Question: Additional information Peeulred a. Montribb surbates ebe ciodti b. Dent weichidi mind Problem 19-5A Computing and applying overhead to jobs; recording under-or overapplied overhead 93

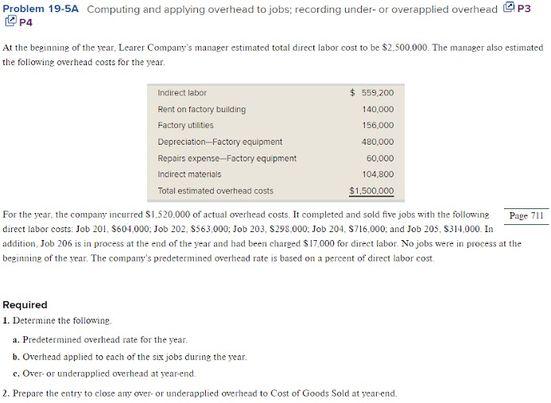

Additional information Peeulred a. Montribb surbates ebe ciodti b. Dent weichidi mind Problem 19-5A Computing and applying overhead to jobs; recording under-or overapplied overhead 93 [P] P4 At the beemnine of the year, Learer Company's manaeer estimated total direct labor cost to be $2.500.000. The manager also estimated the following orerhead costs for the year. For the year, the company incurred S1. 520.000 of actual overhead costs. It completed and sold five jobs with the following direct Iabor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$29s,000; Job 204, \$716,000; and Job 205, \$314,000. In atdition, Job 206 is in process at the end of the yeaf and had been charged $17.000 for direct labor. No jobs were in process at the begimine of the sear. The compamy's predetermined owerhesd rate is based on a percent of direct labor cost Required 1. Determine the following. a. Predetermined overhead rate for the year. b. Overhead applied to each of the six jobs during the year. c. Over or underapplied overhead at yearend 2. Prepare the entry to elose amy over- or underapplied overhead to Cost of Goods Sold at yearend. Additional information Peeulred a. Montribb surbates ebe ciodti b. Dent weichidi mind Problem 19-5A Computing and applying overhead to jobs; recording under-or overapplied overhead 93 [P] P4 At the beemnine of the year, Learer Company's manaeer estimated total direct labor cost to be $2.500.000. The manager also estimated the following orerhead costs for the year. For the year, the company incurred S1. 520.000 of actual overhead costs. It completed and sold five jobs with the following direct Iabor costs: Job 201, \$604,000; Job 202, \$563,000; Job 203, \$29s,000; Job 204, \$716,000; and Job 205, \$314,000. In atdition, Job 206 is in process at the end of the yeaf and had been charged $17.000 for direct labor. No jobs were in process at the begimine of the sear. The compamy's predetermined owerhesd rate is based on a percent of direct labor cost Required 1. Determine the following. a. Predetermined overhead rate for the year. b. Overhead applied to each of the six jobs during the year. c. Over or underapplied overhead at yearend 2. Prepare the entry to elose amy over- or underapplied overhead to Cost of Goods Sold at yearend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts