Question: Additional information: 1. Candy received a holiday package worth $5,000 from her employer for exemplary services provided to her customers. 2. Candy spent the following

Additional information:

1. Candy received a holiday package worth $5,000 from her employer for exemplary services provided to her customers.

2. Candy spent the following expenses which were not reimbursed by her employer: - Business entertainment expenses: $400 - Petrol expenses related to employment-related travels using her car: $800

3. Candy and her employer make CPF contributions within the statutory limits on both her ordinary and additional wages.

4. Candy made a cash donation of $3,000 to the Singapore Cancer Society, an Institute of Public Character (IPC), on 16 September 2021. Candy also made cash donations of $2,000 on 15 June 2021 to her church which organised a fundraising for a Singaporean woman and her young children who had lost their familys sole breadwinner.

5. The couple has a daughter, Danielle, who is a Singapore citizen and is 4 years old. Candy is expecting the couples second child.

6. Candys mother lives with the couple and help to look after Danielle together with a foreign domestic helper hired by William. William pays the annual foreign maid levy of $720 for the helper as well as the helpers annual salary of $6,000. DIPL/ACC3004/Aug 2022/OnlineMainEQP Page 3 of 13 Candys mother is a housewife. She won $70,000 in lottery winnings during the year 2021.

7. William derived the following dividend income during the year 2021: Dividend of $3,800 paid by companies tax resident in Singapore and Dividends of $40,100 paid by companies tax resident in other countries.

8. William, who is a key appointment holder, was in Taiwan for 2 weeks of in-camp training.

9. The couple has fully utilised the parenthood tax rebate in respect of Danielle.

Required: Compute the tax liability for Y/A 2021 for Candy who would like to utilise the maximum reliefs and rebates available to her in order to minimise her tax liability. Please prepare your tax computation

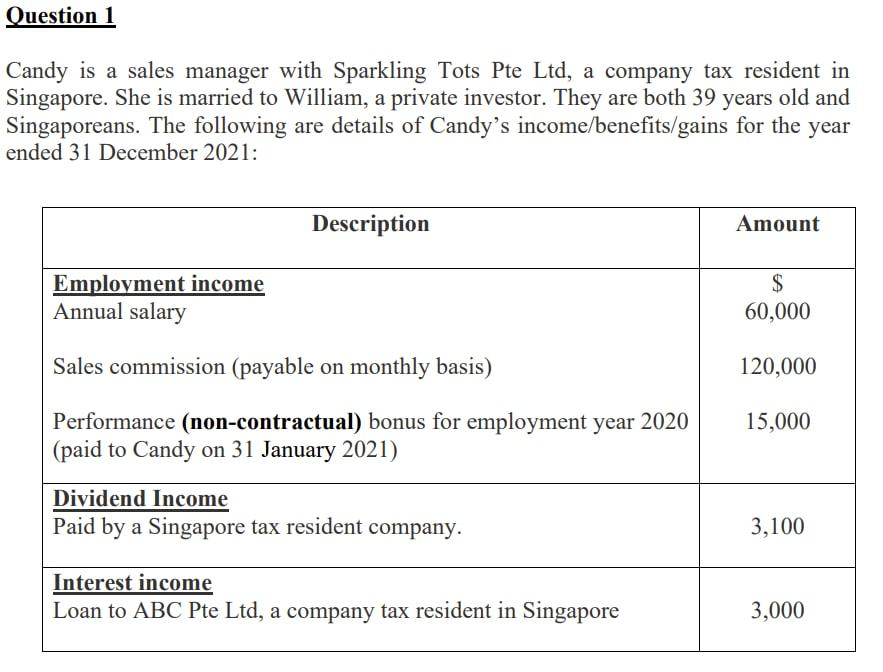

Candy is a sales manager with Sparkling Tots Pte Ltd, a company tax resident in Singapore. She is married to William, a private investor. They are both 39 years old and Singaporeans. The following are details of Candy's income/benefits/gains for the year ended 31 December 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts