Question: Adam does not believe that historical trading data could help generating abnormal returns, however, he tries to analyze quarterly reports of firms and macroeconomic data

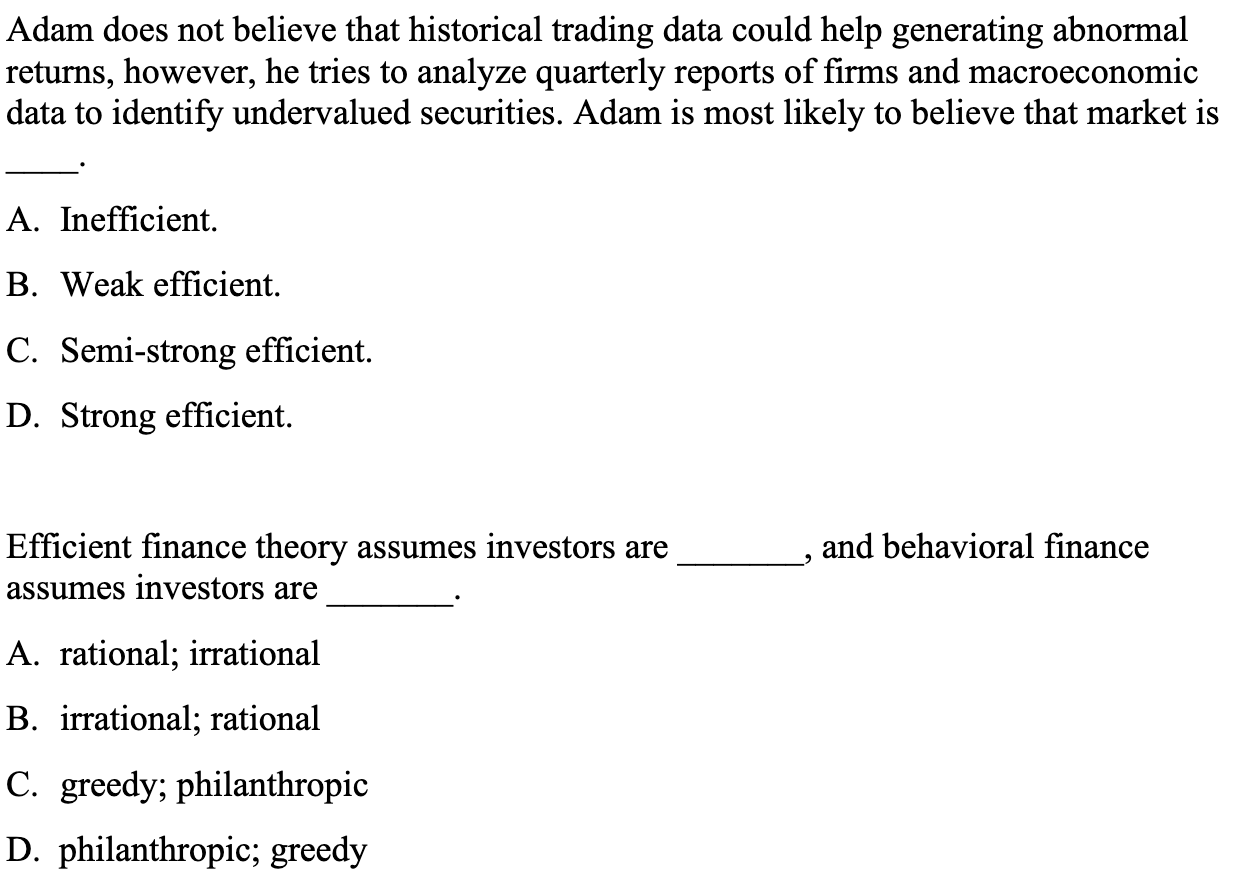

Adam does not believe that historical trading data could help generating abnormal returns, however, he tries to analyze quarterly reports of firms and macroeconomic data to identify undervalued securities. Adam is most likely to believe that market is A. Inefficient B. Weak efficient. C. Semi-strong efficient. D. Strong efficient. , and behavioral finance Efficient finance theory assumes investors are assumes investors are A. rational; irrational B. irrational; rational C. greedy; philanthropic D. philanthropic; greedy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts