Question: Additional Information: Current market price per common share = $ 195 Before tax cost of borrowing (secured loan) = 5% Weighted Average Cost of Capital

Additional Information:

Current market price per common share = $ 195

Before tax cost of borrowing (secured loan) = 5%

Weighted Average Cost of Capital =12%

Net Income for 2021 = $925,000

Target D/E ratio based on market values = 0.25

Corporate tax rate = 35%

1. Suppose instead, Evergreen uses a retention ratio of 30%. Their capital budget for the upcoming year = $1,600,000. Calculate the debt, external equity financing required and the dividends per share. (6 marks)

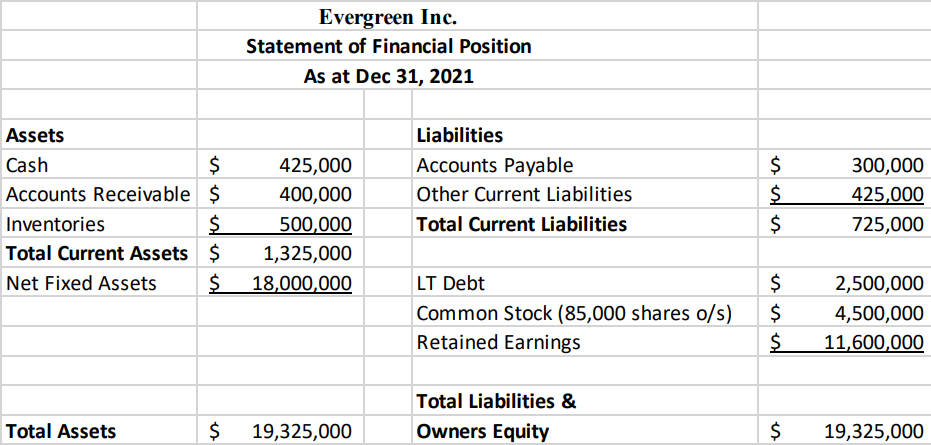

Evergreen Inc. Statement of Financial Position As at Dec 31, 2021 Assets Cash $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500,000 1,325,000 18,000,000 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities $ $ $ 300,000 425,000 725,000 LT Debt Common Stock (85,000 shares o/s) Retained Earnings $ $ $ 2,500,000 4,500,000 11,600,000 Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000 Evergreen Inc. Statement of Financial Position As at Dec 31, 2021 Assets Cash $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500,000 1,325,000 18,000,000 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities $ $ $ 300,000 425,000 725,000 LT Debt Common Stock (85,000 shares o/s) Retained Earnings $ $ $ 2,500,000 4,500,000 11,600,000 Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts