Question: Additional Exercise: A machine that was purchased 3 years ago for 140k $ is now too slow to satisfy increased demand. The machine can be

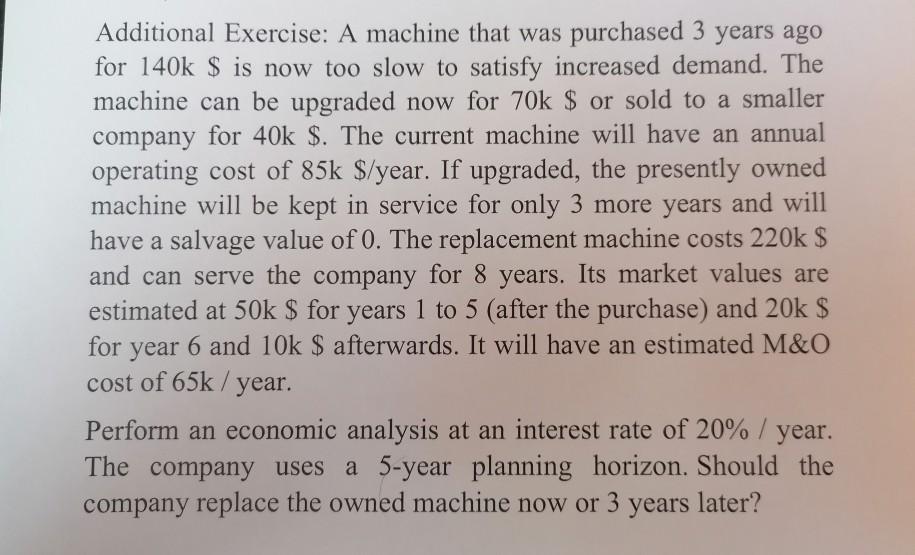

Additional Exercise: A machine that was purchased 3 years ago for 140k $ is now too slow to satisfy increased demand. The machine can be upgraded now for 70k $ or sold to a smaller company for 40k $. The current machine will have an annual operating cost of 85k $/year. If upgraded, the presently owned machine will be kept in service for only 3 more years and will have a salvage value of 0. The replacement machine costs 220k $ and can serve the company for 8 years. Its market values are estimated at 50k $ for years 1 to 5 (after the purchase) and 20k $ for year 6 and 10k $ afterwards. It will have an estimated M&O cost of 65k/year. Perform an economic analysis at an interest rate of 20%/year. The company uses a 5-year planning horizon. Should the company replace the owned machine now or 3 years later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts