Question: ADA T Normal 1 No Spac. Heading 1 Headir Font Paragraph Styles ed credentials are out of date. Please sign in as BA***@uaedu so we

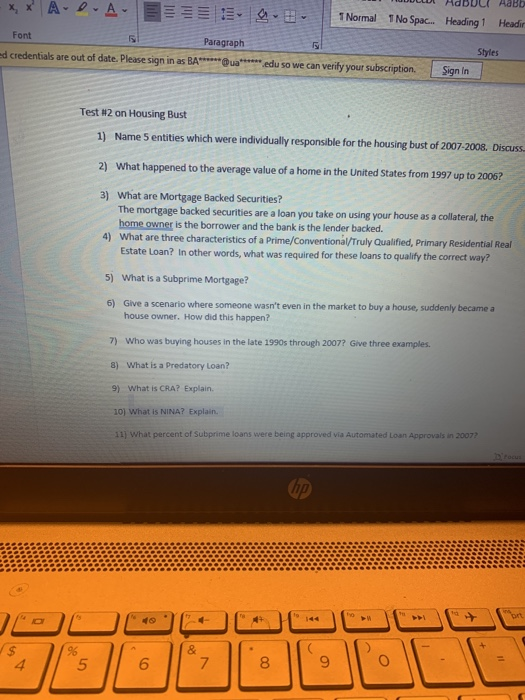

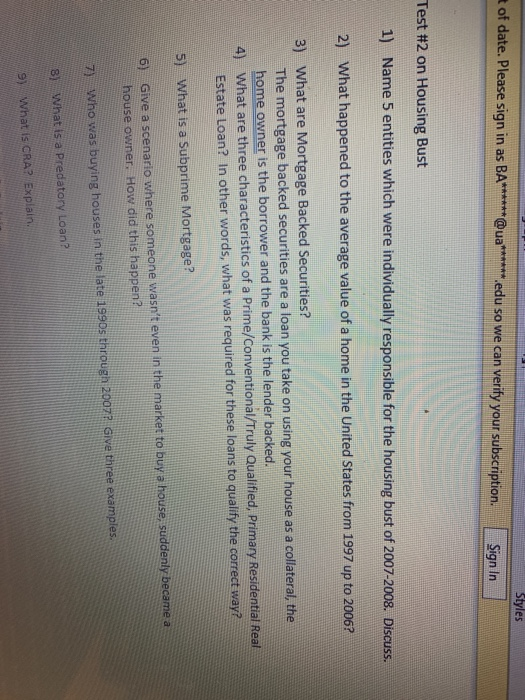

ADA T Normal 1 No Spac. Heading 1 Headir Font Paragraph Styles ed credentials are out of date. Please sign in as BA***@uaedu so we can verify your subscription. Sign In Test #2 on Housing Bust 1) Name 5 entities which were individually responsible for the housing bust of 2007-2008. Discuss 2) What happened to the average value of a home in the United States from 1997 up to 2006? 3) What are Mortgage Backed Securities? The mortgage backed securities are a loan you take on using your house as a collateral, the home owner is the borrower and the bank is the lender backed. 4) What are three characteristics of a Prime/Conventional/Truly Qualified, Primary Residential Real Estate Loan? In other words, what was required for these loans to qualify the correct way? 5) What is a Subprime Mortgage? 6) Give a scenario where someone wasn't even in the market to buy a house, suddenly became a house owner. How did this happen? 7) Who was buying houses in the late 1990s through 2007? Give three examples. 8) What is a Predatory Loan? 9) What is CRA? Explain. 10) What is NINA? Explain. 11) What percent of Subprime loans were being approved via Automated Loan Approvals in 2007? Op brt 96 5 & 7 4 6 00 9 O o Styles t of date. Please sign in as BA******@ua******.edu so we can verify your subscription. Sign In Test #2 on Housing Bust 1) Name 5 entities which were individually responsible for the housing bust of 2007-2008. Discuss. 2) What happened to the average value of a home in the United States from 1997 up to 2006? 3) What are Mortgage Backed Securities? The mortgage backed securities are a loan you take on using your house as a collateral, the home owner is the borrower and the bank is the lender backed. 4) What are three characteristics of a Prime/Conventional/Truly Qualified, Primary Residential Real Estate Loan? In other words, what was required for these loans to qualify the correct way? 5) What is a Subprime Mortgage? 6) Give a scenario where someone wasn't even in the market to buy a house, suddenly became a house owner. How did this happen? 7) Who was buying houses in the late 1990s through 2007 Give three examples. 8) What is a Predatory Loan? 9) What is CRA? Explain. ADA T Normal 1 No Spac. Heading 1 Headir Font Paragraph Styles ed credentials are out of date. Please sign in as BA***@uaedu so we can verify your subscription. Sign In Test #2 on Housing Bust 1) Name 5 entities which were individually responsible for the housing bust of 2007-2008. Discuss 2) What happened to the average value of a home in the United States from 1997 up to 2006? 3) What are Mortgage Backed Securities? The mortgage backed securities are a loan you take on using your house as a collateral, the home owner is the borrower and the bank is the lender backed. 4) What are three characteristics of a Prime/Conventional/Truly Qualified, Primary Residential Real Estate Loan? In other words, what was required for these loans to qualify the correct way? 5) What is a Subprime Mortgage? 6) Give a scenario where someone wasn't even in the market to buy a house, suddenly became a house owner. How did this happen? 7) Who was buying houses in the late 1990s through 2007? Give three examples. 8) What is a Predatory Loan? 9) What is CRA? Explain. 10) What is NINA? Explain. 11) What percent of Subprime loans were being approved via Automated Loan Approvals in 2007? Op brt 96 5 & 7 4 6 00 9 O o Styles t of date. Please sign in as BA******@ua******.edu so we can verify your subscription. Sign In Test #2 on Housing Bust 1) Name 5 entities which were individually responsible for the housing bust of 2007-2008. Discuss. 2) What happened to the average value of a home in the United States from 1997 up to 2006? 3) What are Mortgage Backed Securities? The mortgage backed securities are a loan you take on using your house as a collateral, the home owner is the borrower and the bank is the lender backed. 4) What are three characteristics of a Prime/Conventional/Truly Qualified, Primary Residential Real Estate Loan? In other words, what was required for these loans to qualify the correct way? 5) What is a Subprime Mortgage? 6) Give a scenario where someone wasn't even in the market to buy a house, suddenly became a house owner. How did this happen? 7) Who was buying houses in the late 1990s through 2007 Give three examples. 8) What is a Predatory Loan? 9) What is CRA? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts