Question: . Additional data for the period January 1, Year 2, through December 31, Year 2, are: Sales on account, $70,000. Purchases on account, $40,000. Depreciation,$5,000.

.

.

Additional data for the period January 1, Year 2, through December 31, Year 2, are:

Sales on account, $70,000.

Purchases on account, $40,000.

Depreciation,$5,000.

Expenses paid in cash,$18,000(including $4,000 of interest and $6,000 in taxes).

Decrease in inventory, $2,000.

Sales of fixed assets for $6,000 cash; cost $21,000 and two-thirds depreciated (loss or gain is included in income).

Purchase of fixed assets for cash,$4,000.

Fixed assets are exchanged for bonds payable of $30,000.

Sale of investments for $9,000 cash.

Purchase of treasury stock for cash, $11,500.

Retire bonds payable by issuing common stock, $10,000.

Collections on accounts receivable, $65,000.

Sold unissued common stock for cash, $1,000.

Required: a. Prepare a statement of cash flows (indirect method) for the year ended December31,Year2.

b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cash flows from operations.

c. Which of the two financial reports in (b) better reflects profitability? Explain.

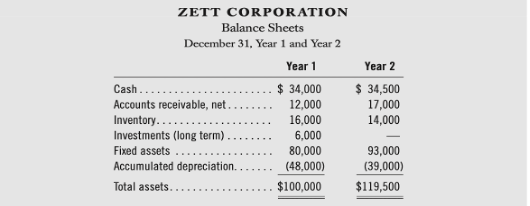

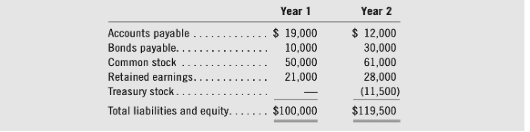

ZETT CORPORATION Balance Sheets December 31, Year 1 and Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts