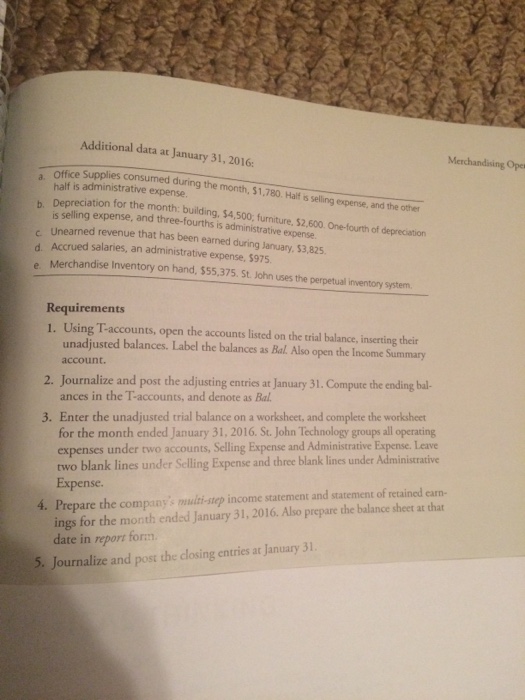

Question: Additional data m January 31. 2016:office Supplies consumed during the month,$1,780 half is selling expense, and the other half is administrative expense. Depreciation for the

Additional data m January 31. 2016:office Supplies consumed during the month,$1,780 half is selling expense, and the other half is administrative expense. Depreciation for the month; building,$4,500; furniture,$2,600. One-fourths of depreciation is selling expense, and three-fouths is administrative expense. Unearned revenue that has been earned during January.$3,825. Accrued salaries, an administrative expense,$975. Merchandise Inventory on hand,$55,375. St.John uses the perpetual inventory system. Using T-accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Also open the Income Summary account. Journalize and post the adjusting entries at January 31f. Compute the ending balances in the T-accounts, and denote as Bal. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31,2016. St.John Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense. Prepare the company's multi-step income statement and statement of retained carnings for the month ended January 31,2016. Also prepare the balance sheet at that date in report form. Jounrnalize and post the closing cntries at January 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts