Question: Actuary problem. I provided the answer, please help me to get the answer process. i need no.11. Use the following for the next two problems:

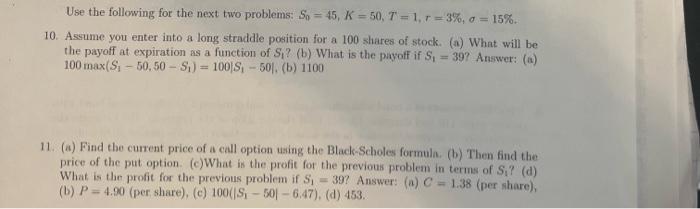

Use the following for the next two problems: So = 45, K = 50,7 = 1, r = 3%, 0 = 15%. 10. Assume you enter into a long straddle position for a 100 shares of stock. (a) What will be the payoff at expiration as a function of Si? (b) What is the payoff if S = 397 Answer: (a) 100 max(S. - 50.50 - $) = 100$, - 501. (b) 1100 11. (a) Find the current price of a call option using the Black-Scholes formula (b) Then find the price of the put option (c)What is the profit for the previous problem in terms of S.? (d) What is the profit for the previous problem if S = 397 Answer: () C = 1.38 (per share), (6) P = 4.90 (per share), (e) 1000$, - 501 - 6:47), (d) 453

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts