Question: Additional Cost Classifications PA 5 . LO 2 . 2 Wachowski Company reported these cost data for the year 2 0 2 3 .

Additional Cost Classifications

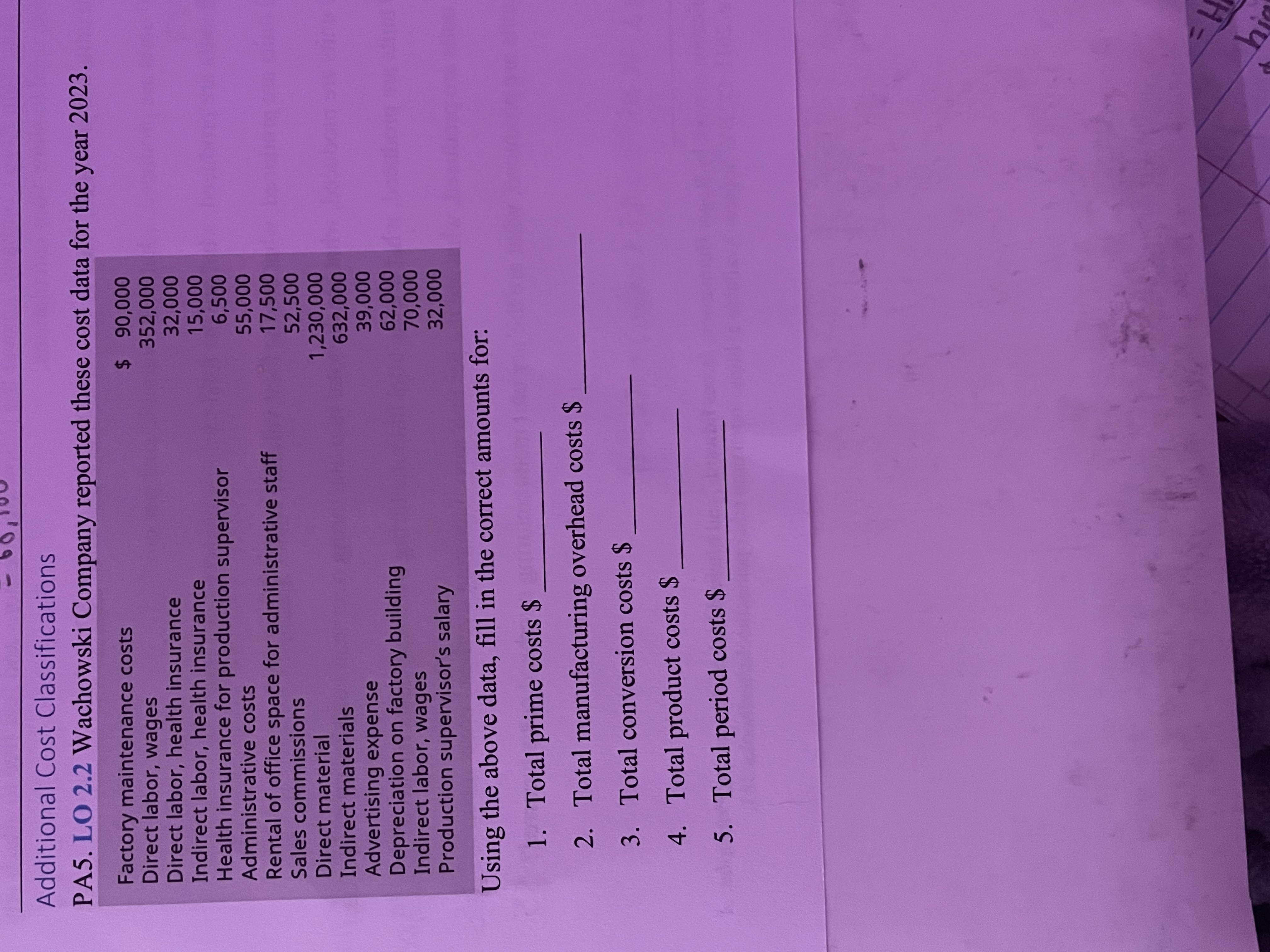

PA LO Wachowski Company reported these cost data for the year

begintabularlr

hline Factory maintenance costs & $

hline Direct labor, wages &

Direct labor, health insurance &

Indirect labor, health insurance &

Health insurance for production supervisor &

Administrative costs &

Rental of office space for administrative staff &

Sales commissions &

Direct material &

Indirect materials &

Advertising expense &

Depreciation on factory building &

Indirect labor, wages &

Production supervisor's salary &

hline

endtabular

Using the above data, fill in the correct amounts for:

Total prime costs $ square

Total manufacturing overhead costs $ square

Total conversion costs $ square

Total product costs $ square

Total period costs $ square

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock