Question: Additional information: The fair value of Cliffs assets was equal to their carrying amounts with the exception of its plant, which had a fair value

Additional information:

- The fair value of Cliffs assets was equal to their carrying amounts with the exception of its plant, which had a fair value of RM3.2 million in excess of its carrying amount at the date of acquisition. The remaining life of Cliffs plant at the date of acquisition was four years and this period has not changed as a result of the acquisition. Deprecation of the plant is on a straight-line and charged to cost of sales. Cliff has not adjusted the value of its plant as a result of the fair value exercise.

- In the post-acquisition period, Hill sold goods to Cliff at a price of RM6,000,000. These goods had cost Hill RM4,500,000. During the year, Cliff had sold RM5,000,000 (at cost to Cliff) of these goods for RM7,500,000 million.

- Hill bears almost all of the administration costs incurred on behalf of the group (invoicing, credit controls, etc.). it does not charge Cliff for this service as to do so would not have a material effect on the groups profit.

- Revenues and profits should be deemed to accrue evenly throughout the year.

Required:

Prepare the consolidated statement of profit or loss for Hill for the year to 31 March x3.

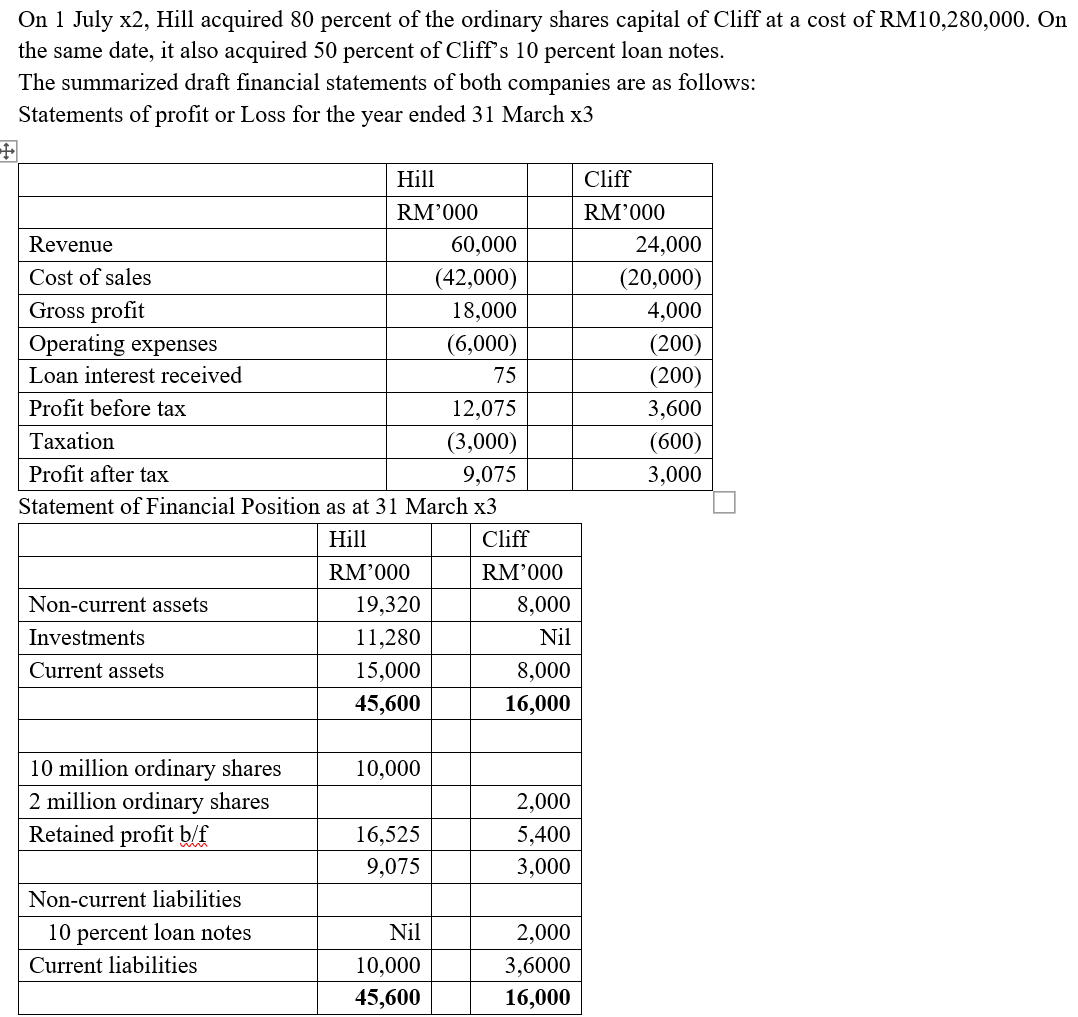

On 1 July x2, Hill acquired 80 percent of the ordinary shares capital of Cliff at a cost of RM10,280,000. On the same date, it also acquired 50 percent of Cliff's 10 percent loan notes. The summarized draft financial statements of both companies are as follows: Statements of profit or Loss for the year ended 31 March x3 1 Hill Cliff RM000 RM'000 Revenue 60,000 24,000 Cost of sales (42,000) (20,000) Gross profit 18,000 4,000 Operating expenses (6,000) (200) Loan interest received 75 (200) Profit before tax 12,075 3,600 Taxation (3,000) (600) Profit after tax 9,075 3,000 Statement of Financial Position as at 31 March x3 Hill Cliff RM'000 RM000 Non-current assets 19,320 8,000 Investments 11,280 Nil Current assets 15,000 8,000 45,600 16,000 10,000 10 million ordinary shares 2 million ordinary shares Retained profit b/f 16,525 9,075 2,000 5,400 3,000 Non-current liabilities 10 percent loan notes Current liabilities Nil 10,000 45,600 2,000 3,6000 16,000 On 1 July x2, Hill acquired 80 percent of the ordinary shares capital of Cliff at a cost of RM10,280,000. On the same date, it also acquired 50 percent of Cliff's 10 percent loan notes. The summarized draft financial statements of both companies are as follows: Statements of profit or Loss for the year ended 31 March x3 1 Hill Cliff RM000 RM'000 Revenue 60,000 24,000 Cost of sales (42,000) (20,000) Gross profit 18,000 4,000 Operating expenses (6,000) (200) Loan interest received 75 (200) Profit before tax 12,075 3,600 Taxation (3,000) (600) Profit after tax 9,075 3,000 Statement of Financial Position as at 31 March x3 Hill Cliff RM'000 RM000 Non-current assets 19,320 8,000 Investments 11,280 Nil Current assets 15,000 8,000 45,600 16,000 10,000 10 million ordinary shares 2 million ordinary shares Retained profit b/f 16,525 9,075 2,000 5,400 3,000 Non-current liabilities 10 percent loan notes Current liabilities Nil 10,000 45,600 2,000 3,6000 16,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts