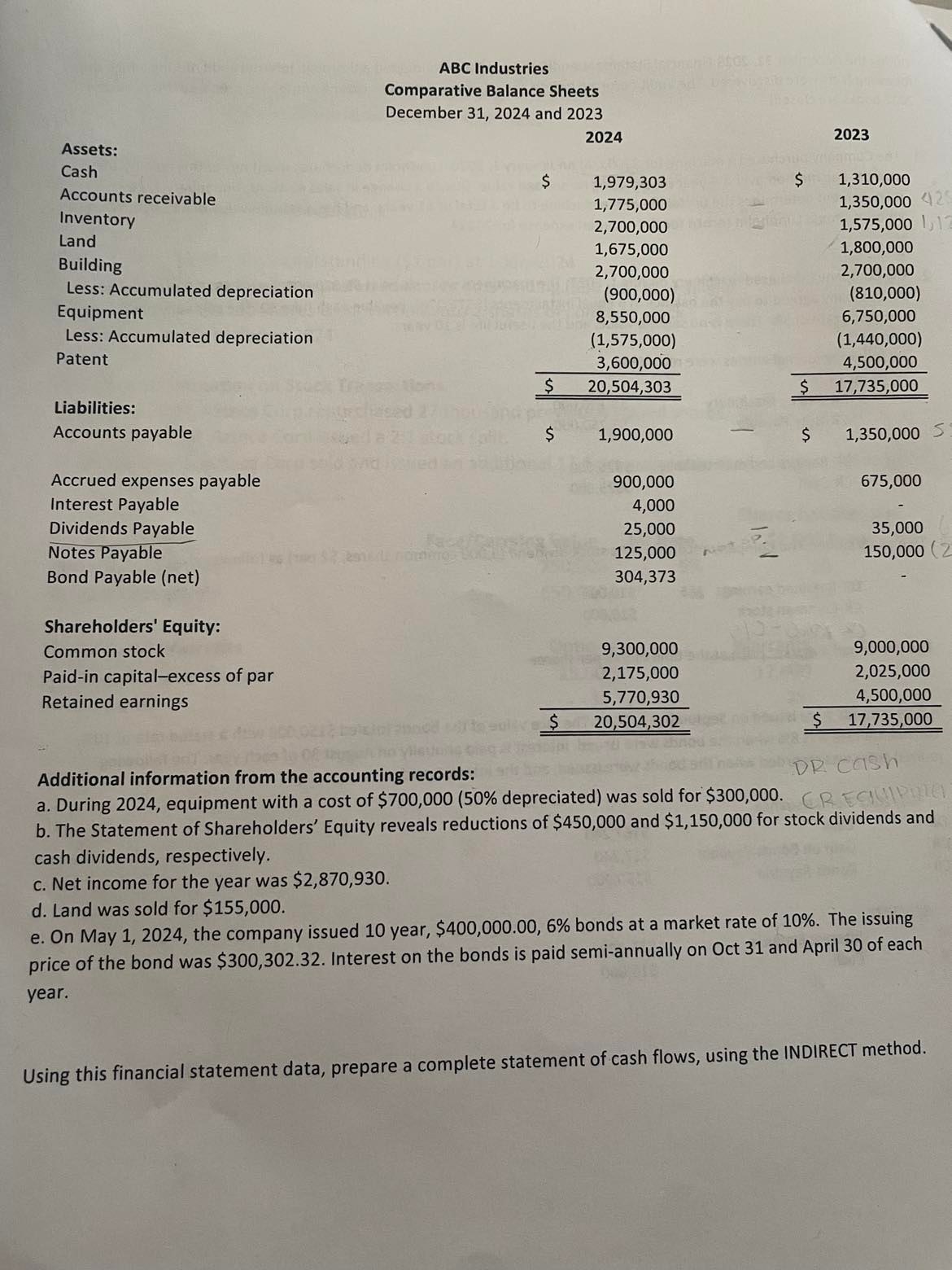

Question: Additional information from the accounting records: a. During 2024 , equipment with a cost of $700,000 ( 50% depreciated) was sold for $300,000. b. The

Additional information from the accounting records: a. During 2024 , equipment with a cost of $700,000 ( 50% depreciated) was sold for $300,000. b. The Statement of Shareholders' Equity reveals reductions of $450,000 and $1,150,000 for stock dividends and cash dividends, respectively. c. Net income for the year was $2,870,930. d. Land was sold for $155,000. e. On May 1, 2024, the company issued 10 year, $400,000.00,6% bonds at a market rate of 10%. The issuing price of the bond was $300,302.32. Interest on the bonds is paid semi-annually on Oct 31 and April 30 of each year. Using this financial statement data, prepare a complete statement of cash flows, using the INDIRECT method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts