Question: Additional information: a ) . On 3 1 December 2 0 1 1 , PAB held stocks purchased from MKB amounting to RM 3 0

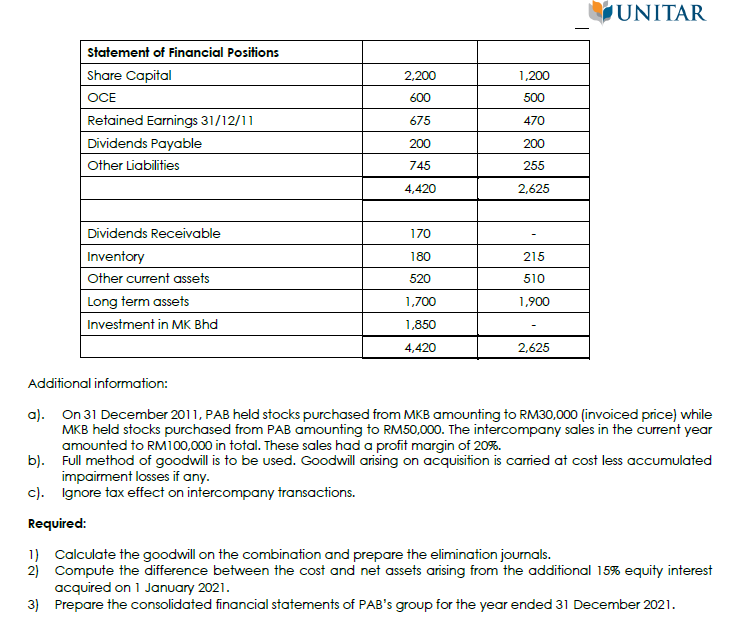

Additional information: a On December PAB held stocks purchased from MKB amounting to RMinvoiced price while MKB held stocks purchased from PAB amounting to RM The intercompany sales in the current year amounted to RM in total. These sales had a profit margin of b Full method of goodwill is to be used. Goodwill arising on acquisition is carried at cost less accumulated impairment losses if any. c Ignore tax effect on intercompany transactions. Required: Calculate the goodwill on the combination and prepare the elimination journals. Compute the difference between the cost and net assets arising from the additional equity interest acquired on January Prepare the consolidated financial statements of PAB's group for the year ended December Question

On January PA Bhd PAB acquired of the voting shares in MK Bhd MKB for RM On that date, the shareholder's fund of MK Bhd was as follows which represents the fair values of its identifiable net assets.

On January PAB acquired another of MKBs shares for RM On the date of acquisition, the shareholders' fund of MKB was as follows:

The Statement of Financial Positions and Comprehensive Income and Retained Profits of the two companies for the year ended December were as follows:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock