Question: - A-D-A- 116 EEEE 1 Normal 1 No Spac... Heading 1 Heading 2 Title Gic Repi A Sele Paragraph Styles Editin 63) Using the following

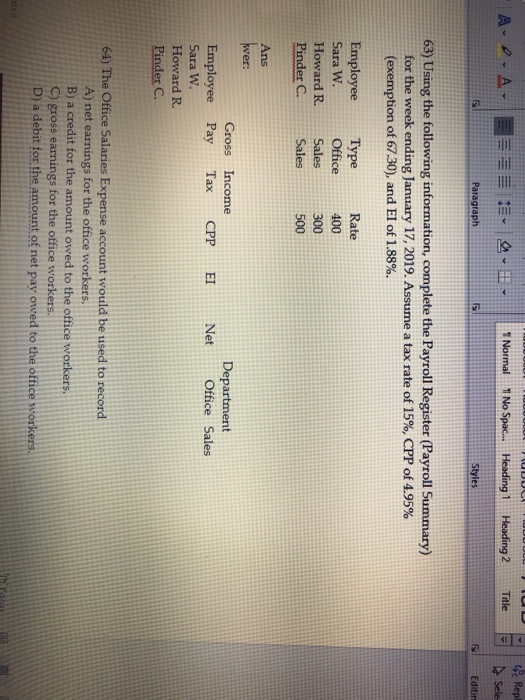

- A-D-A- 116 EEEE 1 Normal 1 No Spac... Heading 1 Heading 2 Title Gic Repi A Sele Paragraph Styles Editin 63) Using the following information, complete the Payroll Register (Payroll Summary) for the week ending January 17, 2019. Assume a tax rate of 15%, CPP of 4.95% (exemption of 67.30), and EI of 1.88%. Rate 400 Employee Sara W. Howard R. Pinder C. Type Office Sales Sales 300 500 Ans wer: Gross Income Pay Tax CPP EI N et Department Office Sales Employee Sara W. Howard R. Pinder C. 64) The Office Salaries Expense account would be used to record A) net earnings for the office workers. B) a credit for the amount owed to the office workers. C) gross earnings for the office workers. D) a debit for the amount of net pay owed to the office workers. Focus PEF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts