Question: a-d please! part a and b are wrong Stock repurchase The following data on the Bond Record Company are available: . The firm is currently

a-d please! part a and b are wrong

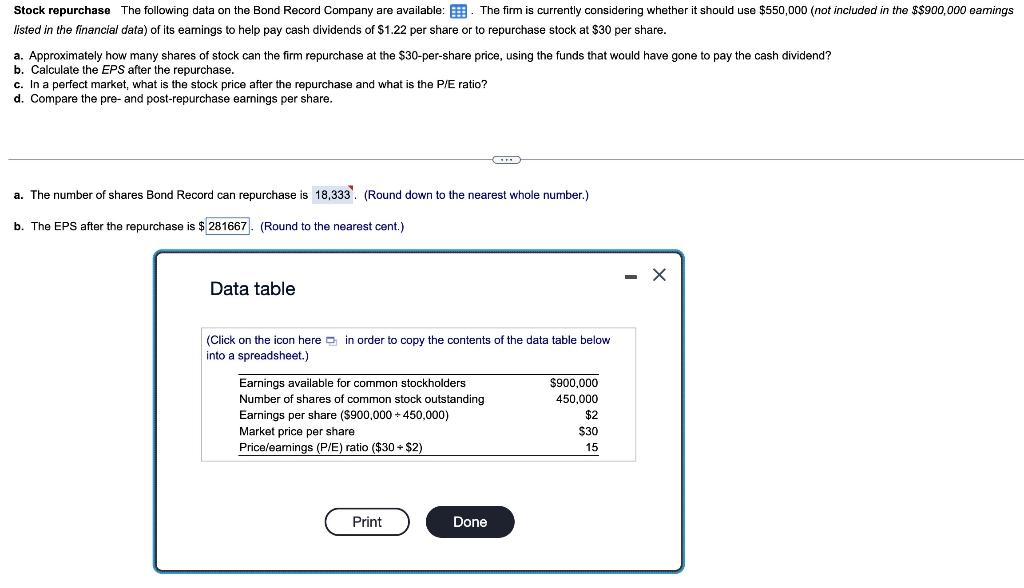

Stock repurchase The following data on the Bond Record Company are available: . The firm is currently considering whether it should use $550,000 (not included in the $900,000 eamings listed in the financial data) of its earnings to help pay cash dividends of $1.22 per share or to repurchase stock at $30 per share. a. Approximately how many shares of stock can the firm repurchase at the $30-per-share price, using the funds that would have gone to pay the cash dividend? b. Calculate the EPS after the repurchase. c. In a perfect market, what is the stock price after the repurchase and what is the P/E ratio? d. Compare the pre- and post-repurchase earnings per share. a. The number of shares Bond Record can repurchase is (Round down to the nearest whole number.) b. The EPS after the repurchase is ? (Round to the nearest cent.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) \begin{tabular}{lr} \hline Earnings available for common stockholders & $900,000 \\ Number of shares of common stock outstanding & 450,000 \\ Earnings per share ($900,000450,000) & $2 \\ Market price per share & $30 \\ Pricelearmings (P/E) ratio ($30$2) & 15 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts