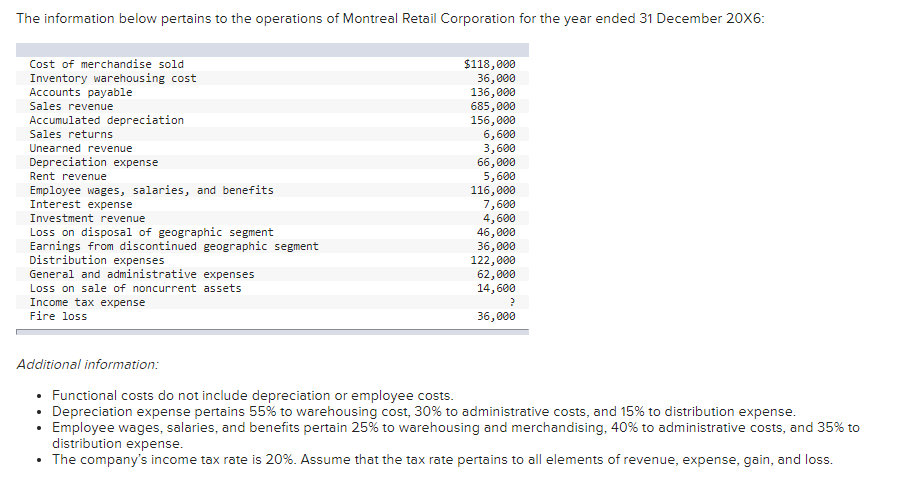

Question: Additional information: - Functional costs do not include depreciation or employee costs. - Depreciation expense pertains 55% to warehousing cost, 30% to administrative costs, and

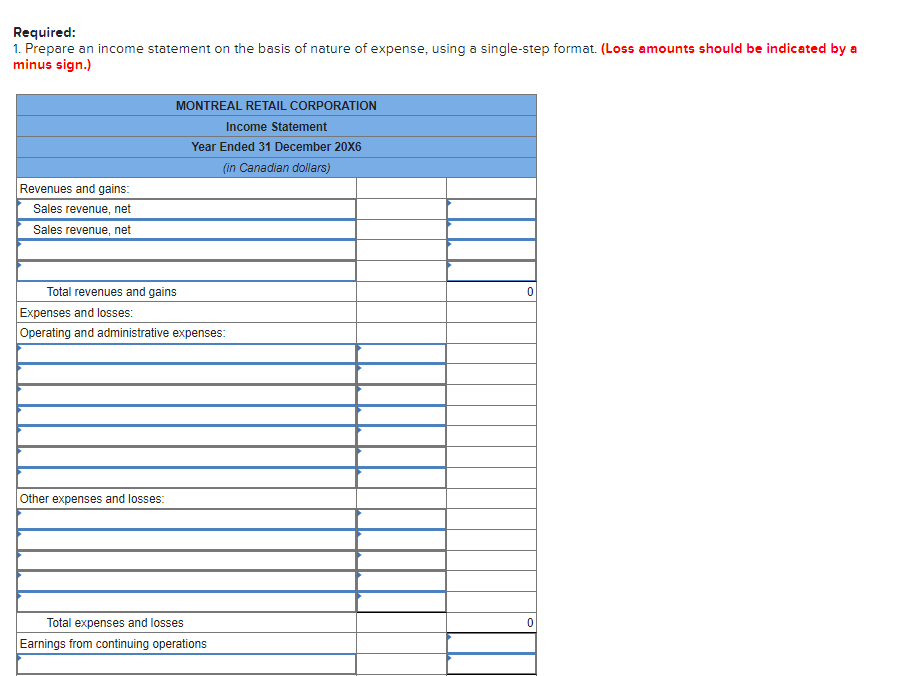

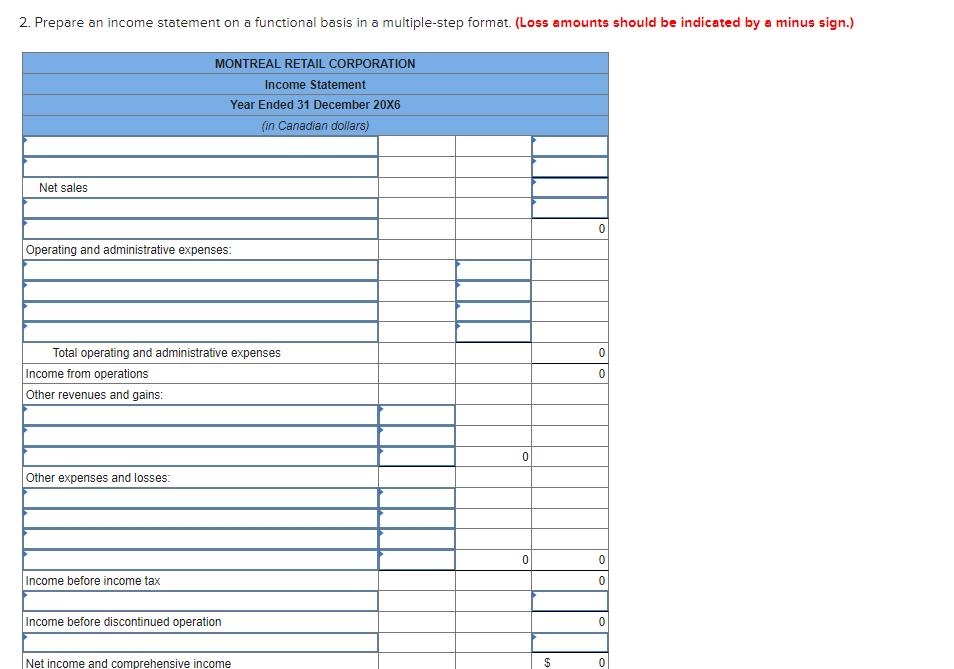

Additional information: - Functional costs do not include depreciation or employee costs. - Depreciation expense pertains 55% to warehousing cost, 30% to administrative costs, and 15% to distribution expense. - Employee wages, salaries, and benefits pertain 25% to warehousing and merchandising, 40% to administrative costs, and 35% to distribution expense. - The company's income tax rate is 20%. Assume that the tax rate pertains to all elements of revenue, expense, gain, and loss. Required: 1. Prepare an income statement on the basis of nature of expense, using a single-step format. (Loss amounts should be indicated by a minus sign.) 2. Prepare an income statement on a functional basis in a multiple-step format. (Loss anounts should be inclicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts