Question: Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $10,125 (details in b). b. Sold equipment costing $61,875,

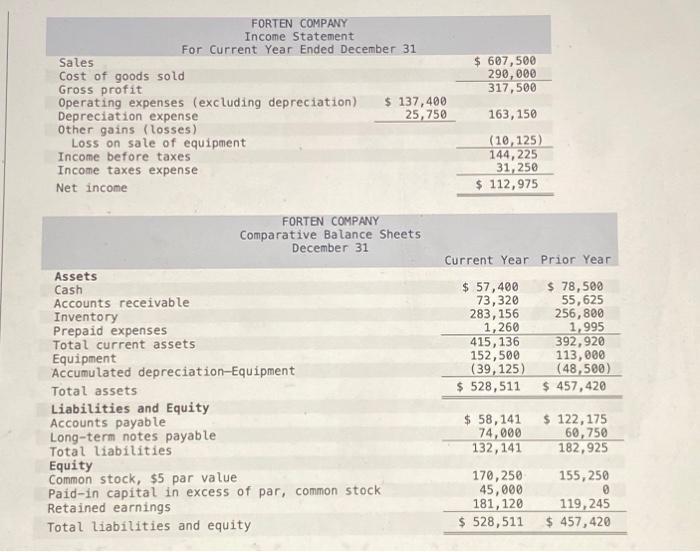

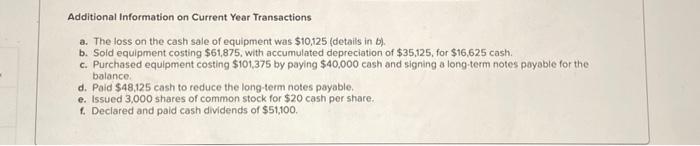

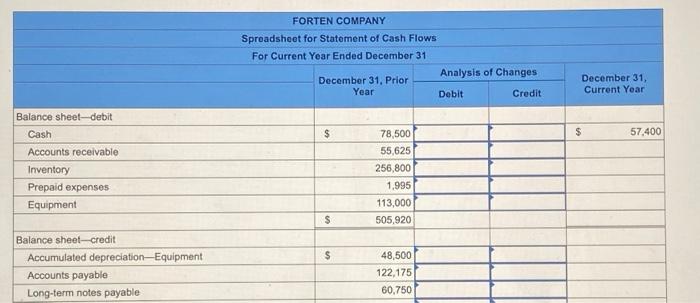

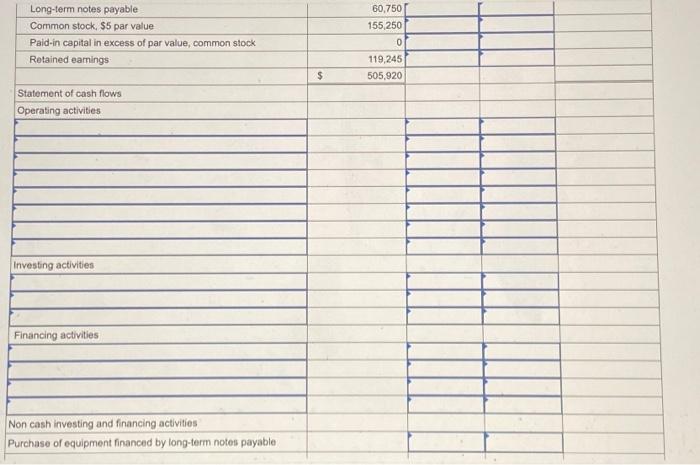

Additional Information on Current Year Transactions a. The loss on the cash sale of equipment was $10,125 (details in b). b. Sold equipment costing $61,875, with accumulated depreciation of $35,125, for $16,625 cash. c. Purchased equipment costing $101,375 by paying $40,000 cash and signing a long-term notes payable for the batance. d. Paid $48,125 cash to reduce the long-term notes payable. e. Issued 3,000 shares of common stock for $20 cash per share. f. Declared and paid cash dividends of $51,100. \begin{tabular}{|l|l|l|} \hline Long-term notes payable & \\ \hline Common stock, \$5 par value & \\ \hline Paid-in capital in excess of par value, common stock & \\ \hline Retained earnings & & \\ \hline Statement of cash flows & & \\ \hline Operating activities & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ FORTEN COMPANY } \\ \hline \multicolumn{7}{|c|}{ Sproadsheet for Statement of Cash Flows } \\ \hline \multicolumn{7}{|c|}{ For Current Year Ended December 31} \\ \hline & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} December 31, Prior \\ Year \end{tabular}}} & \multicolumn{2}{|c|}{ Analysis of Changes } & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{l} December 31 , \\ Current Year \end{tabular}}} \\ \hline & & & Debit & Credit & & \\ \hline \multicolumn{7}{|l|}{ Balance sheet-debit } \\ \hline Cash & $ & 78,500 & & & $ & 57,400 \\ \hline Accounts receivable & & 55,625 & & & & \\ \hline Inventory & = & 256,800 & & & & \\ \hline Prepaid expenses & & 1,995 & & & & \\ \hline \multirow[t]{2}{*}{ Equipment } & & 113,000 & & & & \\ \hline & $ & 505,920 & & & & \\ \hline \multicolumn{7}{|l|}{ Balance sheet-credit } \\ \hline Accumulated depreciation-Equipment & s & 48,500 & & & & \\ \hline Accounts payable & & 122,175 & & & & \\ \hline Long-term notes payable & & 60,750 & & & & \\ \hline \end{tabular} FORTEN COMPANY Income Statement For Current Year Ended December 31 \begin{tabular}{|c|c|c|} \hline & & \\ \hline Sales & & $607,500 \\ \hline \begin{tabular}{l} Cost of goods sold \\ Gross profit \end{tabular} & & \begin{tabular}{l} 290,000 \\ 317,500 \end{tabular} \\ \hline Operating expenses (excluding depreciation) & $137,400 & \\ \hline Depreciation expense & 25,750 & 163,150 \\ \hline other gains (losses) & & \\ \hline \begin{tabular}{l} Loss on sale of equipment \\ Income before taxes \end{tabular} & & (10,125) \\ \hline \begin{tabular}{l} Income before taxes \\ Income taxes expense \end{tabular} & & 144,225 \\ \hline \begin{tabular}{l} Income taxes expense \\ Net income \end{tabular} & & 31,250 \\ \hline income & & $112,975 \\ \hline \end{tabular} FORTEN COMPANY Comparative Batance Sheets December 31 Current Year Prior Year Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity \begin{tabular}{rr} $57,400 & $78,500 \\ 73,320 & 55,625 \\ 283,156 & 256,800 \\ 1,260 & 1,995 \\ \hline 415,136 & 392,920 \\ 152,500 & 113,000 \\ (39,125) & (48,500) \\ \hline$528,511 & $457,420 \\ \hline \hline \end{tabular} \begin{tabular}{rr} $58,141 & $122,175 \\ 74,000 & 60,750 \\ \hline 132,141 & 182,925 \end{tabular} 170,250155,250 45,000 \begin{tabular}{rr} 181,120 & 119,245 \\ \hline$528,511 & $457,420 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts