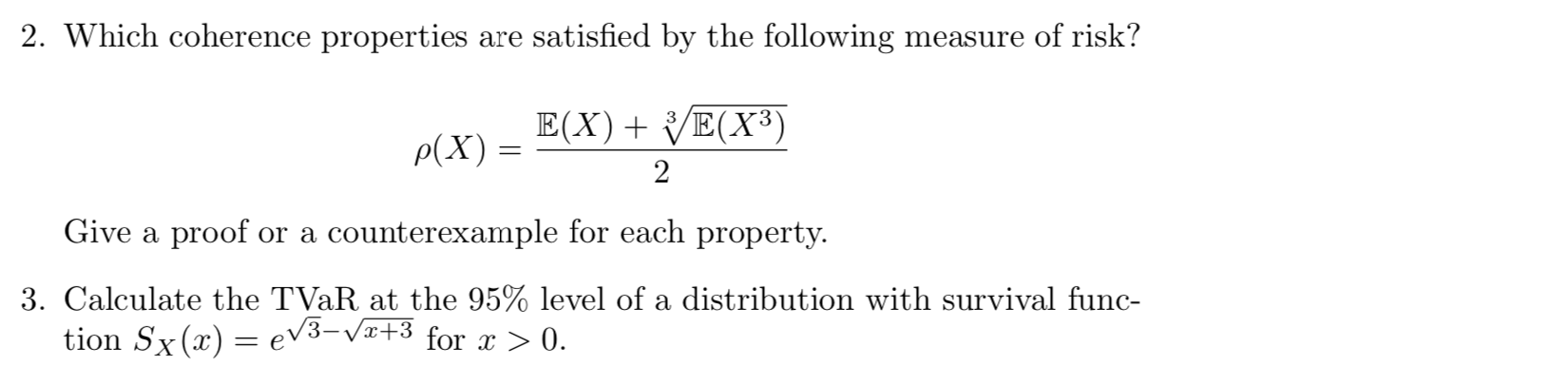

Question: Actuarial Science 2. Which coherence properties are satisfied by the following measure of risk? p ( X ) = - E(X) + VE(X3 2 Give

Actuarial Science

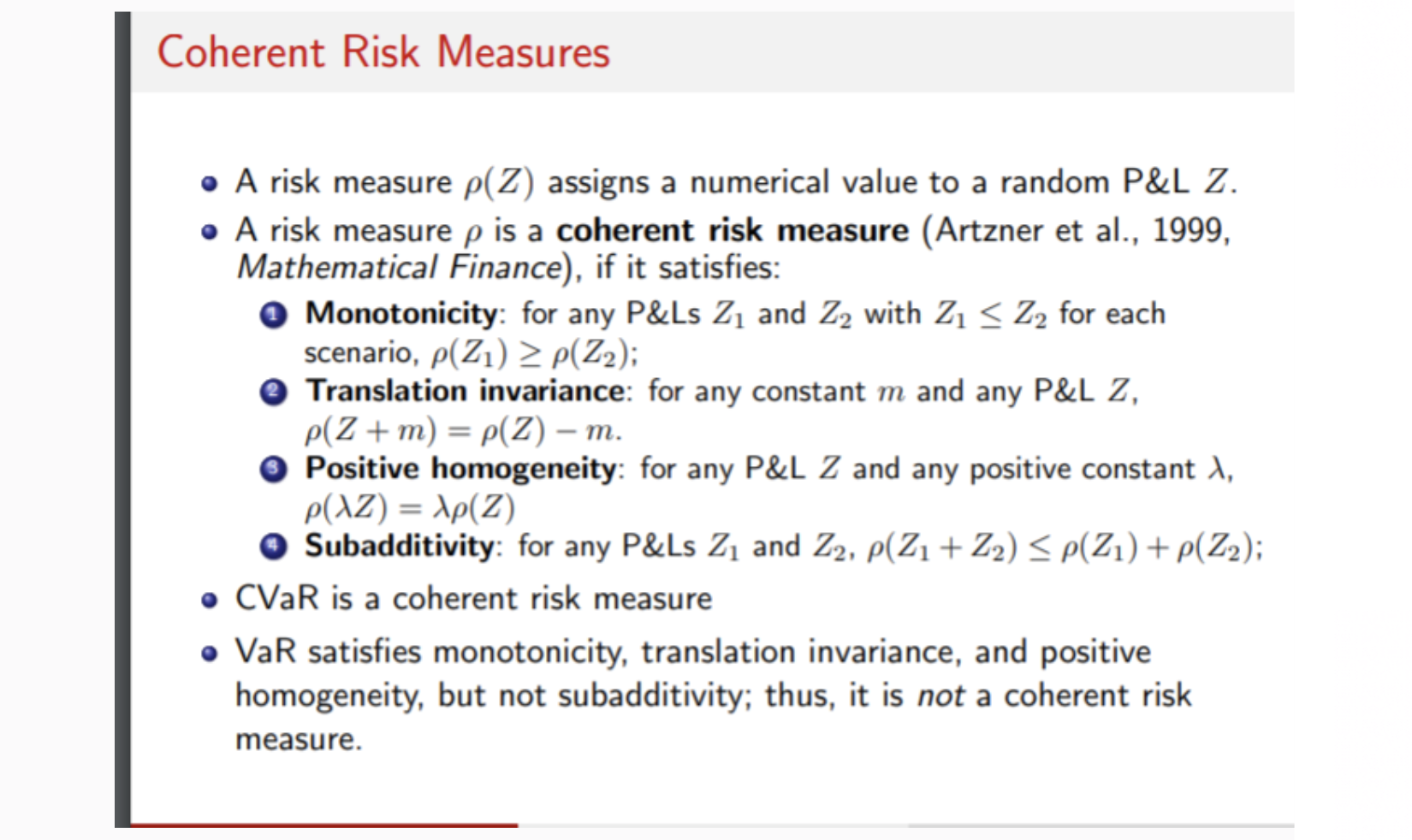

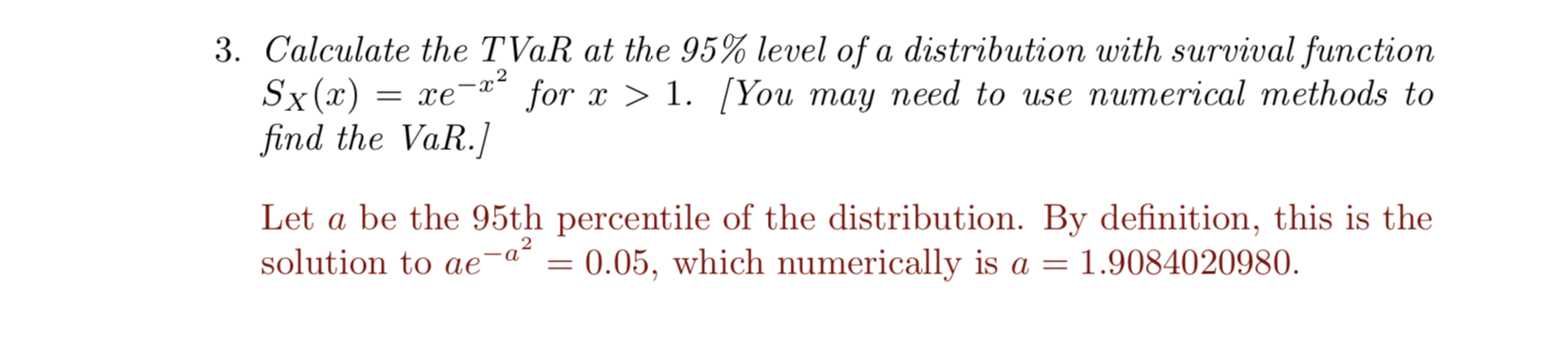

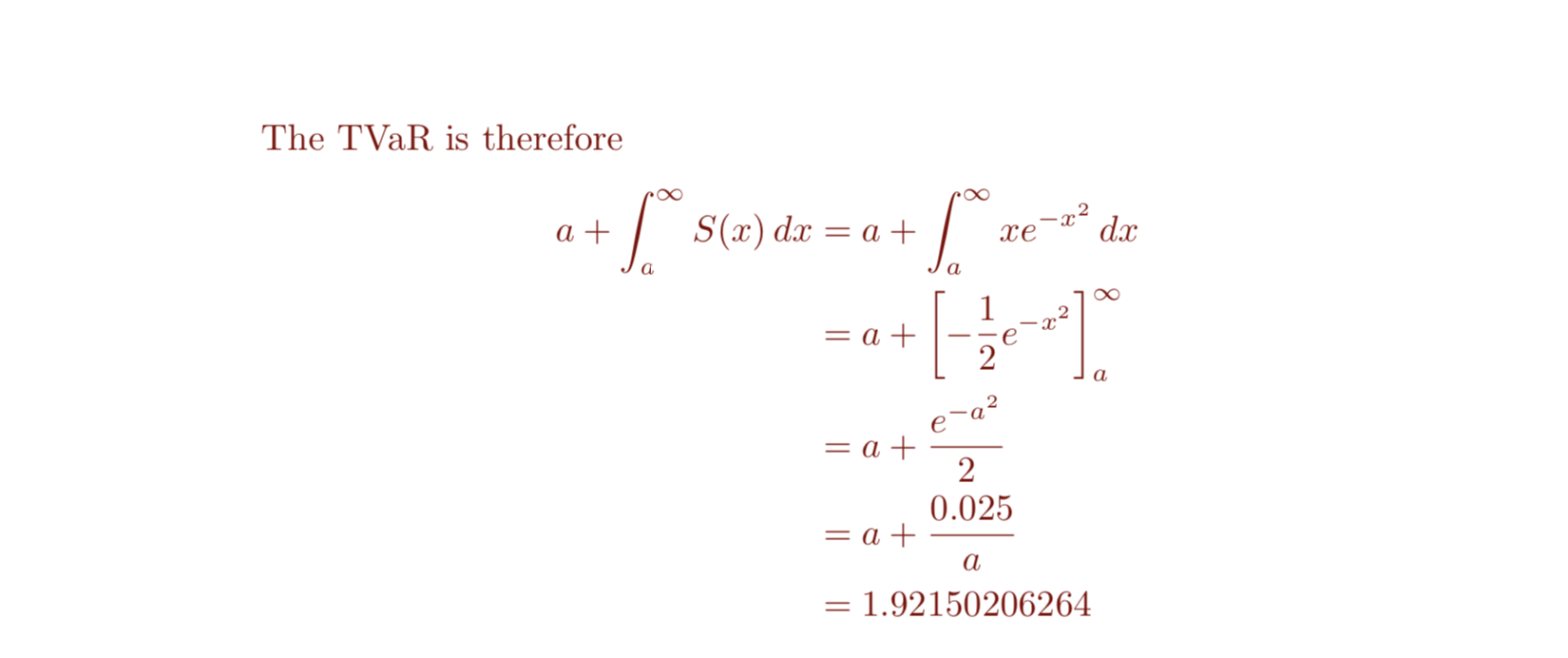

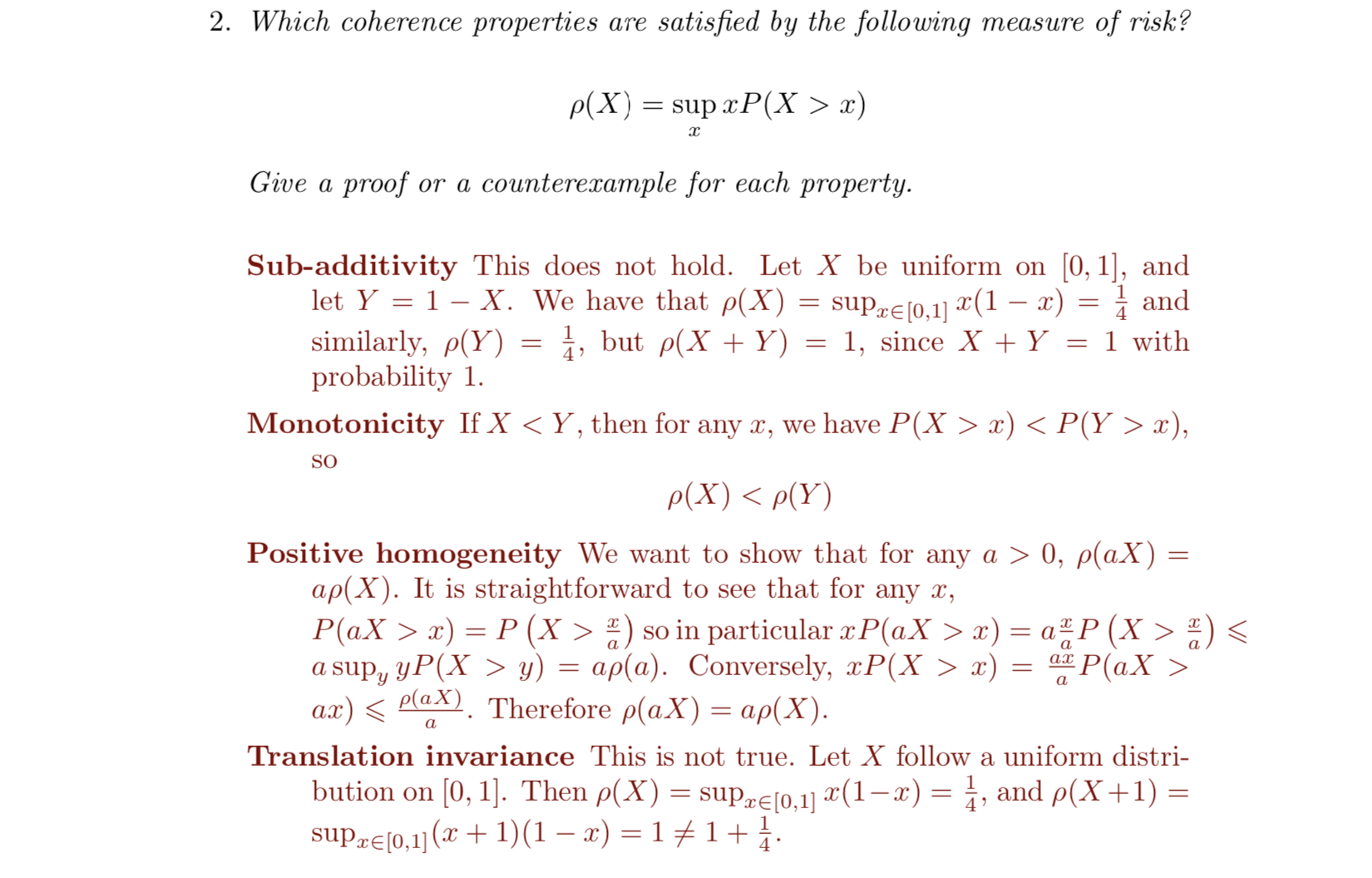

2. Which coherence properties are satisfied by the following measure of risk? p ( X ) = - E(X) + VE(X3 2 Give a proof or a counterexample for each property. 3. Calculate the TVaR at the 95% level of a distribution with survival func- tion Sx (x) = eV3-vi+3 for x > 0.Coherent Risk Measures . A risk measure p(Z) assigns a numerical value to a random P&L Z. . A risk measure p is a coherent risk measure (Artzner et al., 1999, Mathematical Finance), if it satisfies: Monotonicity: for any P&Ls Z1 and Z2 with Z1 1. [You may need to use numerical methods to find the VaR.] Let a be the 95t1 percentile of the distribution. By definition, this is the solution to ae = 0.05, which numerically is a = 1.9084020980. \f2. Which coherence properties are satisfied by the following measure of risk? p(X) = sup xP(X > x) Give a proof or a counterexample for each property. Sub-additivety This does not hold. Let X be uniform on [0, 1], and let Y = 1 - X. We have that p(X) = suprejo,1] x(1 - x) = - and similarly, p(Y) = 4, but p(X + Y) = 1, since X + Y = 1 with probability 1. Monotonicity If X x) x), SO p ( X ) 0, p(aX) = ap(X). It is straightforward to see that for any x, Plax > x) = P(X > ) so in particular x P(aX > x) = atP (X > I) y) = ap(a). Conversely, xP(X > x) = at P(aX > ax)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts