Question: Additional information pertaining to 2 0 2 4 : Net income was $ 1 0 5 , 8 0 0 . Sales were $ 9

Additional information pertaining to :

Net income was $

Sales were $

Cost of goods sold was $

Operating expenses were $ exclusive of depreciation expense.

Depreciation expense was $

Interest expense was $

Income tax expense was $

Longterm investments were sold at a gain of $ These investments are carried at their cost, so gains and losses on

these investments are recorded only when the investments are sold.

No equipment was sold during the year.

$ of the bank loan was repaid during the year.

Common shares were issued for $

a SUNLAND LTD

Statement of Cash FlowsIndirect Method

Cash Flows from Ooeratine Actlvitles

Adjustments to reconcile net income to

Net Cash Frovided bv Ooeratinc Actlvitles

Depreclation Expense

Decrease In Accounts Favable

Increase in Accounts Pavable

Increase in Estimated Imventory Retums

F $

lceil

~~

eTextbook and Media

eTextbook and Media

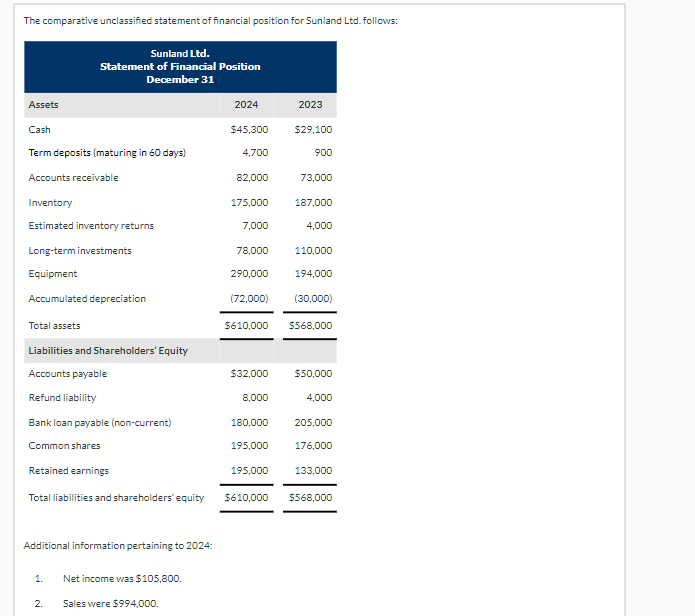

Attempts: unlimitedThe comparative unclassified statement of financial position for Sunland Ltd follows:

Additional information pertaining to :

Net income was $

Sales were $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock