Question: Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet method is 10%. The $230,000 in

Additional Information:

- Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet method is 10%. The $230,000 in Other Expenses includes all company expenses except Bad Debt Expense.

- Company B: Bad debt estimation percentage using the income statement method is 6.5%, and the balance sheet method is 8%. The $140,000 in Other Expenses includes all company expenses except Bad Debt Expense.

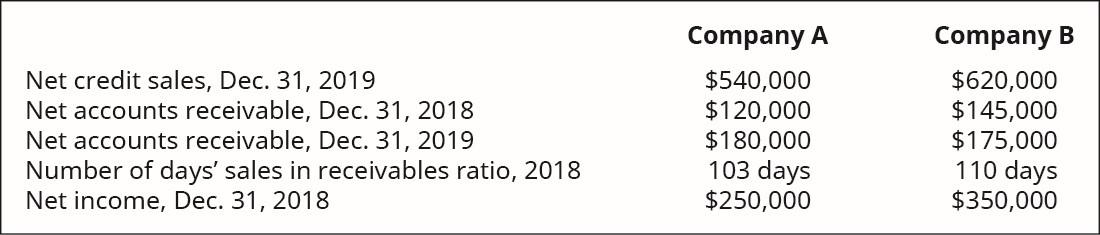

- Compute the number of days sales in receivables ratio for each company for 2019 and interpret the results (round answer to nearest whole number) point).

Net credit sales, Dec. 31, 2019 Net accounts receivable, Dec. 31, 2018 Net accounts receivable, Dec. 31, 2019 Number of days' sales in receivables ratio, 2018 Net income, Dec. 31, 2018 Company A $540,000 $120,000 $180,000 103 days $250,000 Company B $620,000 $145,000 $175,000 110 days $350,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts