Question: Additional Example Assume there are two decrements: (1) withdrawal and (2) death. A four-year endowment insurance is issued to a life aged 40. The

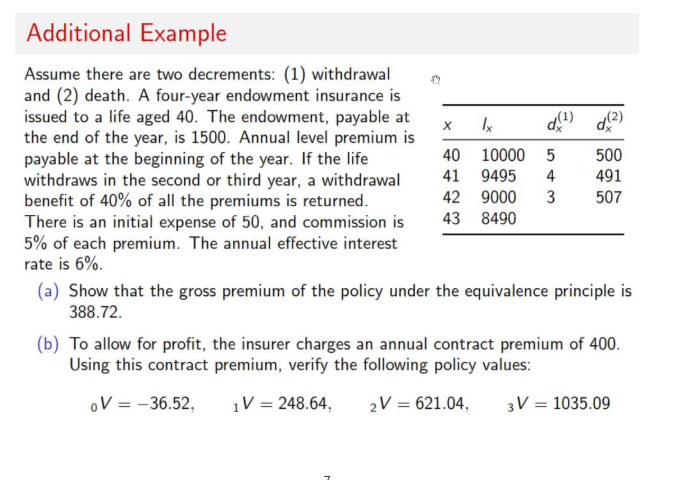

Additional Example Assume there are two decrements: (1) withdrawal and (2) death. A four-year endowment insurance is issued to a life aged 40. The endowment, payable at the end of the year, is 1500. Annual level premium is payable at the beginning of the year. If the life withdraws in the second or third year, a withdrawal benefit of 40% of all the premiums is returned. There is an initial expense of 50, and commission is 5% of each premium. The annual effective interest rate is 6%. x 1x d(1) (2) 40 10000 5 500 41 9495 4 491 42 9000 3 507 43 8490 (a) Show that the gross premium of the policy under the equivalence principle is 388.72. (b) To allow for profit, the insurer charges an annual contract premium of 400. Using this contract premium, verify the following policy values: V = -36.52, 1V = 248.64, 2V = 621.04, 3V = 1035.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts