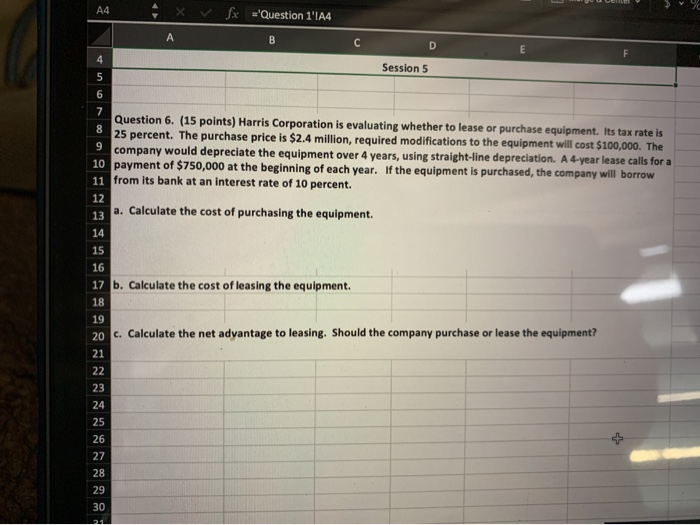

Question: Ad f x X A ='Question 1'1A4 B C . D Session 5 Question 6. (15 points) Harris Corporation is evaluating whether to lease or

Ad f x X A ='Question 1'1A4 B C . D Session 5 Question 6. (15 points) Harris Corporation is evaluating whether to lease or purchase equipment. Its tax rate is 25 percent. The purchase price is $2.4 million, required modifications to the equipment will cost $100,000. The company would depreciate the equipment over 4 years, using straight-line depreciation. A 4-vear lease calls for a payment of $750,000 at the beginning of each year. If the equipment is purchased, the company will borrow 11 from its bank at an interest rate of 10 percent. 13 a. Calculate the cost of purchasing the equipment. 17 b. Calculate the cost of leasing the equipment. 20 c. Calculate the net advantage to leasing. Should the company purchase or lease the equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts