Question: ADDITIONAL ASSUMPTIONS FOR PART II. You have completed the initial audit steps for the planning phase of the DTE, Inc. audit and are ready to

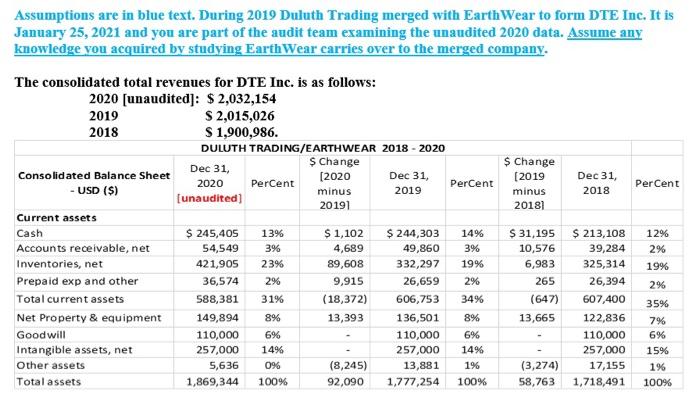

Assumptions are in blue text. During 2019 Duluth Trading merged with EarthWear to form DTE Inc. It is January 25, 2021 and you are part of the audit team examining the unaudited 2020 data. Assume any knowledge vou acquired by studying Earth Wear carries over to the merged company. $ Change [2019 minus 20181 Dec 31, 2018 Percent The consolidated total revenues for DTE Inc. is as follows: 2020 [unaudited]: $ 2,032,154 2019 $ 2,015,026 2018 $1,900,986. DULUTH TRADING/EARTHWEAR 2018 - 2020 Dec 31, $ Change Consolidated Balance Sheet 2020 [2020 Dec 31, Percent - USD ($) Percent minus 2019 (unaudited) 20191 Current assets Cash $ 245,405 13% $ 1,102 $ 244,303 14% Accounts receivable, net 54,549 3% 4,689 49,860 3% Inventories, net 421,905 23% 89,608 332,297 19% Prepaid exp and other 36,574 2% 9,915 26,659 2% Total current assets 588,381 31% (18,372) 606,753 34% Net Property & equipment 149,894 896 13,393 136,501 8% Goodwill 110,000 6% 110,000 6% Intangible assets, net 257,000 149 257,000 14% Other assets 5,636 096 (8,245) 13,881 1% Total assets 1,869,344 100% 92,090 1,777,254 100% $ 31,195 10,576 6,983 265 (647) 13,665 12% 2% 19% 296 3596 $ 213,108 39,284 325,314 26,394 607,400 122,836 110,000 257,000 17,155 1,718,491 7% 6% 15% 1% 100% (3,274) 58,763 Assumptions are in blue text. During 2019 Duluth Trading merged with EarthWear to form DTE Inc. It is January 25, 2021 and you are part of the audit team examining the unaudited 2020 data. Assume any knowledge vou acquired by studying Earth Wear carries over to the merged company. $ Change [2019 minus 20181 Dec 31, 2018 Percent The consolidated total revenues for DTE Inc. is as follows: 2020 [unaudited]: $ 2,032,154 2019 $ 2,015,026 2018 $1,900,986. DULUTH TRADING/EARTHWEAR 2018 - 2020 Dec 31, $ Change Consolidated Balance Sheet 2020 [2020 Dec 31, Percent - USD ($) Percent minus 2019 (unaudited) 20191 Current assets Cash $ 245,405 13% $ 1,102 $ 244,303 14% Accounts receivable, net 54,549 3% 4,689 49,860 3% Inventories, net 421,905 23% 89,608 332,297 19% Prepaid exp and other 36,574 2% 9,915 26,659 2% Total current assets 588,381 31% (18,372) 606,753 34% Net Property & equipment 149,894 896 13,393 136,501 8% Goodwill 110,000 6% 110,000 6% Intangible assets, net 257,000 149 257,000 14% Other assets 5,636 096 (8,245) 13,881 1% Total assets 1,869,344 100% 92,090 1,777,254 100% $ 31,195 10,576 6,983 265 (647) 13,665 12% 2% 19% 296 3596 $ 213,108 39,284 325,314 26,394 607,400 122,836 110,000 257,000 17,155 1,718,491 7% 6% 15% 1% 100% (3,274) 58,763

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts