Question: Adams Construction bought a front-end loader for $55,000. As a new intern of the company, you have been tasked to develop depreciation schedules of

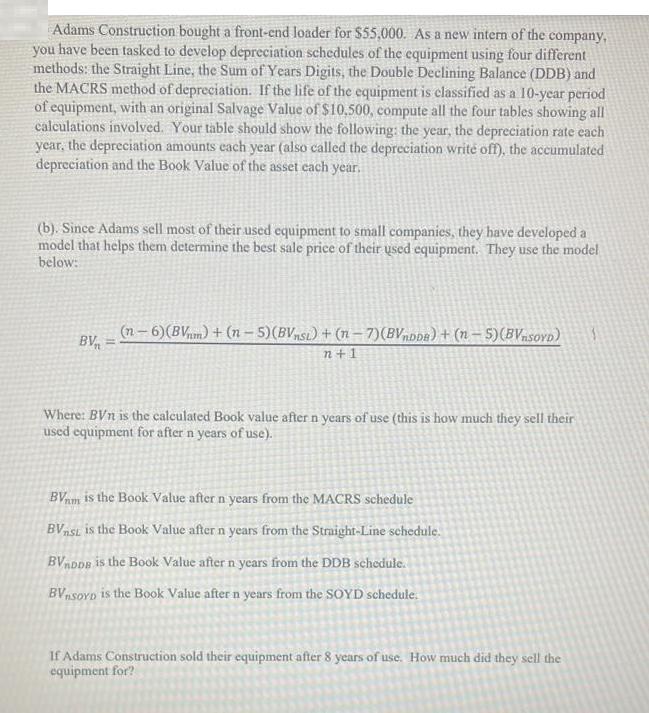

Adams Construction bought a front-end loader for $55,000. As a new intern of the company, you have been tasked to develop depreciation schedules of the equipment using four different methods: the Straight Line, the Sum of Years Digits, the Double Declining Balance (DDB) and the MACRS method of depreciation. If the life of the equipment is classified as a 10-year period of equipment, with an original Salvage Value of $10.500, compute all the four tables showing all calculations involved. Your table should show the following: the year, the depreciation rate each year, the depreciation amounts each year (also called the depreciation write off), the accumulated depreciation and the Book Value of the asset each year. (b). Since Adams sell most of their used equipment to small companies, they have developed a model that helps them determine the best sale price of their used equipment. They use the model below: BV (n-6) (BVm) + (n-5)(BVnst) + (n 7) (BVnDDA) + (n - 5)(BVSOYD) n+1 Where: BVn is the calculated Book value after n years of use (this is how much they sell their used equipment for after n years of use). BVm is the Book Value after n years from the MACRS schedule BVnst is the Book Value after n years from the Straight-Line schedule. BVMDDB is the Book Value after n years from the DDB schedule. BV SOYD is the Book Value after n years from the SOYD schedule. If Adams Construction sold their equipment after 8 years of use. How much did they sell the equipment for?

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts