Question: Additional information : (1) All items of PPE except o ffice buildings are bought on 1 January 20 21 . Depreciation charges for the year

Additional information:

Required:

Prepare

a) a statement of profit or loss and other comprehensive income for the year ended 31 December 2021,

b) a statement of changes in equity for the year ended 31 December 2021,

c) a statement of financial position at that date,

d) notes, in accordance with IAS 1 Presentation of Financial Statements.

Your answer should be as complete and informative as possible within the limits of the information given to you. An accounting policy note is also required

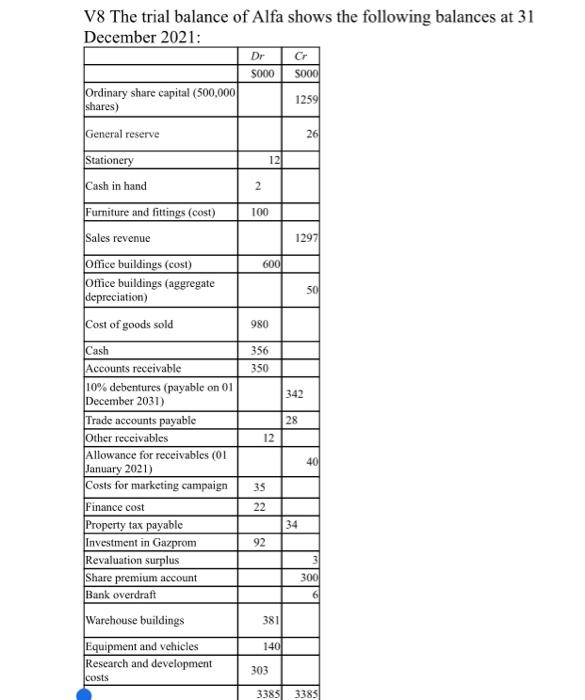

12 600 980 V8 The trial balance of Alfa shows the following balances at 31 December 2021: Dr Cr 5000 S000 Ordinary share capital (500,000 12591 shares) General reserve 261 Stationery Cash in hand 2 Furniture and fittings (cost) 100 Sales revenue 12971 office buildings (cost) Office buildings (aggregate depreciation) 50 Cost of goods sold Cash 356 Accounts receivable 350 10% debentures (payable on 01 342 December 2031) Trade accounts payable Other receivables 12 Allowance for receivables (OL 40 January 2021) Costs for marketing campaign 35 Finance cost 22 Property tax payable Investment in Gazprom 92 Revaluation surplus Share premium account Bank overdraft Warehouse buildings 381 Equipment and vehicles Research and development 303 28 34 31 3001 6 140 costs 3385 3385

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts