. III. Contributions by the employer is c% of the monthly salary at the end of every month. Contributions by the employee is 0.3% of the monthly salary at the end of every month. Contributions earn investment returns of 8% effective per year. Salary increases at a rate of 0.26% per month. The retirement age is 65. Upon retirement, the employee will use the proceeds to buy a life annuity due payable monthly. Under an appropriate mortality and interest rate assumption, gs = 15.498. Brian enters the company at age 31. Calculate the smallest contribution rate required by Brian to meet a target replacement ratio of 65%. Assume uniform distribution of death over each year of age, that the first contribution is made one month from now, and that Brian receives no other retirement income. (b) An employer establishes a defined contribution plan. The contribution rate is set using the following assumptions: I. III. Contributions by the employer is c% of the monthly salary at the end of every month. Contributions by the employee is 0.3% of the monthly salary at the end of every month. Contributions earn investment returns of 8% effective per year. Salary increases at a rate of 0.26% per month. The retirement age is 65. Upon retirement, the employee will use the proceeds to buy a life annuity due payable monthly. Under an appropriate mortality and interest rate assumption, gs = 15.498. Brian enters the company at age 31. Calculate the smallest contribution rate required by Brian to meet a target replacement ratio of 65%. Assume uniform distribution of death over each year of age, that the first contribution is made one month from now, and that Brian receives no other retirement income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts