Question: Additional Information Monica Ltd Group is a reporting entity and is required to prepare consolidated financial statements in accordance with AASB 10 Consolidated Financial Statements.

Additional Information

Monica Ltd Group is a reporting entity and is required to prepare consolidated financial statements in accordance with AASB 10 Consolidated Financial Statements.

Jack Ltd

On 1 October 2017 Chandler Ltd purchased 60% of the shares in Jack Ltd for $42,000. On that date the retained earnings of Jack Ltd was $29,000.

Chandler Ltd

On 1 October 2017 Monica Ltd purchased 80% of the shares in Chandler Ltd. On that date the retained earnings of Chandler Ltd was $86,000.

All the net identifiable assets of Chandler Ltd and Jack Ltd were considered to be fairly valued on 1 October 2017.

Other information

Companies in the group use the perpetual inventory system. Total intra-group sales revenue during the year were $100,000. Inventory was sold by Jack Ltd to Chandler Ltd at cost plus 20%. Included in Chandler Ltds books was outstanding inventory purchased from Jack Ltd as follows:

30 June 2019 $25,000

30 June 2020 $32,000

There has been no change to issued capital for all entities since 1 October 2017.

On 30 September 2018, Chandler Ltd sold equipment to Monica for $52,500. Chandler had originally purchased the equipment for $40,000 on 1 July 2017. The original estimated useful life of the equipment was 10 years.

On 1 April 2018, Monica Ltd loaned $40,000 to Chandler Ltd to be repaid at the end of 5 years. Interest of 8% per annum was payable annually, in arrears, over the term of the loan.

Monica Ltd decided to measure the non-controlling interest at their proportionate share of the fair value of the identifiable net assets at acquisition.

Tax rate is 30%.

Required

- Prepare NCI Memorandum Account to calculate the total non-controlling interest in both Jack Ltd and Chandler Ltd.

- In the consolidated statement of financial position of the Monica Group, what is the balance of the Deferred Tax (net) account as at 30 June 2020?

- In the consolidated statement of financial position of the Monica Group, what is the balance of the Loan Payable account as at 30 June 2020?

- In the consolidated statement of financial position of the Monica Group, what is the balance of the Non-Controlling Interest account as at 30 June 2020?

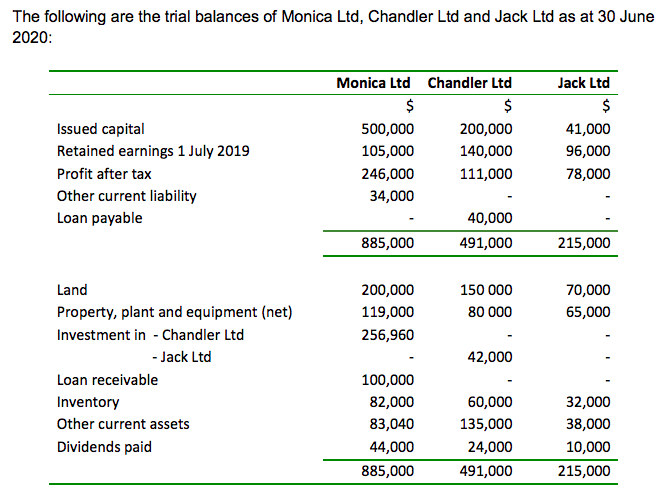

The following are the trial balances of Monica Ltd, Chandler Ltd and Jack Ltd as at 30 June 2020: Monica Ltd Chandler Ltd Jack Ltd $ $ $ 200,000 500,000 Issued capital Retained earnings 1 July 2019 41,000 96,000 105,000 140,000 Profit after tax 111,000 78,000 246,000 34,000 Other current liability Loan payable 40,000 885,000 491,000 215,000 Land 150 000 200,000 119,000 70,000 65,000 Property, plant and equipment (net) 80 000 Investment in - Chandler Ltd 256,960 - Jack Ltd 42,000 Loan receivable Inventory 100,000 82,000 83,040 60,000 135,000 24,000 32,000 38,000 Other current assets Dividends paid 44,000 10,000 885,000 491,000 215,000 The following are the trial balances of Monica Ltd, Chandler Ltd and Jack Ltd as at 30 June 2020: Monica Ltd Chandler Ltd Jack Ltd $ $ $ 200,000 500,000 Issued capital Retained earnings 1 July 2019 41,000 96,000 105,000 140,000 Profit after tax 111,000 78,000 246,000 34,000 Other current liability Loan payable 40,000 885,000 491,000 215,000 Land 150 000 200,000 119,000 70,000 65,000 Property, plant and equipment (net) 80 000 Investment in - Chandler Ltd 256,960 - Jack Ltd 42,000 Loan receivable Inventory 100,000 82,000 83,040 60,000 135,000 24,000 32,000 38,000 Other current assets Dividends paid 44,000 10,000 885,000 491,000 215,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts