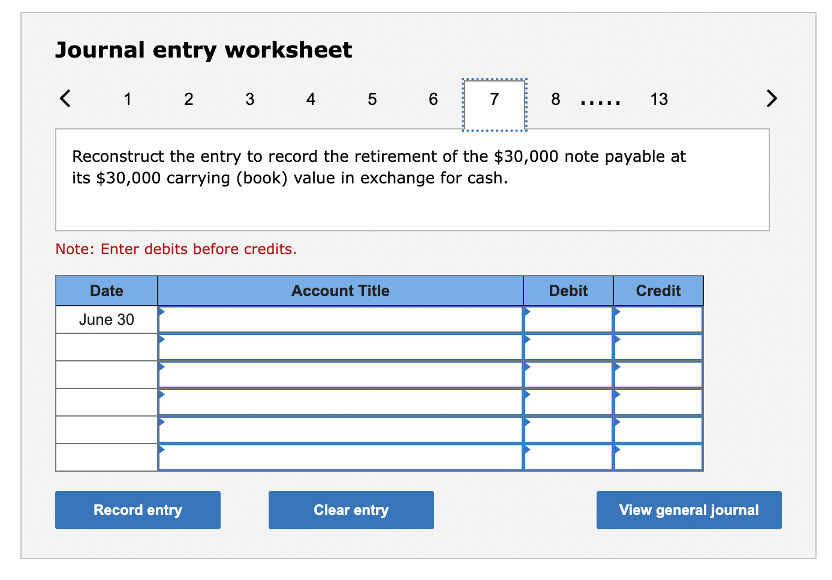

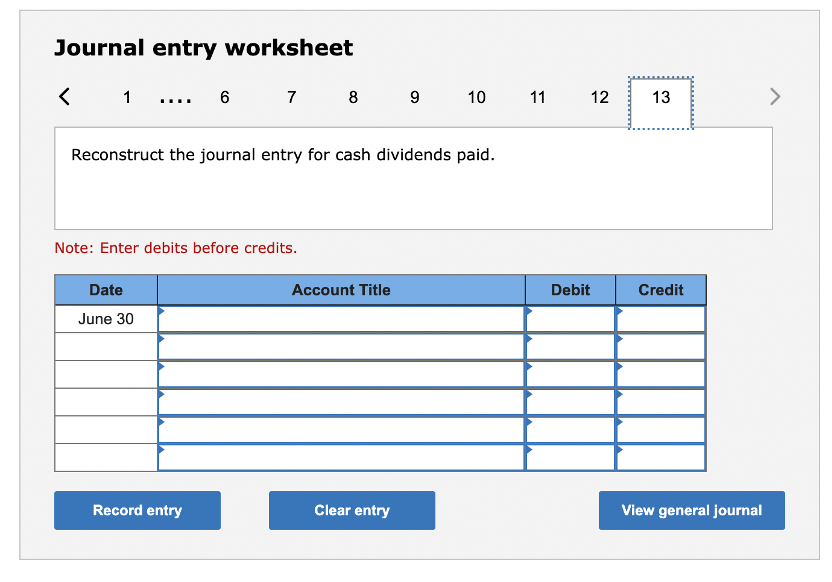

Question: Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained

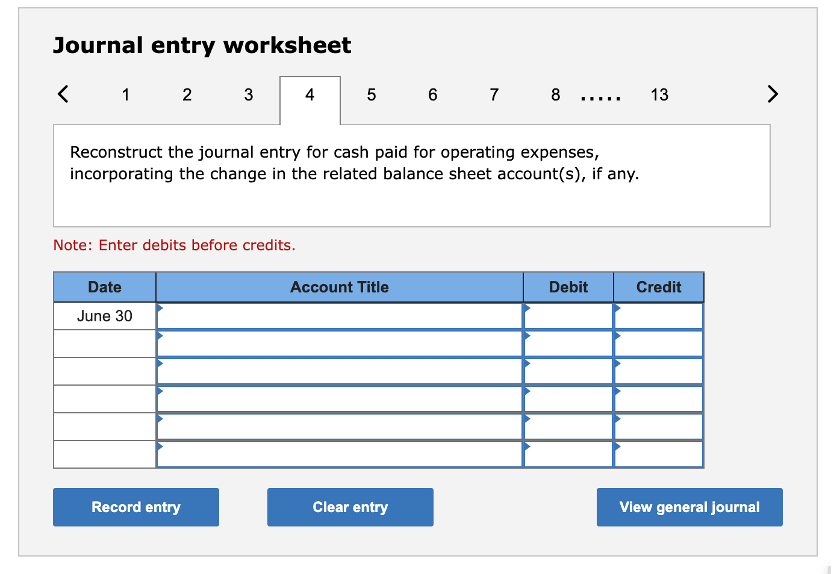

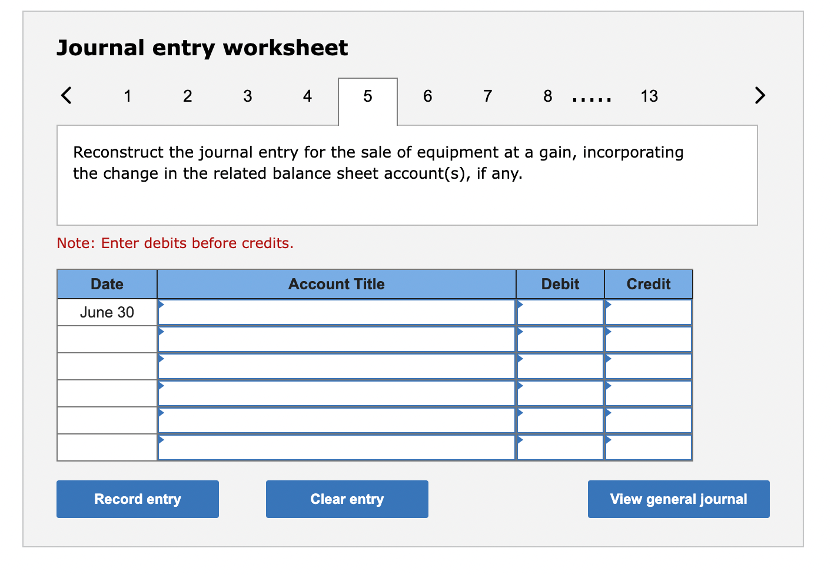

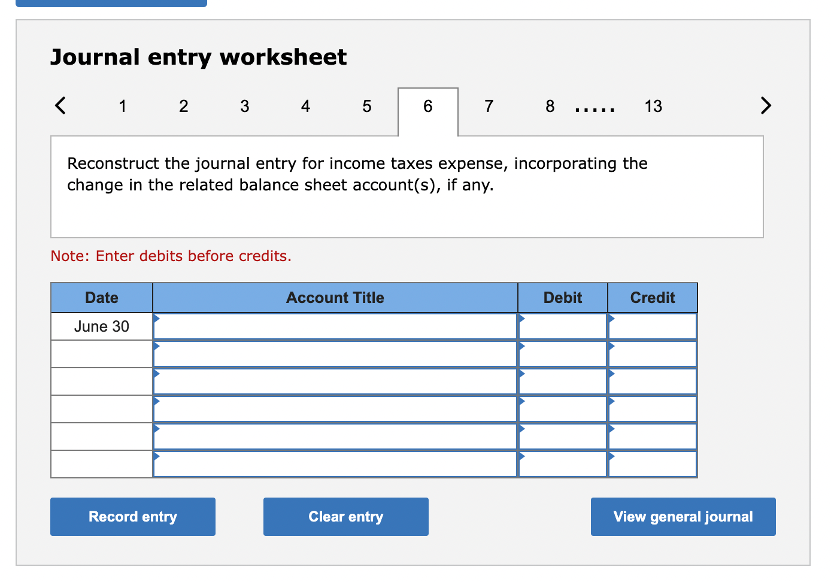

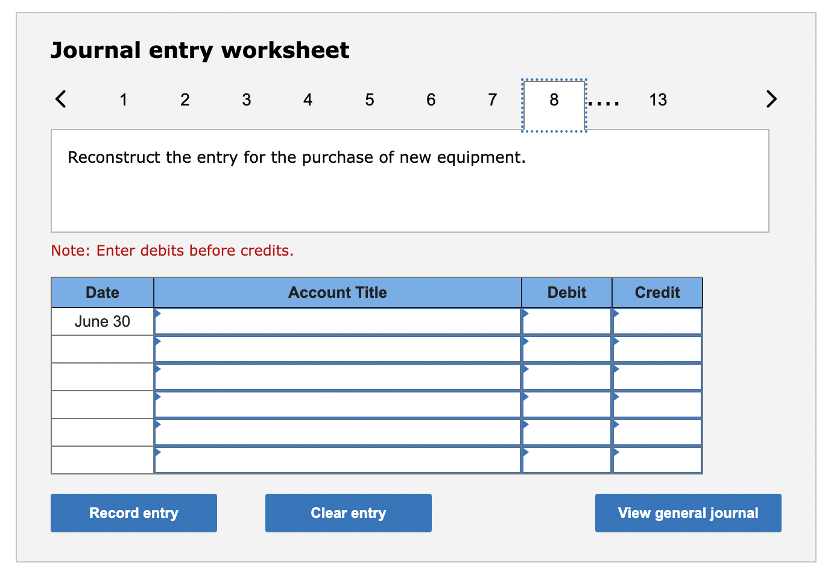

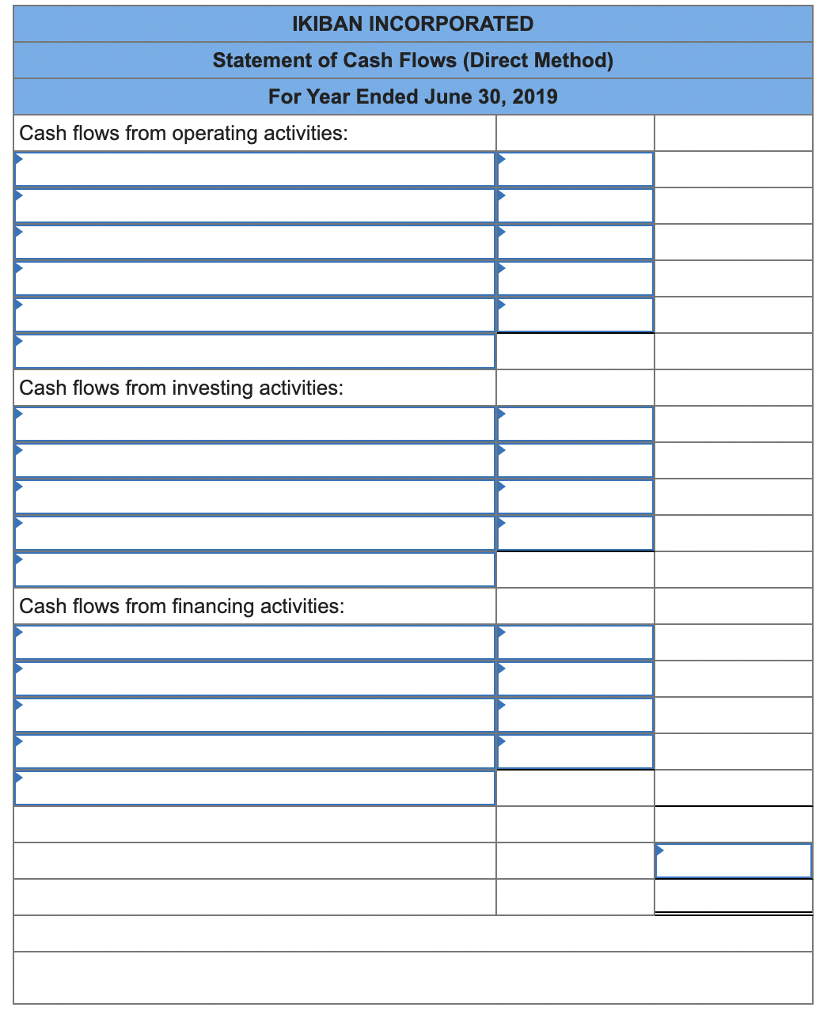

Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $57,600 cash. d. Received cash for the sale of equipment that had cost $48,600, yielding a $2,000 gain, e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement f. All purchases and sales of inventory are on credit.

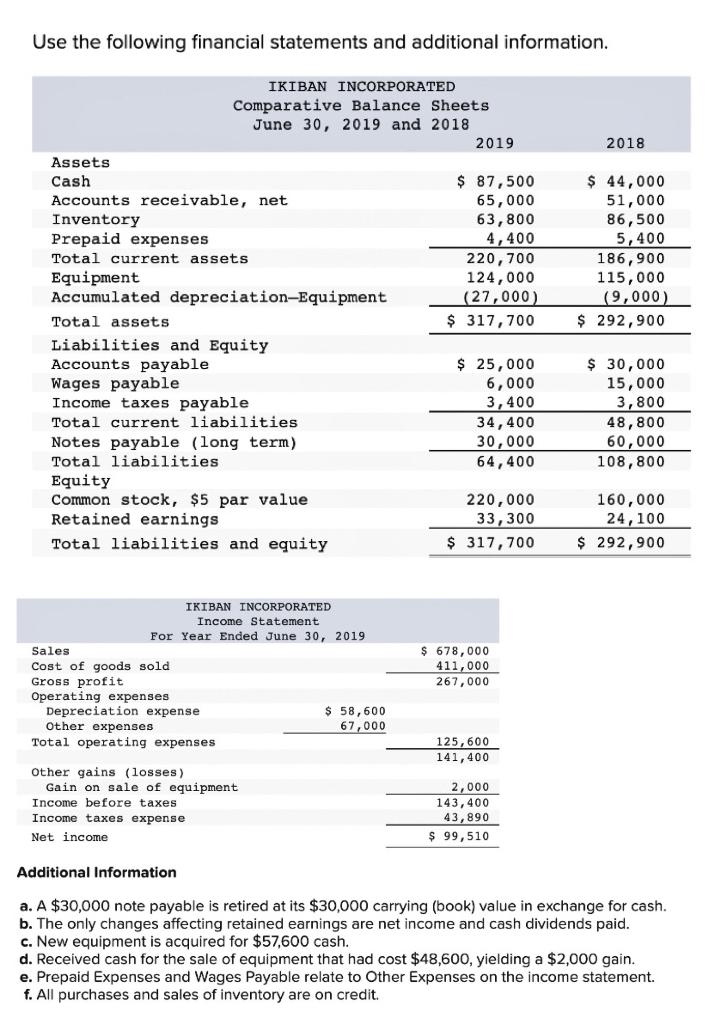

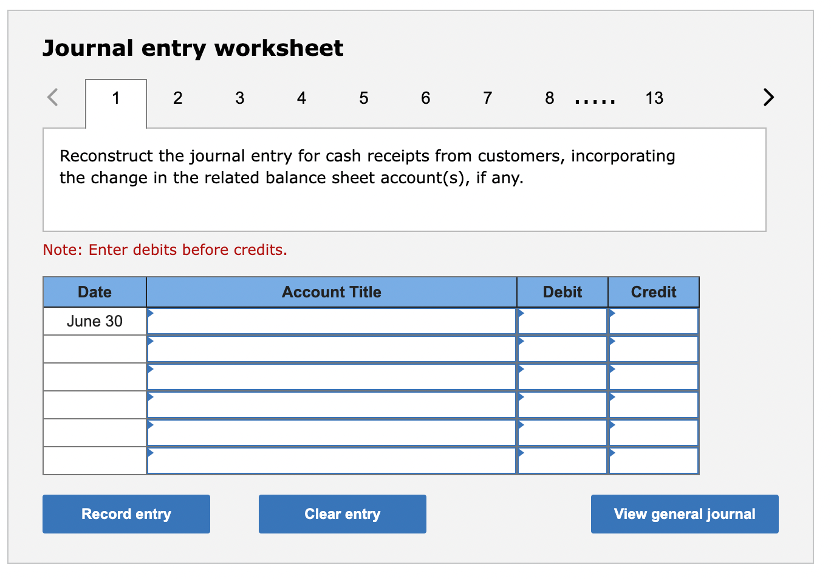

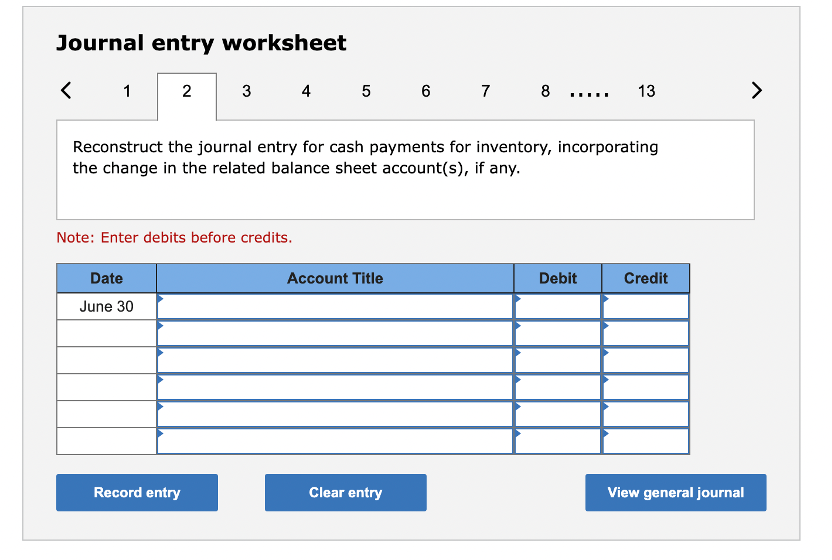

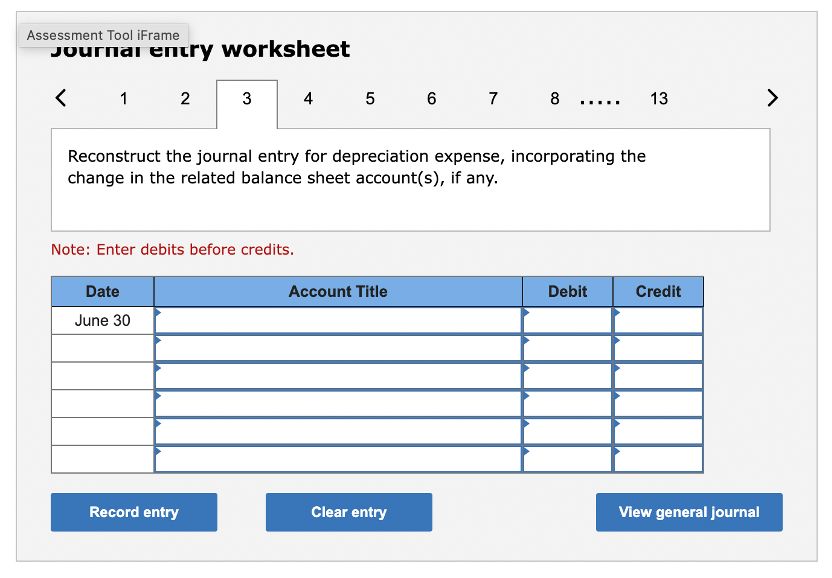

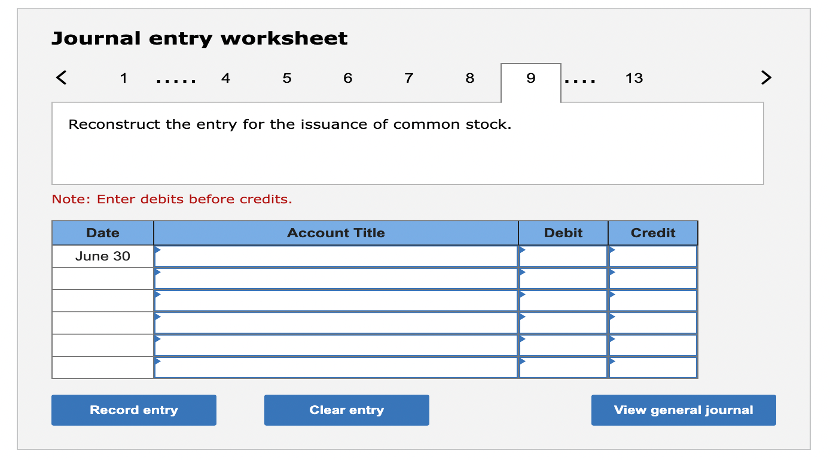

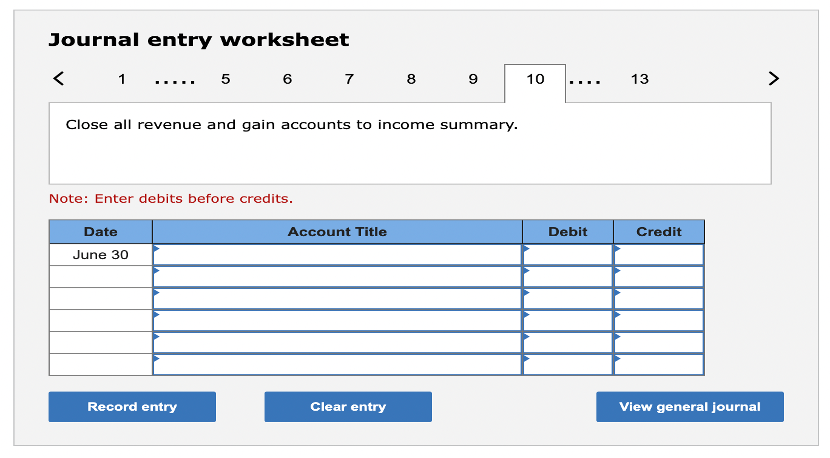

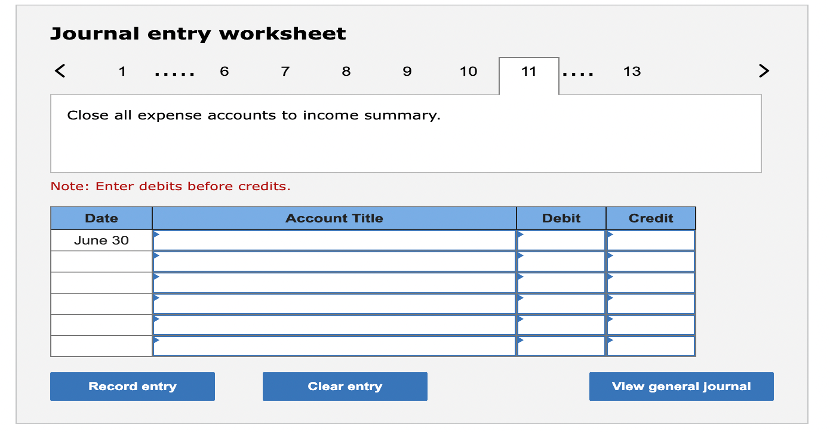

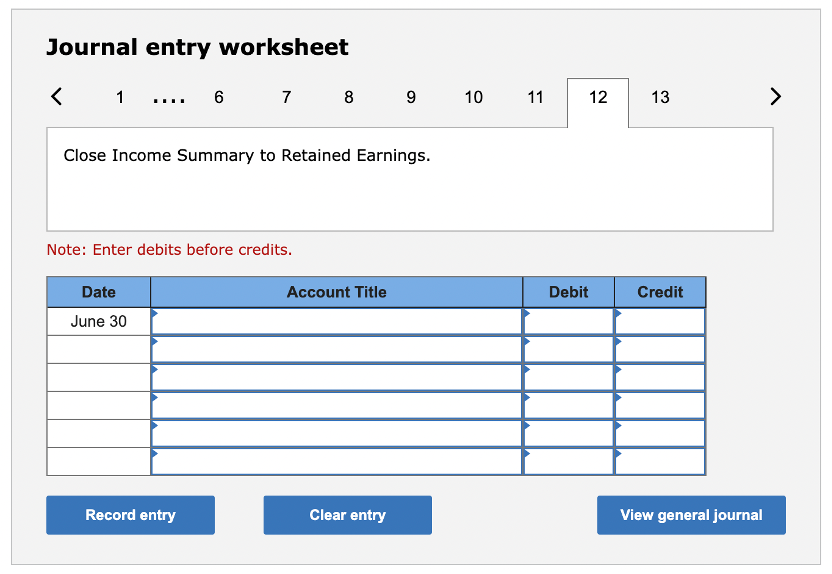

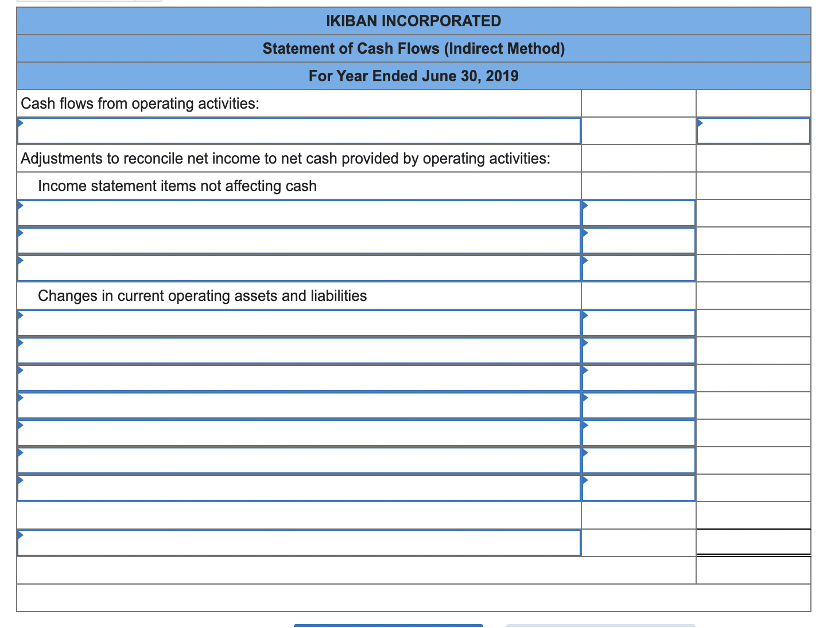

Use the following financial statements and additional information. IKIBAN INCORPORATED Comparative Balance Sheets June 30, 2019 and 2018 2018 Assets Cash $ 44,000 Accounts receivable, net 51,000 Inventory 86,500 Prepaid expenses 5,400 Total current assets 186,900 Equipment 115,000 Accumulated depreciation-Equipment (9,000) Total assets $ 292,900 Liabilities and Equity $ 30,000 Accounts payable Wages payable 15,000 3,800 Income taxes payable Total current liabilities 48,800 60,000 Notes payable (long term) Total liabilities 108,800 Equity Common stock, $5 par value Retained earnings 160,000 24,100 Total liabilities and equity $ 292,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2019 Sales $ 678,000 Cost of goods sold 411,000 267,000 Gross profit Operating expenses Depreciation expense $ 58,600 Other expenses 67,000 Total operating expenses 125,600 141,400 Other gains (losses) Gain on sale of equipment 2,000 Income before taxes 143,400 43,890 Income taxes expense Net income $ 99,510 Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $57,600 cash. d. Received cash for the sale of equipment that had cost $48,600, yielding a $2,000 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. 2019 $ 87,500 65,000 63,800 4,400 220,700 124,000 (27,000) $ 317,700 $ 25,000 6,000 3,400 34,400 30,000 400 220,000 33,300 $ 317,700 Journal entry worksheet 1 2 3 4 5 6 7 8 13 .. Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit June 30 Clear entry View general journal Record entry > Journal entry worksheet Assessment Tool iFrame Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet 1 ..... 4 5 6 7 8 9 Reconstruct the entry for the issuance of common stock. Note: Enter debits before credits. Date Account Title June 30 Clear entry Record entry Debit 13 Credit View general journal A Journal entry worksheet Journal entry worksheet Journal entry worksheet Assessment Tool iFrame Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet Journal entry worksheet 1 ..... 4 5 6 7 8 9 Reconstruct the entry for the issuance of common stock. Note: Enter debits before credits. Date Account Title June 30 Clear entry Record entry Debit 13 Credit View general journal A Journal entry worksheet Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts