Question: Additional Information - Every year, goodwill is evaluated to determine if there has been a loss. The recoverable amount for ENS's goodwill was valued at

Additional Information

Every year, goodwill is evaluated to determine if there has been a loss. The recoverable amount for ENS's goodwill was valued at $ at the end of Year and $ at the end of Year

RAV's inventories contained $ of merchandise purchased from ENS at December Year and $ at December Year During Year sales from ENS to RAV were $ Merchandise was priced at the same profit margin as applicable to other customers. RAV owed $ to ENS at December Year and $ at December Year

On July Year ENS purchased a building from RAV for $ The building had an original cost of $ and a carrying amount of $ on RAV's books on July Year ENS estimated the remaining life of the building was years at the time of the purchase from RAV.

ENS rented another building from RAV throughout the year for $ per month.

RAV uses the equity method of accounting for its longterm investments.

Both companies pay tax at the rate of Ignore deferred income taxes when allocating and recording changes to the acquisition differential.

Required:

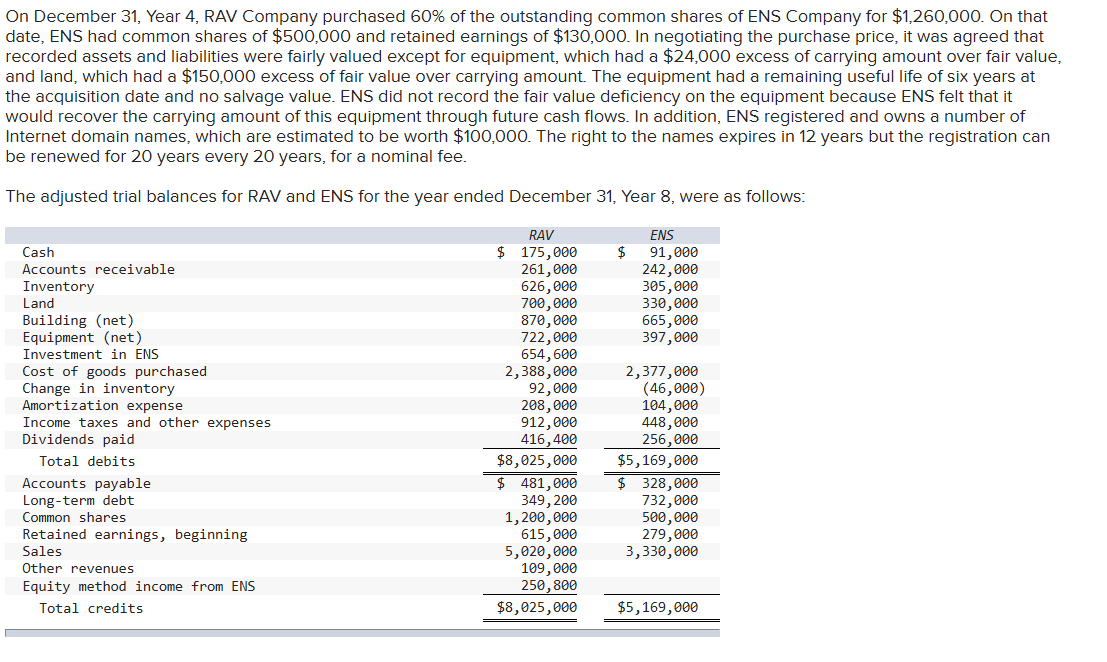

a Prepare a consolidated income statement for the year ended December Year Enter your answers in thousands of dollars. Round your "Shareholders of RAV" and "Noncontrolling interest" answers to decimal place. Input all values as positive numbers.b Prepare the current assets; property, plant, and equipment; and intangible assets sections of the consolidated balance sheet at December Year Enter your answers in thousands of dollars.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock