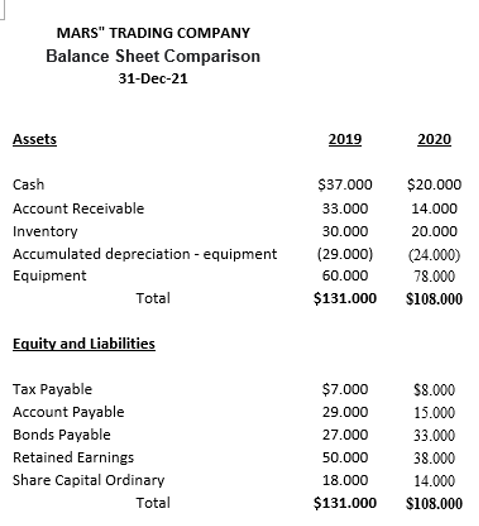

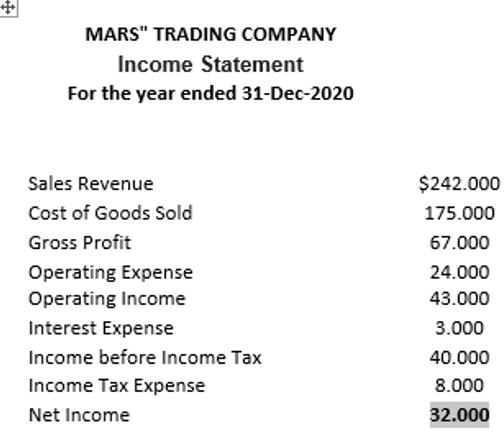

Question: Additional information: Depreciation expense is $ 13,300. Dividends declared and paid in cash of $ 20,000. In 2020, the equipment will sell for $ 9,700

Additional information: Depreciation expense is $ 13,300. Dividends declared and paid in cash of $ 20,000. In 2020, the equipment will sell for $ 9,700 in cash (the amount sold equipment equals the book value of the equipment).

QUESTIONS Based on the data above a. Prepare a 2020 cash flow statement for trading company "MARS" with using the indirect method b. Based on the answer in point a, calculate free cash flow trading company "MARS". Provide an interpretation of the cash flow calculation results. c. Based on the answer in point b, give a recommendation to the trading company "MARS" how should they use the cash flow.

MARS" TRADING COMPANY Balance Sheet Comparison 31-Dec-21 Assets 2019 2020 Cash Account Receivable Inventory Accumulated depreciation - equipment Equipment Total $37.000 33.000 30.000 (29.000) 60.000 $131.000 $20.000 14.000 20.000 (24.000) 78.000 $108.000 Equity and Liabilities Tax Payable Account Payable Bonds Payable Retained Earnings Share Capital Ordinary Total $7.000 29.000 27.000 50.000 18.000 $131.000 $8.000 15.000 33.000 38.000 14.000 $108.000 MARS" TRADING COMPANY Income Statement For the year ended 31-Dec-2020 Sales Revenue Cost of Goods Sold Gross Profit Operating Expense Operating Income Interest Expense Income before Income Tax Income Tax Expense Net Income $242.000 175.000 67.000 24.000 43.000 3.000 40.000 8.000 32.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts