Question: ADDITIONAL INCOME STATEMENT DATA: - ?Depreciation Expense: $ 1 5 3 0 - ?Earnings Before Interest & Taxes ( EBIT ) : $ 2 6

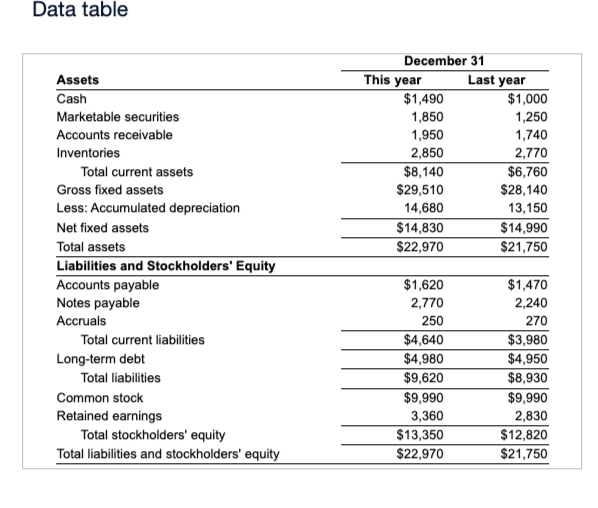

Data table Assets Cash Marketable securities Accounts receivable Inventories This year December 31 Last year $1,490 $1,000 1,850 1,250 1,950 1,740 2,850 2,770 Total current assets $8,140 $6,760 Gross fixed assets $29,510 $28,140 Less: Accumulated depreciation 14,680 13,150 Net fixed assets $14,830 $14,990 Total assets $22,970 $21,750 Liabilities and Stockholders' Equity Accounts payable $1,620 $1,470 Notes payable 2,770 2,240 Accruals 250 270 Total current liabilities $4,640 $3,980 Long-term debt Total liabilities $4,980 $4,950 $9,620 $8,930 Common stock $9,990 $9,990 Retained earnings 3,360 2,830 Total stockholders' equity $13,350 $12,820 Total liabilities and stockholders' equity $22,970 $21,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts