Question: Additional information: a. Closing stock: raw material 8,000; indirect material 5,000; work in progress 4,500; and finished goods 12,000 b. Goods produced are transferred at

Additional information: a. Closing stock: raw material 8,000; indirect material 5,000; work in progress 4,500; and finished goods 12,000 b. Goods produced are transferred at a markup of 20% c. Provide for depreciation as follows: factory assets 10%; office assets 5%; motor vehicle 10%. Note: the motor vehicle is used equally in the factory and the office d. The rent expense is to be apportioned 70% in the factory and 30% in the office Required: Prepare the manufacturing account, income statement for the year, as well as the balance sheet as at year end of the year

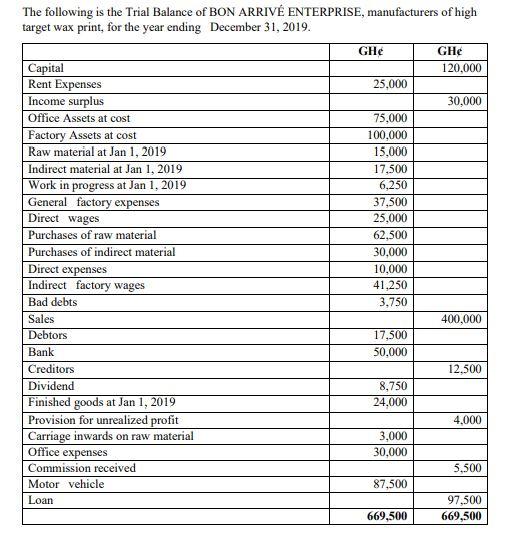

The following is the Trial Balance of BON ARRIV ENTERPRISE, manufacturers of high target wax print, for the year ending December 31, 2019. GHE GHE Capital 120,000 Rent Expenses 25,000 Income surplus 30,000 Office Assets at cost 75.000 Factory Assets at cost 100,000 Raw material at Jan 1, 2019 15,000 Indirect material at Jan 1, 2019 17.500 Work in progress at Jan 1, 2019 6,250 General factory expenses 37,500 Direct wages 25,000 Purchases of raw material 62,500 Purchases of indirect material 30,000 Direct expenses 10,000 Indirect factory wages 41.250 Bad debts 3,750 Sales 400,000 Debtors 17,500 Bank 50,000 Creditors 12.500 Dividend 8.750 Finished goods at Jan 1, 2019 24.000 Provision for unrealized profit 4.000 Carriage inwards on raw material 3,000 Office expenses 30,000 Commission received 5.500 Motor vehicle 87,500 Loan 97,500 669,500 669,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts