Question: Additional Information: Current market price per common share = $ 195 Before tax cost of borrowing (secured loan) = 5% Weighted Average Cost of Capital

Additional Information:

Current market price per common share = $ 195

Before tax cost of borrowing (secured loan) = 5%

Weighted Average Cost of Capital =12%

Net Income for 2021 = $925,000

Target D/E ratio based on market values = 0.25

Corporate tax rate = 35%

1. Suppose instead, Evergreen follows a stable dividend policy and declares a $2.00 per share dividend. The holder of record date is January 10, 2022, and the payment date is January 31, 2022. Emily sold 500 shares of Evergreen on January 7, 2022, to Anna. Which of the two investors will receive the dividends? How much dividend income with they receive? (3 marks)

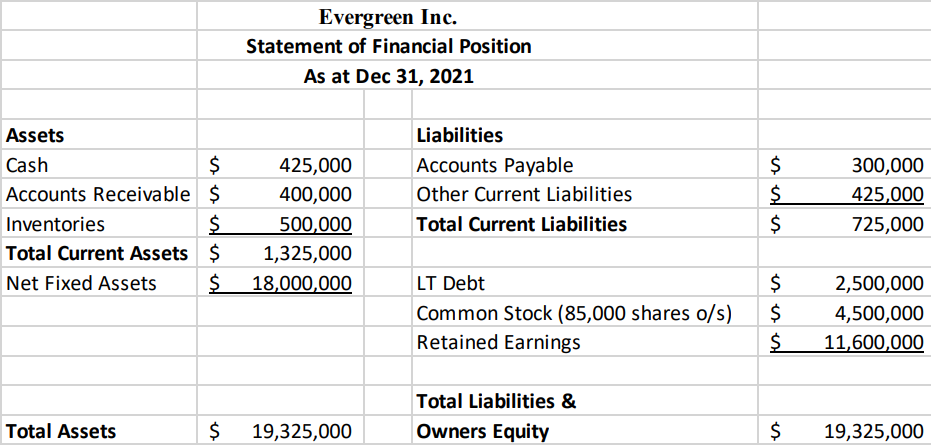

Evergreen Inc. Statement of Financial Position As at Dec 31, 2021 Assets Cash $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500,000 1,325,000 18,000,000 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities $ $ $ 300,000 425,000 725,000 LT Debt Common Stock (85,000 shares o/s) Retained Earnings $ $ $ 2,500,000 4,500,000 11,600,000 Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts