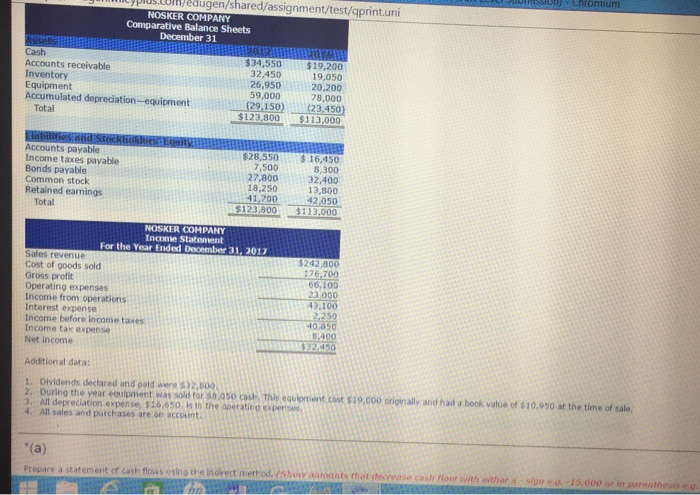

Question: Additional data: Dividends declared and paid were $32, 500. During the year equipment was sold for $8, 050 cash. This equipment cost $19,000 originally and

Additional data: Dividends declared and paid were $32, 500. During the year equipment was sold for $8, 050 cash. This equipment cost $19,000 originally and had a book, value of $10, 950 at the time of sale. All depreciation expense, $16, 650, is in the operation expenses. All sales and purchases are on account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts