Question: Additional information from the accounting records: a. During 2024 , $194.0 million of equipment was purchased to replace $140.0 million of equipment (95.0% depreciated) sold

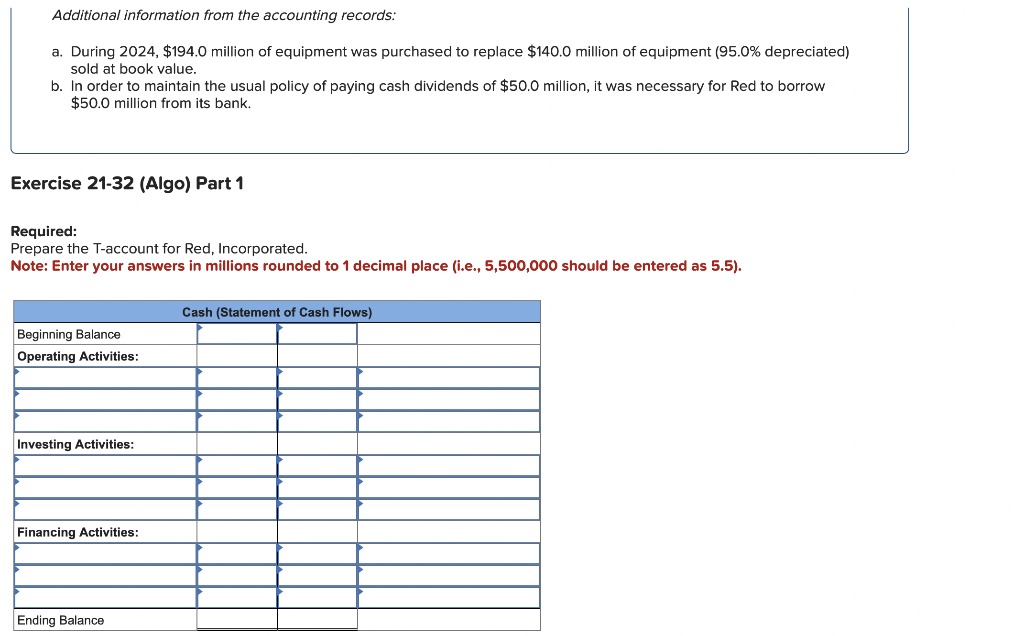

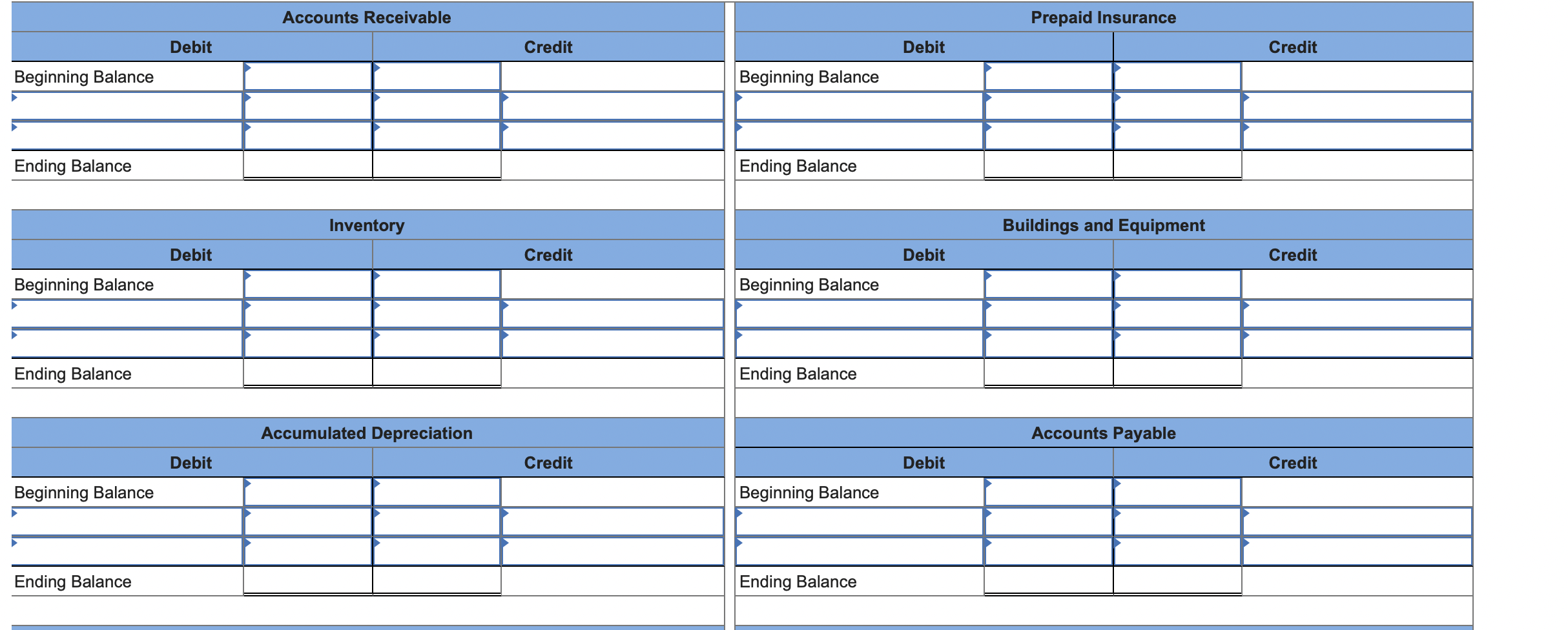

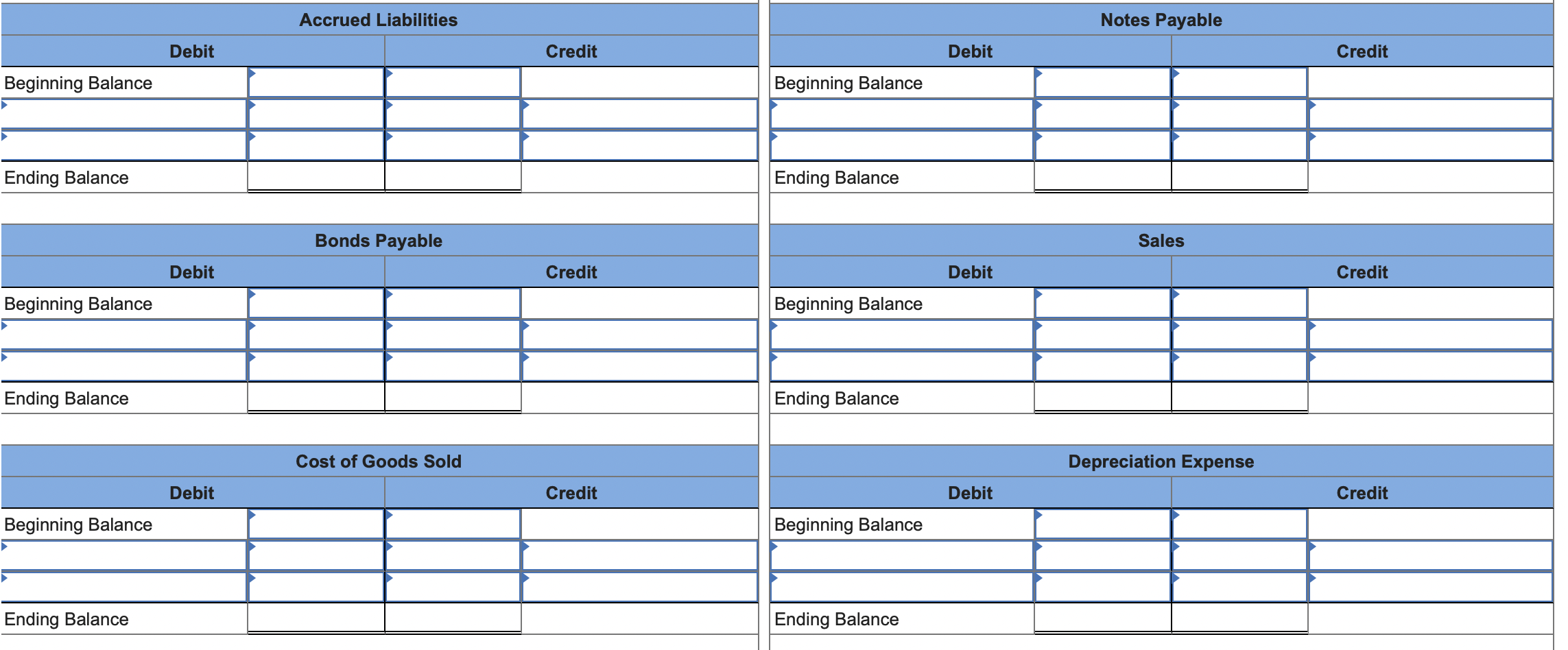

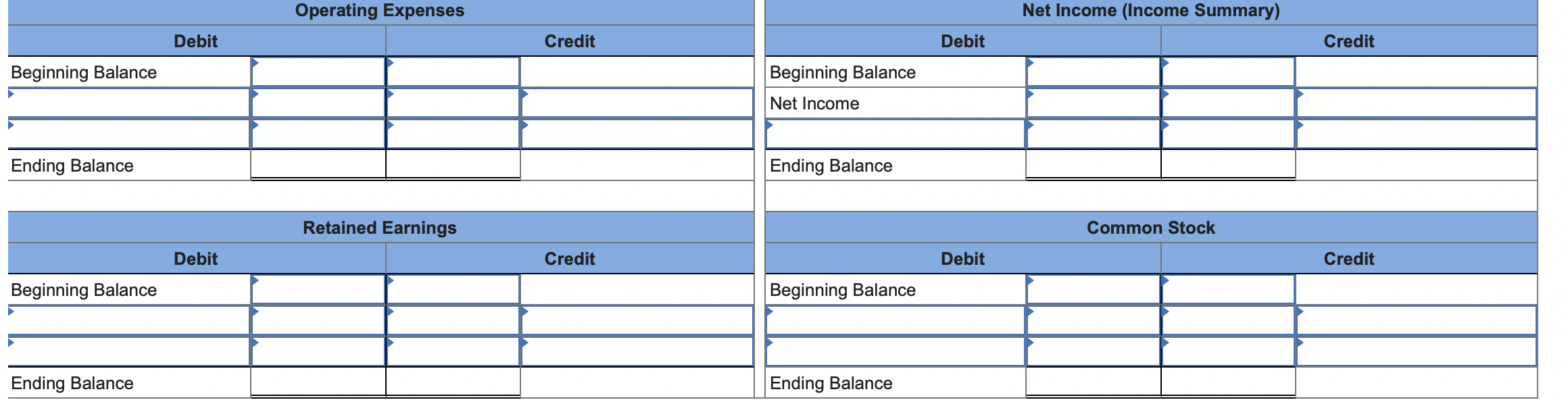

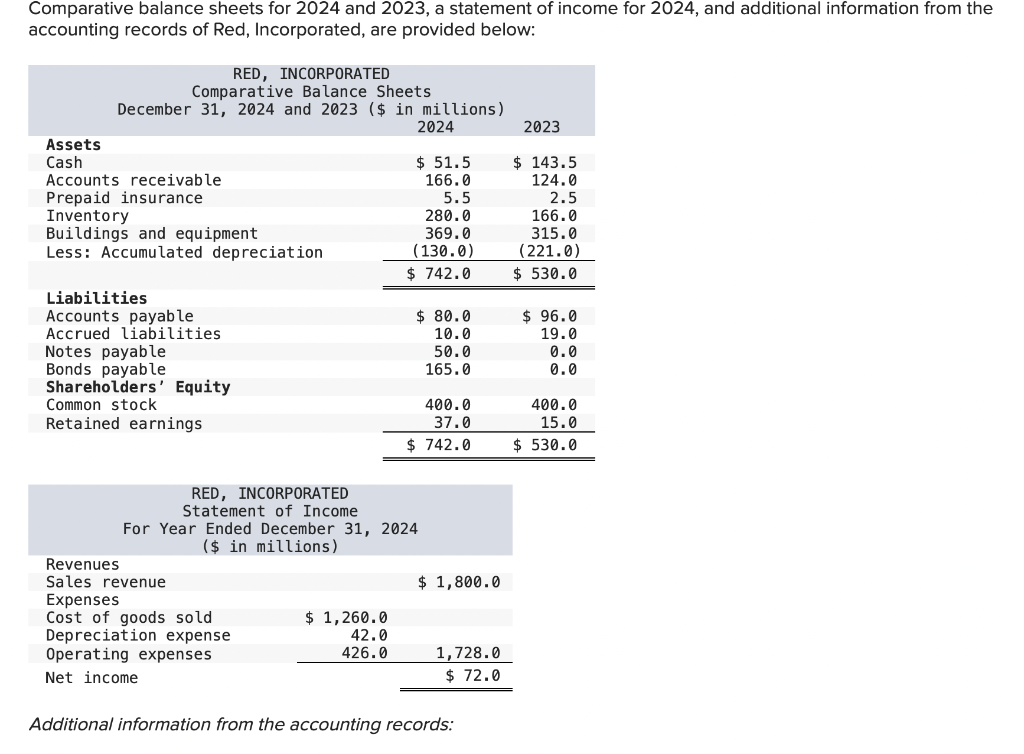

Additional information from the accounting records: a. During 2024 , $194.0 million of equipment was purchased to replace $140.0 million of equipment (95.0\% depreciated) sold at book value. b. In order to maintain the usual policy of paying cash dividends of $50.0 million, it was necessary for Red to borrow $50.0 million from its bank. Exercise 21-32 (Algo) Part 1 Required: Prepare the T-account for Red, Incorporated. Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Comparative balance sheets for 2024 and 2023 , a statement of income for 2024 , and additional information from the accounting records of Red, Incorporated, are provided below: Additional information from the accounting records: Additional information from the accounting records: a. During 2024 , $194.0 million of equipment was purchased to replace $140.0 million of equipment (95.0\% depreciated) sold at book value. b. In order to maintain the usual policy of paying cash dividends of $50.0 million, it was necessary for Red to borrow $50.0 million from its bank. Exercise 21-32 (Algo) Part 1 Required: Prepare the T-account for Red, Incorporated. Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Comparative balance sheets for 2024 and 2023 , a statement of income for 2024 , and additional information from the accounting records of Red, Incorporated, are provided below: Additional information from the accounting records

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts