Question: Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained

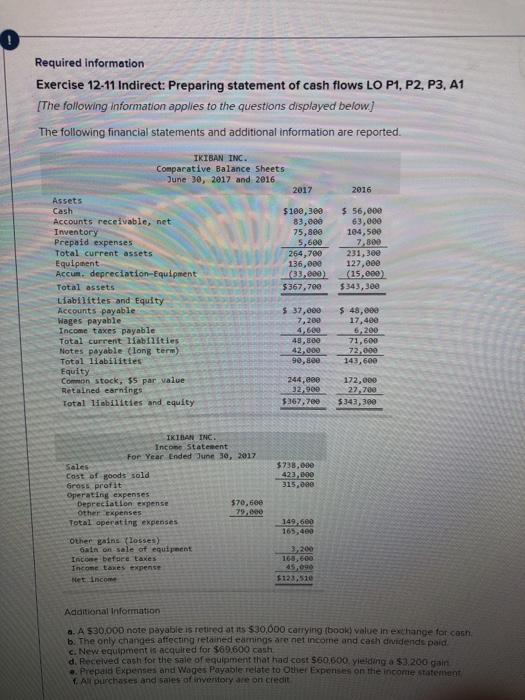

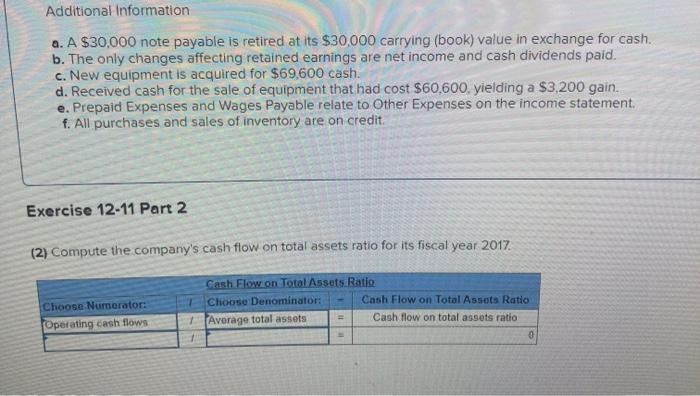

Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $69,600 cash. d. Received cash for the sale of equipment that had cost $60.600. yielding a $3,200 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement f. All purchases and sales of inventory are on credit. Exercise 12-11 Part 2 (2) Compute the company's cash flow on total assets ratio for its fiscal year 2017 Choose Numerator: Operating cash flows Cash Flow on Total Assets Ratio Choose Denominator: Cash Flow on Total Assets Ratio 1 Average total assets Cash flow on total assets ratio 0 Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $69,600 cash. d. Received cash for the sale of equipment that had cost $60.600. yielding a $3,200 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement f. All purchases and sales of inventory are on credit. Exercise 12-11 Part 2 (2) Compute the company's cash flow on total assets ratio for its fiscal year 2017 Choose Numerator: Operating cash flows Cash Flow on Total Assets Ratio Choose Denominator: Cash Flow on Total Assets Ratio 1 Average total assets Cash flow on total assets ratio 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts