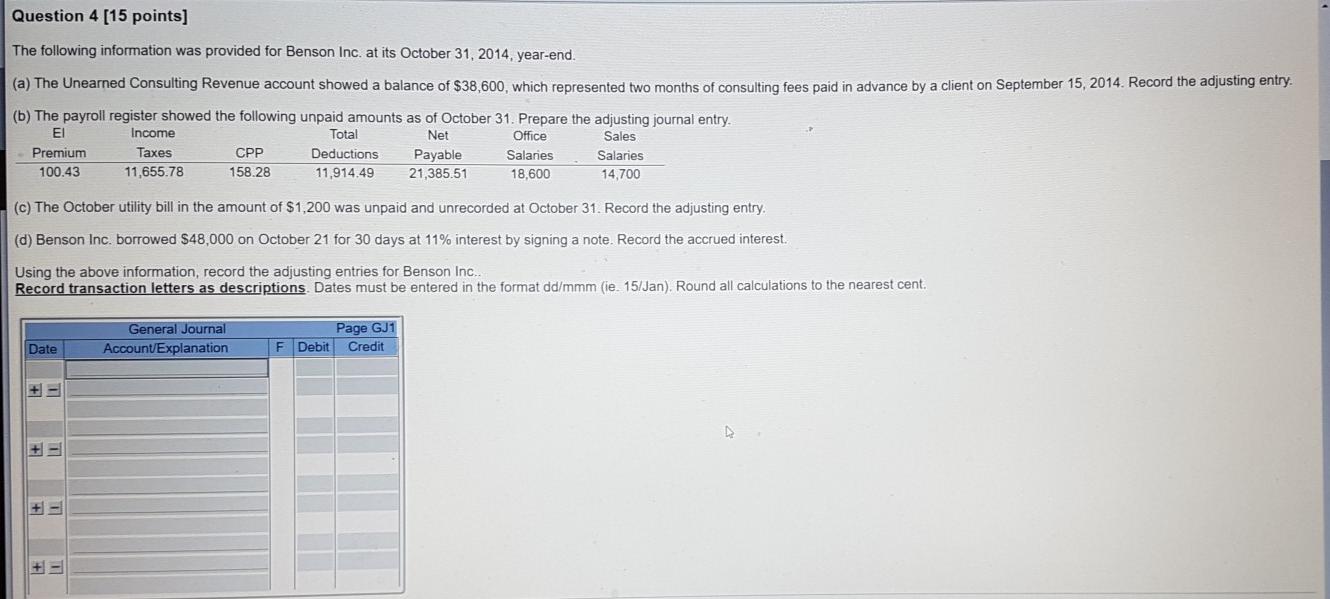

Question: added the headings to make it easier to answer. Question 4 [15 points] The following information was provided for Benson Inc. at its October 31,

![[15 points] The following information was provided for Benson Inc. at its](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f79c4ee8ef6_43866f79c4e71b50.jpg)

added the headings to make it easier to answer.

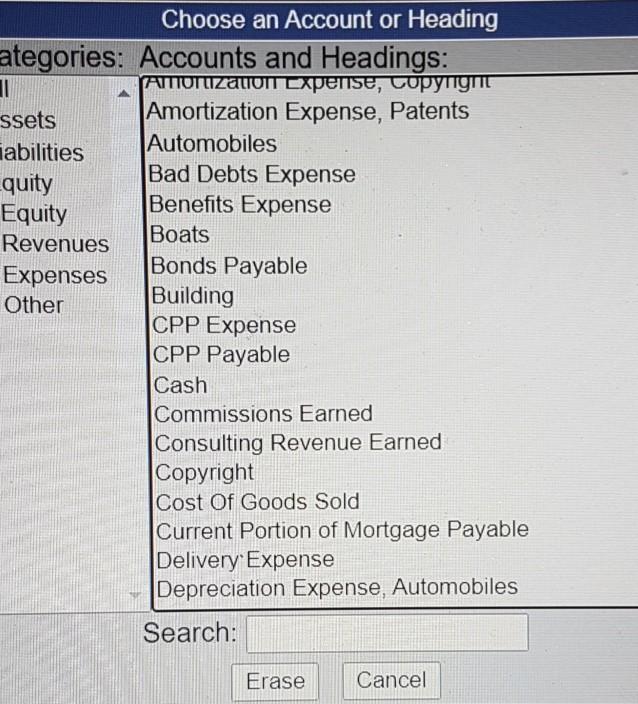

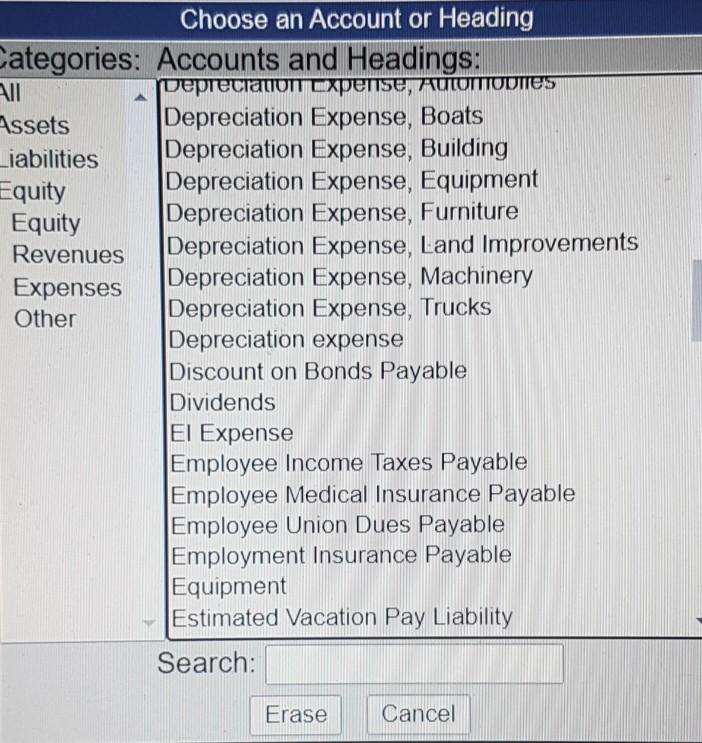

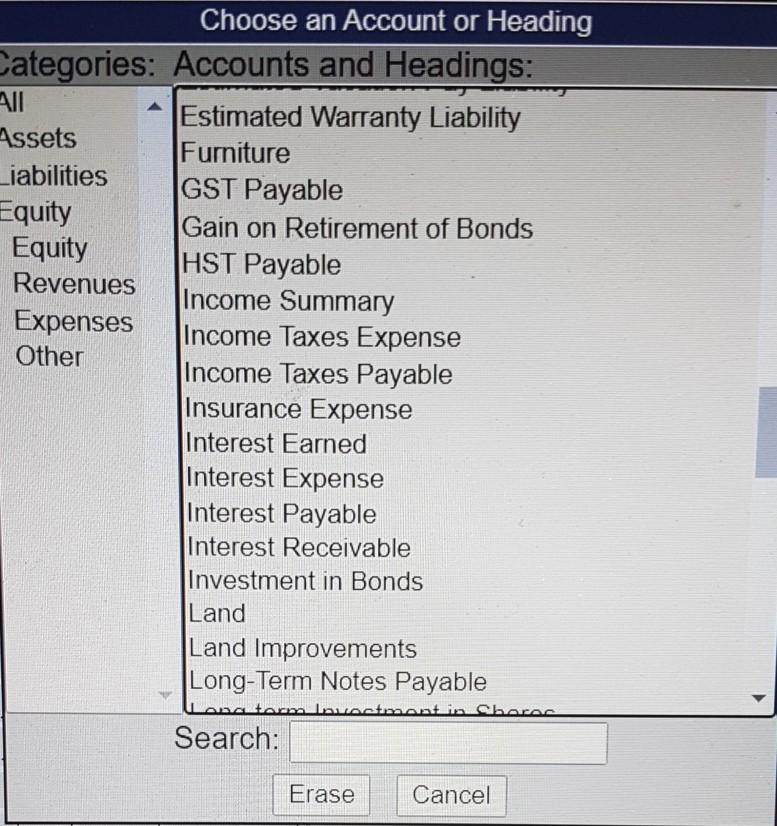

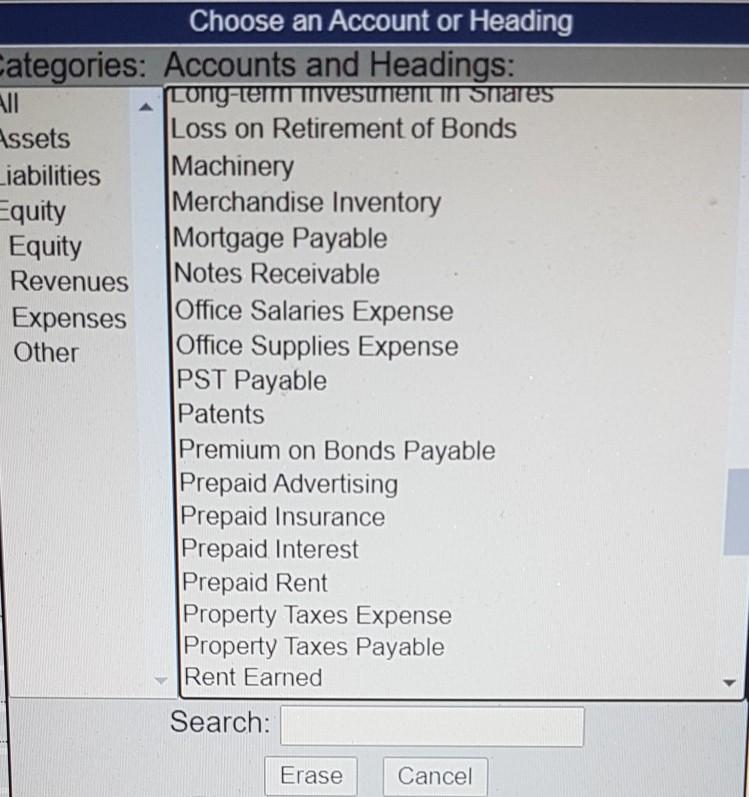

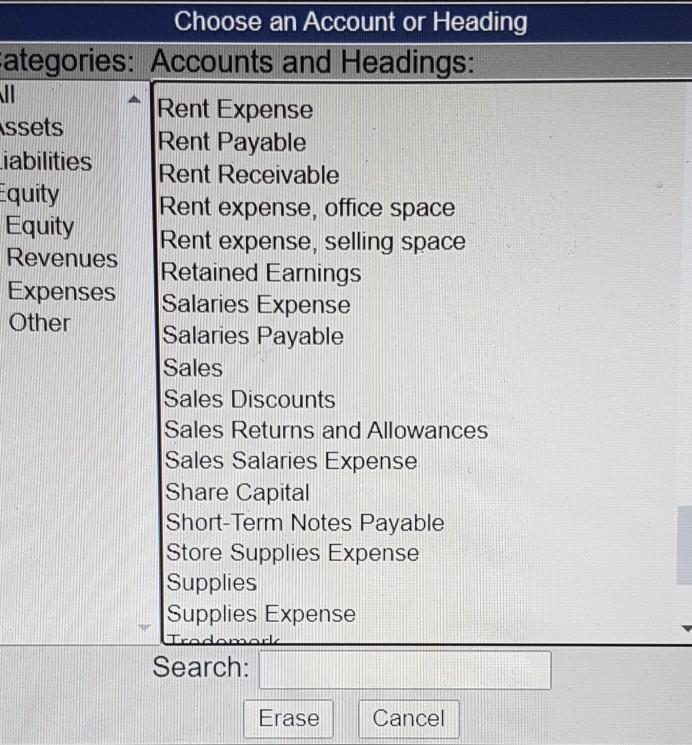

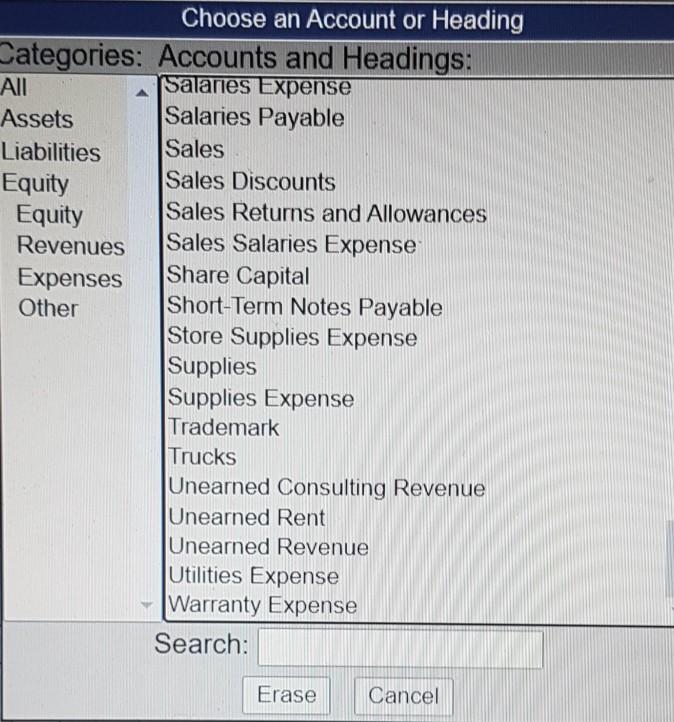

Question 4 [15 points] The following information was provided for Benson Inc. at its October 31, 2014, year-end. (a) The Unearned Consulting Revenue account showed a balance of $38,600, which represented two months of consulting fees paid in advance by a client on September 15, 2014. Record the adjusting entry. (b) The payroll register showed the following unpaid amounts as of October 31. Prepare the adjusting journal entry. Income Total Net Office Sales Premium Taxes CPP Deductions Payable Salaries Salaries 100.43 11,655.78 158.28 11,914.49 21,385.51 18,600 14,700 (c) The October utility bill in the amount of $1,200 was unpaid and unrecorded at October 31. Record the adjusting entry (d) Benson Inc. borrowed 48,000 on October 21 for 30 days at 11% interest by signing a note. Record the accrued interest. Using the above information, record the adjusting entries for Benson Inc.. Record transaction letters as descriptions Dates must be entered in the format dd/mmm (ie. 15/Jan). Round all calculations to the nearest cent. General Journal Account/Explanation Page Gj1 F Debit Credit Date + - + Choose an Account or Heading Categories: Accounts and Headings: All Accounts Payable Assets Accounts Receivable Liabilities Accumulated Amortization, Copyright Equity Accumulated Amortization, Patents Equity Accumulated Amortization, Trademark Revenues Accumulated Depreciation, Automobiles Expenses Accumulated Depreciation, Boats Other Accumulated Depreciation, Building Accumulated Depreciation, Equipment Accumulated Depreciation, Furniture Accumulated Depreciation, Land Improvements Accumulated Depreciation, Machinery Accumulated Depreciation, Trucks Advertising Expense Advertising Payable Allowance for Doubtful Accounts Amortization Expense, Copyright Amortization Expense, Patents Search: Erase Cancel Choose an Account or Heading ategories: Accounts and Headings: AMTOTLIZATION Cxperise, copyright ssets Amortization Expense, Patents habilities Automobiles quity Bad Debts Expense Equity Benefits Expense Revenues Boats Expenses Bonds Payable Other Building CPP Expense CPP Payable Cash Commissions Earned Consulting Revenue Earned Copyright Cost Of Goods Sold Current Portion of Mortgage Payable Delivery Expense Depreciation Expense, Automobiles Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: II Depreciation Expense, AUTOMODNES Assets Depreciation Expense, Boats Liabilities Depreciation Expense, Building Equity Depreciation Expense, Equipment Equity Depreciation Expense, Furniture Revenues Depreciation Expense, Land Improvements Expenses Depreciation Expense, Machinery Other Depreciation Expense, Trucks Depreciation expense Discount on Bonds Payable Dividends EI Expense Employee Income Taxes Payable Employee Medical Insurance Payable Employee Union Dues Payable Employment Insurance Payable Equipment Estimated Vacation Pay Liability Search: Erase Cancel A Choose an Account or Heading Categories: Accounts and Headings: All Estimated Warranty Liability Assets Furniture Liabilities GST Payable Equity Gain on Retirement of Bonds Equity HST Payable Revenues Income Summary Expenses Income Taxes Expense Other Income Taxes Payable Insurance Expense Interest Earned Interest Expense Interest Payable Interest Receivable Investment in Bonds Land Land Improvements Long-Term Notes Payable Lana tarm Investment in Charac Search: > Erase Cancel Choose an Account or Heading ategories: Accounts and Headings: VII Long-term investment in Shares Assets Loss on Retirement of Bonds Liabilities Machinery Equity Merchandise Inventory Equity Mortgage Payable Revenues Notes Receivable Expenses Office Salaries Expense Other Office Supplies Expense PST Payable Patents Premium on Bonds Payable Prepaid Advertising Prepaid Insurance Prepaid Interest Prepaid Rent Property Taxes Expense Property Taxes Payable Rent Earned Search: Erase Cancel Choose an Account or Heading Fategories: Accounts and Headings: Rent Expense issets Rent Payable Liabilities Rent Receivable Equity Rent expense, office space Equity Rent expense, selling space Revenues Retained Earnings Expenses Salaries Expense Other Salaries Payable Sales Sales Discounts Sales Returns and Allowances Sales Salaries Expense Share Capital Short-Term Notes Payable Store Supplies Expense Supplies Supplies Expense Search: Erase Cancel Choose an Account or Heading Categories: Accounts and Headings: All Salaries Expense Assets Salaries Payable Liabilities Sales Equity Sales Discounts Equity Sales Returns and Allowances Revenues Sales Salaries Expense Expenses Share Capital Other Short-Term Notes Payable Store Supplies Expense Supplies Supplies Expense Trademark Trucks Unearned Consulting Revenue Unearned Rent Unearned Revenue Utilities Expense Warranty Expense Search: Erase Cancel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts